A silly Inflation Report, presented by governor Prof Sahap Kavcioglu who was visibly in pain for being forced into defending positions no economist ought to suffer, ended the brief uptrend in TL. Kavcioglu’s new policy of fighting inflation by generating a current account surplus, and refusing to defend the TL is becoming the butt of many jokes in social media by Thursday afternoon. Turkish markets are shut as of 12:00 through Monday to celebrate Independence Day. At 17:30 TST dollar/TL is at 9.53-54, saved by the weaker Dollar Index.

PATurkey received two reports this afternoon, which raised 2022 inflation and dollar/TL forecasts. Commerzbank notes that the new target for dollar/TL is 11.00 by March 2022.

The report states:

We had warned in our last update that a dangerous monetary policy experiment had been unleashed upon Turkey. Turkey’s status quo with flat interest rate came to an end in September when CBT cut the benchmark rate by 100bp to 18.00% and then again by 200bp to 16.00%, which has sent the lira exchange rate flying. Further cuts are in the pipeline. The argument that inflation is transitory may be true broadly, but not in the case of Turkey, which has experienced high inflation for over a decade. The ever-depreciating exchange rate is recognized as the main culprit. This latest round of lira depreciation will also boost inflation, and feed back into a familiar inflation-FX spiral, which will likely ultimately derail the rate cuts and force interest rates back up. But until then, significant exchange rate overshooting is possible: we revise our March-2022 USD-TRY forecast from 10.00 to 11.00.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

What level the lira?

During such times, readers often ask us 1) how far we think CBT might lower rates, 2) how far the lira might weaken before things eventually turn around. The answers to these questions are elusive as ever – more so in the current situation, because some kind of regime or paradigm shift may be required to put an end to this experiment. In any case, it is worth pointing out that such details will likely not matter for the bigger picture. Here is why.

It might seem that the exchange rate should depreciate by a margin, which depends on how fast and how much CBT will cut rates. We do not think so. We think that the pace of recent rate cuts is only acting as a ‘trigger’ by confirming that the counter-intuitive monetary policy is now truly being implemented in Turkey. Earlier, it had been a risk factor of course, but its timing was not clear, and the CBT Governor appeared to resist the idea – it was highly uncertain when and how the president would impose his will. TRY’s high carry ensures that during interim periods without specific triggers – until the timing of a sell-off becomes concrete – the exchange rate will tend to drift stronger. In the end, however, this provides no defense and only lures in the complacent.

WATCH: How Bad is Fed Taper for Turkish Assets?

When readers ask us how far the lira might depreciate, there is probably the underlying assumption that the exchange rate is trying to reach a “fair value”, after which the move should stop. At this fair value, the weaker exchange rate will create positive real economic effects which will counter the depreciation.

But, without inflation targeting, there is no such fair-value – the system is like an “open loop” which never closes. Let us take an example where the exchange rate has just depreciated by 20% in nominal terms. Even if this will be inflationary in the near-term, if there is strict inflation targeting, the market has every reason to assume that inflation will be back at its 5% target in the medium term.

In this case, the prospective real exchange rate will depreciate by 20% – 5% = 15% and the real economy will respond with an appropriate balance of payments adjustment.

WATCH: How Erdogan is Destroying Turkish Economy ?

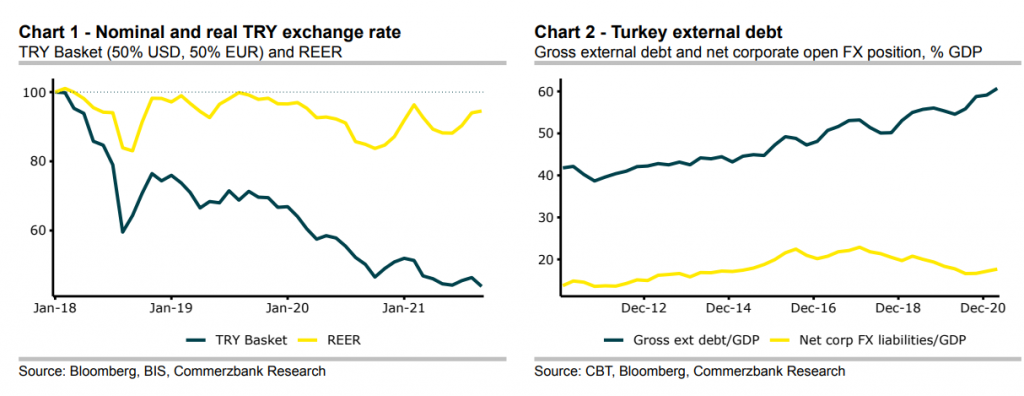

However, if there is no inflation targeting, then the inflation rate will not fall back to target in the medium term; if inflation is also running at, say, 20%, then the real exchange rate will remain unchanged, and there will be no real economy benefits. Chart 1 shows this situation for Turkey: since 2018, the nominal lira exchange rate (TRY basket against 50% USD and 50% EUR) has nearly halved in value; but, Turkey’s real effective exchange rate has hardly declined. This is because inflation has continued to run sky high. Under such a scenario, imagined benefits such as current account adjustment cannot occur (possibly except briefly during the exchange rate shock). There is no “equilibration” mechanism proceeding in the background.

Corporates will be hit hard

One might ask another question: let us say that the Turkish electorate has got de-sensitized to decades of high inflation and no longer care. In other words, the lack of inflation targeting has no political consequences. Meanwhile, the real exchange rate is not changing – and things are continuing as “neutral”. So, why should we care? Why is this not sustainable?

The answer is in private sector balance sheets. It may be true that nominal exchange rate depreciation and high inflation are balancing each other out, but there is one variable which is affected one-for-one by nominal lira depreciation – the value of the external debt (or FX liability) burden. Even if the country is not freshly borrowing much in hard currency, the outstanding value of the FX debt will rise sharply as percentage of GDP. In Turkey’s case, steady lira depreciation has resulted in external debt/GDP rising from less than 40% at the beginning of 2012 to higher than 60% now.

Domestic currency devaluation is also the reason why significant efforts to lower non-financial corporates’ net FX liabilities have not proved effective: the nominal USD value of net liabilities have come down from nearly $190bn at the beginning of 2018 to $127bn at present, but they have not been able to decline much as percentage of GDP.

When will there be a financing problem?

Rising external debt ratios and rollover obligations (which amount to c.25% of GDP every year) may appear not to be a problem while global market risk appetite is abundant, but every market correction will expose the lira to increasing vulnerability and credit ratings will head lower. Once again, a favorite question of investors – at what level of external debt/GDP will a financing problem be precipitated – cannot be answered with any certainty; it is not a specific threshold which will precipitate the problem, but the global market mood for financing (or not financing) which will determine rollover ratios.

Our USD-TRY forecast of 11.00 for end of Q1 2022 is, therefore, not based on some precise calculus, but is “symbolic” to represent sharp overshooting which might occur as the market tests the central bank’s credibility in coming months. In the medium-term, however, the resultant damage to private sector balance sheets will likely force a policy reversal.

We forecast further rate cuts in the time ahead before the rate has to rise back up to 20% by the middle of 2022. Past experience suggests that policymakers are unlikely to do enough to bring back USD-TRY to older levels such as 8.00; they usually appear content to engineer a period of sideways in the exchange rate. When things get awry, policymakers may attempt to keep the exchange rate stable using a plethora of on and off capital controls, such as restrictions on swap limits, restrictions on short positions, re-use of CBT’s rate corridor, bans on FX-indexed transactions, restrictions on FX deposits and the like. The risk of “harder” capital controls will also increase as pressure on the exchange rate increases…

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng