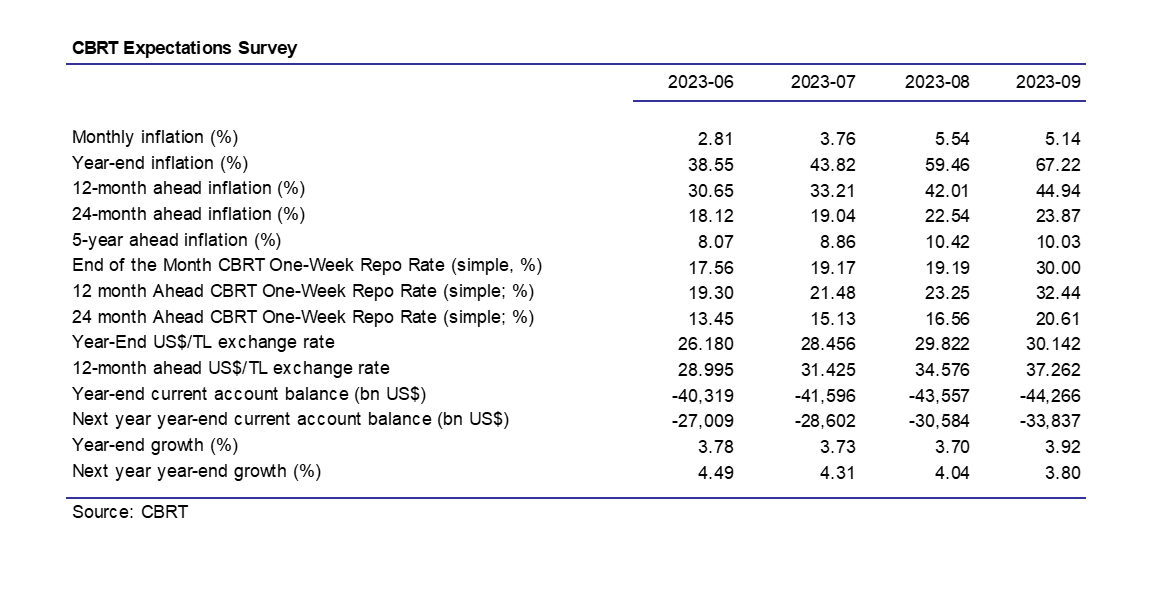

Based on the September 2023 Market Participants Survey conducted with representatives from the real and financial sectors as well as professionals, the inflation projection for the end of the year surged from 59.46% to 67.22%.

The study, which encompassed the views of 41 participants, indicated a perceptible shift in financial predictions compared to previous data. While inflation expectations for a 12-month period escalated from 42.01% to 44.94%, the forecast for 24 months later settled at 23.87%.

Moreover, there has been a notable uptick in the anticipated US dollar to Turkish lira exchange rate. The participants corrected their earlier prediction of 29.82 to a slightly steeper 30.14 for the year-end exchange rate.

In addition to inflation and exchange rate predictions, the survey also shed light on other critical economic indicators.

The participants have raised their expectations concerning the overnight interest rate in the BIST Repo and Reverse Repo Market from 19.34% in the last survey period to a staggering 29.26% in the current survey period. Similarly, the one-week repo auction interest rate expectation for the current month-end also surged from 19.19% to 30%.

Interestingly, participants also revised their growth expectations for the year 2023, slightly pushing it up from 3.7% during the previous survey to 3.9% in the recent survey, hinting at an optimistic outlook amidst the rising inflation and dollar rate predictions.

Gerçek news, CBRT