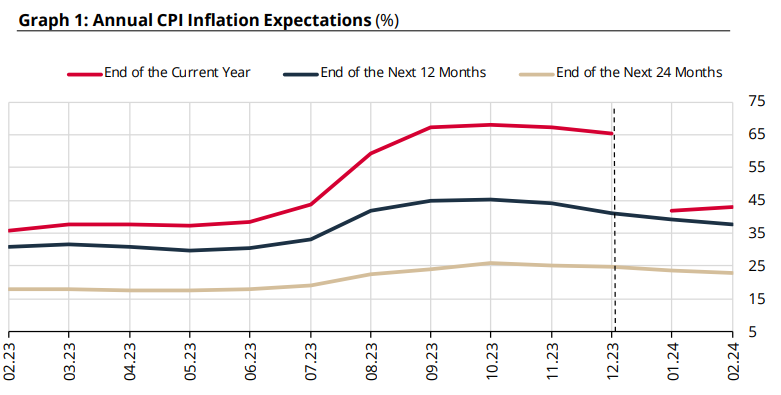

According to the ‘Market Participants Survey’ published by the Central Bank of Turkey; year-end inflation expectation increased from 42.04 percent to 42.96 percent in February. The year-end dollar/TL expectation is 40.02 TL. CBRT’s estimate for 2024YE CPI inflation is at 36%.

In the Central Bank of the Republic of Turkey (CBRT) February Market Participants Survey, the current year-end consumer inflation (CPI) expectation was 42.96 percent. In January, the expectation was 42.04 percent.

The year-end USD/TL exchange rate expectation, which was 40.00 TL in the previous survey period, became 40.02 TL in this survey period.

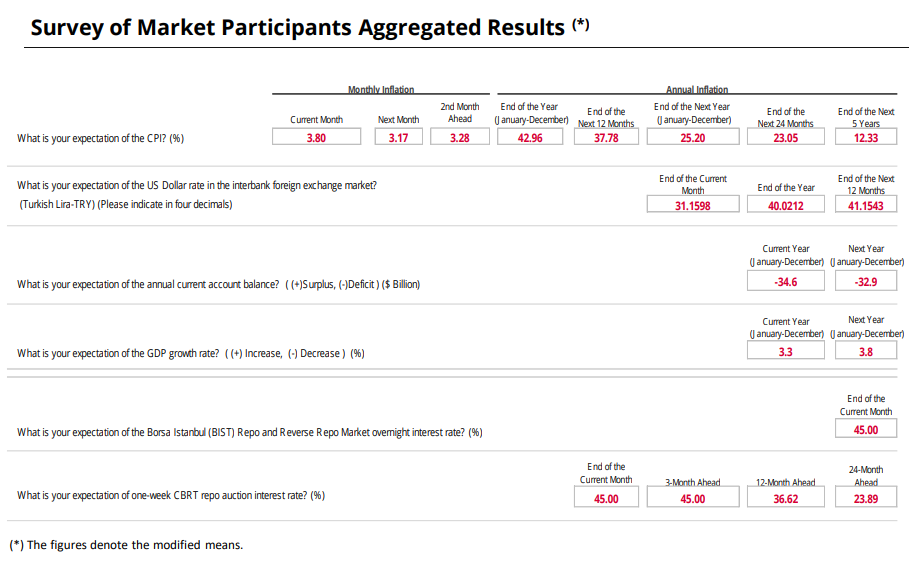

The results of the CBRT February Market Participants Survey are as follows:

“The current year-end consumer inflation (CPI) expectation of the participants, which was 42.04 percent in the previous survey period, became 42.96 percent in this survey period. The 12-month-ahead CPI expectation was 39.09 percent in the previous survey period, while it was 37.78 percent in this survey period. 24-month-ahead CPI expectations were realized as 23.69 percent and 23.05 percent in the same survey periods, respectively.

In the February 2024 survey period, when the probability forecasts of the participants for the next 12 months are evaluated, it is predicted that the CPI will increase between 30.00 – 34.99 percent with a probability of 15.36 percent, between 35.00 – 39.99 percent with a probability of 59.99 percent and between 40.00 – 44.99 percent with a probability of 16.76 percent.

According to the evaluation based on point estimates (2) in the same survey period, 11.11 percent of the participants’ expectations were between 30.00 – 34.99 percent, 66.67 percent of the participants’ expectations were between 35.00 – 39.99 percent, and 17.46 percent of the participants’ expectations were between 40.00 – 44.99 percent.

In the February 2024 survey period, when the probability forecasts of the participants for 24 months ahead are evaluated, it is predicted that the CPI will increase between 16.00 – 20.99 percent with 23.99 percent probability, between 21.00 – 25.99 percent with 47.65 percent probability and between 26.00 – 30.99 percent with 20.80 percent probability.

According to the evaluation based on point estimates (2) in the same survey period, when the 24-month-ahead CPI inflation expectations are evaluated, it is observed that 23.33 percent of the participants’ expectations are between 16.00 – 20.99 percent, 46.67 percent of the participants’ expectations are between 21.00 – 25.99 percent, and 21.67 percent of the participants’ expectations are between 26.00 – 30.99 percent.

Policy rate expectations remained unchanged

Participants’ expectation for the current month-end overnight interest rate at the BIST Repo and Reverse Repo Market and the CBRT one-week repo auction interest rate were realized as 45.00 percent in this survey period as in the previous survey period.

The respondents expect the current 45.00 percent policy rate to ease down to 36.62 percent in 12 months’ time.

2024 USD/TL expectation 40.02

Participants’ year-end exchange rate expectation (USD/TRY) was 40.02 TRY in the current survey period, while it was 40.00 TRY in the previous survey period. The 12-month-ahead exchange rate expectation, which was 40.64 TL in the previous survey period, was realized as 41.15 TL in this survey period.

Year-end growth expectation decreased to 3.3 percent

Participants’ GDP growth expectation for 2024 was realized as 3.3 percent, while it was 3.4 percent in the previous survey period. The GDP growth expectation for 2025, which was 3.9 percent in the previous survey period, was realized as 3.8 percent in this survey period.

The February 2024 Market Participants’ Survey was answered by 68 participants consisting of real sector and financial sector representatives, and the results were evaluated by aggregating the responses of the participants.”