Traders see a probability of almost 50% that the lira will surpass its record low of 18.3633 per dollar by the end of the year, according to Bloomberg calculations based on prices of put and call options. The currency slumped as much as 1.2% Thursday before paring its drop to trade at 13.5772 as of 2:08 p.m. in Istanbul.

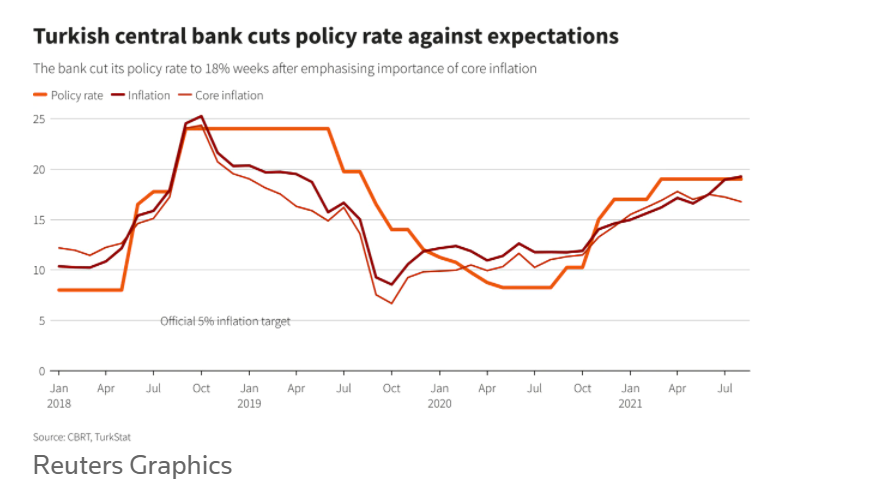

Under pressure from President Recep Tayyip Erdogan, the central bank has slashed interest rates by 500 basis points since September — at a time when policy makers in other developing economies are tightening to rein in prices. With the worst real rate in emerging markets, the lira is likely the most vulnerable to any bout of risk aversion as the Federal Reserve prepares to raise interest rates.

“The lira is the least attractive EM currency due to deeply negative real interest rates in a global environment dominated by a growing tendency to raise interest rates in response to rapidly rising inflation,” said Piotr Matys, a senior currency strategist at InTouch Capital Markets Ltd. in London.

CNBC: The results of Erdogan’s failed monetary policy experiment

“The results of Erdogan’s failed monetary policy experiment,” Timothy Ash, senior emerging markets strategist at BlueBay Asset Management, wrote in a note following the inflation report, CNBC.com reported an hour ago.

WATCH: Has Erdogan Averted a Currency Crisis? | Real Turkey

“Hard to see how the CBRT [Turkish central bank] can cut inflation when it’s unable to hike rates and Erdogan is going to be focused on trying to get credit growth up again to boost his popularity ahead of elections.”

WATCH: TURKEY: Next Stop Is Currency Controls | Real Turkey

Turkish Finance Minister Nureddin Nebati told the Nikkei news agency Wednesday that he predicted inflation will stay below 50%, peaking in April.

The combination of inflation and currency depreciation has rattled the big emerging market economy, upended household and corporate budgets, and deepened poverty ahead of elections scheduled for mid-2023.

Inflation should surpass 50% this month and plateau around 55% for most of 2022 before ending the year at 33%, Goldman Sachs said.

Turkey’s dollar-denominated sovereign bonds slipped while spreads over U.S. safe haven Treasury bonds (.JPMEGDTURR) widened to 559 basis points. The cost of insuring exposure through credit default swaps edged up.

“We have a policy rate of 14% and inflation at 48%… and a government that covers for the FX gap. It’s a bad cocktail for the long-term,” said Ipek Ozkardeskaya, a senior analyst at Swissquote.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng