Wood Company equity research

Following Aselsan’s 1H23 results and analyst day in Istanbul in August, we have updated our valuation model for the company, upgrading our rating to BUY (from Hold). Apart from a major uplift in our earnings estimates, propelling our 12M price target (PT) to TRY 56.4/share (from TRY 13.75/share, adjusted for the recent 100% stock split), the key driver of our rating upgrade is the robust ytd surge in the company’s new contract wins, reaching USD 3.4bn as of end-August (eclipsing Aselsan’s annual contract additions in 2019-22), and improved near-term growth prospects, on the back of sector, geopolitical and technological developments.

We believe that the consensus estimates do not capture Aselsan’s improved growth potential yet, and fail to grasp the technological maturity reached by the company in certain segments of the defence electronics business.

Post our model update, our 12M PT, driven by our blended valuation methodology (based 60% on our DCF and 40% on the target 2024E multiples), suggests 46% upside potential.

FY23E a watershed year for Aselsan: having underperformed its global peers in terms of USD-based backlog and revenue growth in 2021-22, Aselsan has posted robust 24% top-line growth in 1H23 (in USD terms) and, ytd, secured USD 3.4bn in new contract wins (already exceeding its 2020-22 levels). In our view, despite these recent backlog additions, the company’s near-term contract prospects remain very rich, with several domestic and export defence projects gaining momentum under a favourable local and global operating environment post the Ukraine war.

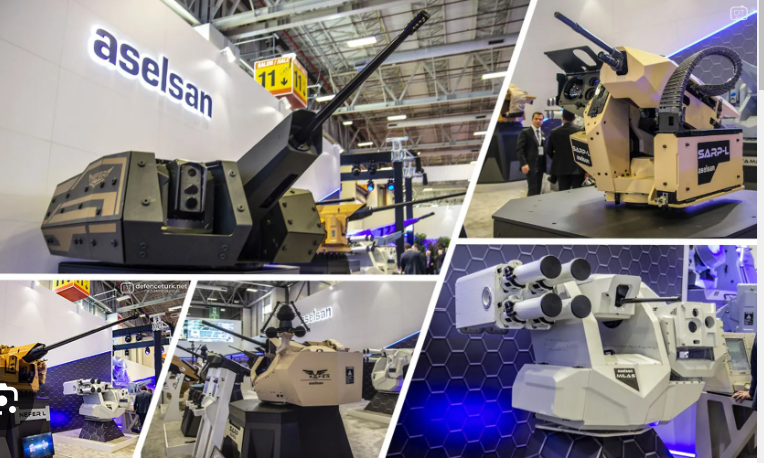

Aselsan reaching technological maturity: after intensive R&D investments in critical technologies, such as GaN transistors, AESA radars and advanced photonics, Aselsan recently gained technological competencies only possessed by a few global defence companies and has started to monetise this capability already (the recent USD 2bn F16 avionics contract and AESA radar deliveries are good examples). We believe this technological leap will expand the company’s wallet share in the higher-end of the defence electronics market in Turkey and abroad. In our view, the street has not realised the implications of the technological maturity reached by Aselsan for the company’s growth prospects.

Estimates increased: our 2023/24 year-end backlog assumptions are now 33% and 50% higher in USD terms, translating to 12%/15% higher revenue estimates and 16%/19% higher EBITDA forecasts for the same period (in USD terms). Our 2023E/24E NI estimates of USD 676m/685m are now 35%/22% higher. Our revised 12M PT of TRY 56.4/share is 30% higher vs. The consensus. Starting with this report, we stop using the special 15% discount factor for geopolitical risk in our PT methodology (introduced in November 2019) to reflect Turkey’s improved relations with its US and NATO partners.

Attractive valuation: on our revised 2024E numbers, the stock is trading currently at 8.4x EV/EBITDA and 7.7x P/E, placing it at 31-57% discounts vs. its international defence electronics peers. We do not see this as justified.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel