As reported by Bloomberg the Turkish central bank has asked local banks to make forward contracts for hard currency more expensive as part of its quest to defend TL.

Lenders were asked to charge a minimum 40% interest rate on dollar forward contracts, according to people with direct knowledge of the matter, who asked not to be named because the request wasn’t public. Previously the price of the contracts was capped at 30%.

The central bank, as usual, declined to comment.

Authorities believe the measure will curb demand for dollars by making it more expensive for clients to buy protection against currency swings via forward contracts with commercial lenders. Those contracts create dollar demand in the spot market because a lender selling a forward contract typically purchases hard currency to hedge its own exposure.

Turkey has been stepping up measures to constrain demand for dollars and gold in the aftermath of two devastating earthquakes last week. Demand typically surges during times of economic uncertainty in Turkey, as citizens seek to protect their savings from inflation and declines in the lira.

New Rules

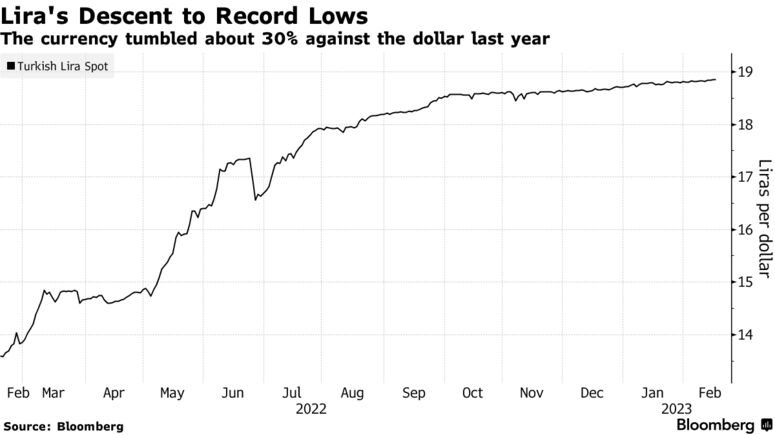

Keeping the lira stable has become a cornerstone of Turkish authorities’ efforts to contain inflation, which hovered around 80% for much of last year. The Turkish currency has lost less than 1% this year after falling about 30% last year, the worst performance in emerging markets after Argentina’s peso.

Bloomberg reported last month that the monetary authority was designing a new regulation to require banks to hold collateral for forward contracts, also aimed at cooling demand in the spot market.

Lenders have also been urged not to sell dollars to retail investors at a rate of below 19.05 liras per dollar, while banning retail investors from buying forward contracts in hard currencies, the people said. The lira was trading at around 18.8548 against the dollar on Thursday.

The central bank has also asked banks to set a minimum spread of 3% on lira-based gold sales, after the government moved to suspend some gold purchases from abroad amid surging demand for and imports of the precious metal that have distorted Turkey’s external balances.

Bloomberg