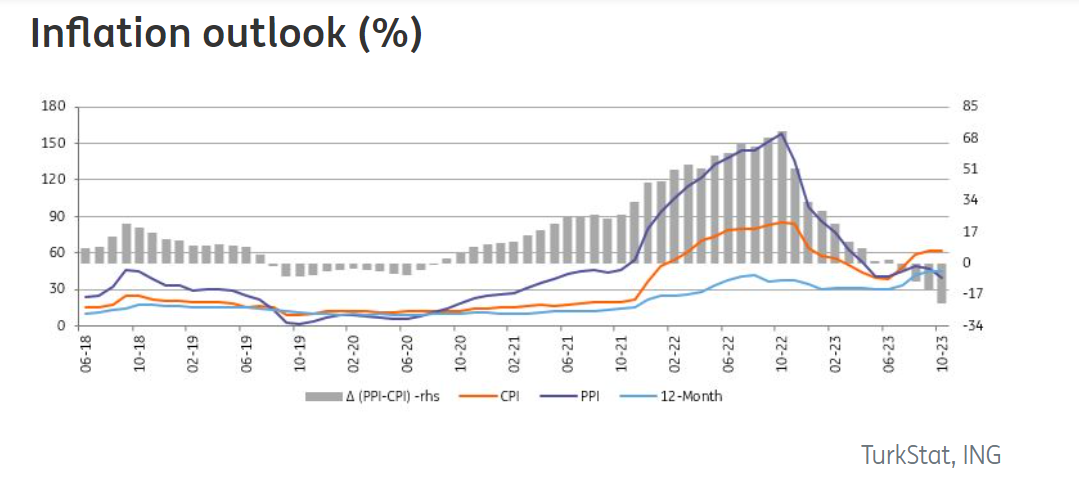

With a better-than-expected monthly inflation rate coming in at 3.4%, Turkey’s annual figure remained broadly unchanged at 61.4% in October. The data reflects continuing deterioration in price dynamics with significant pressure in services and clothing, though deceleration in food and transportation limited the monthly inflation increase. In the last inflation report of the year, the Central Bank of Turkey (CBT) raised its year-end and 2024 inflation forecasts by 7pp to 65% and by 3pp to 36% respectively, while the band of uncertainty around the forecasts widened on the back of higher geopolitical risks and uncertainties surrounding administered prices.

Central Bank governor Gaye Erkan’s presentation of the last Inflation Report of 2023 was praised by economists, however she failed to explain why inflation should decelerate from the current 60-70% band to 36% by year-end 2024. Concerns about stats office TurkStat manipulating data to understate inflation remain, as a group of academicians measured October CPI at almost twice the rate of the official figure. The upcoming local elections, slated for March 2024 is almost certain to trigger unplanned fiscal spending, which could further unhinge inflation expectations. October batch of data point to a modest decline in domestic demand, but certainly not at a magnitude to suppress inflation. As is the case with all Central Banks, CBRT, too, is scared of the Israel HAMAS war, which may engulf the entire region, putting massive pressure on energy and food prices, with World Bank’s latest commodity markets report projecting Brent soaring to $140-170/barrel in the worst case scenario.

Core high and sticky

Core inflation (CPI-C) came in at 3.7% month-on-month, rising to 69.8% on an annual basis on the back of worsening pricing behaviour and inertia in services prices. However, the underlying trend (as measured by 3m-ma, annualised percentage change, based on seasonally adjusted series) improved not only for the core but also the headline rate in October, in line with the CBT’s expectations as specified in the MPC note. Given that the CBT also pledged that the policy rate will be determined in a way that will create the monetary and financial conditions necessary for ensuring a decline in the underlying trend of inflation, we should not rule out a possibility of deceleration in the pace of hikes in the upcoming MPC, noted ING.

Cost-push pressures abate

October PPI, on the other hand, stood at 1.9% on a monthly basis, translating into 39.4% year-on-year. The decline in annual PPI from close to triple digits at the end of last year shows improvement in cost pressures, despite the increase in the TL equivalent of import prices over recent months due to commodity price developments and exchange rate increases.

While the sharp drop in October also reflecting favourable base effects is a positive development, limited moderation in domestic demand so far hints that producers will likely continue to pass their cost increases to consumers, noted ING Research.

Turkey’s Inflation Research Group (ENAG), an independent institution established in 2020 to monitor the country’s inflation, measured the annual consumer price index at 126.18% in October, with a monthly inflation rate of 5.09%.

Outlook remains grim

A more than 33% depreciation in the lira and rise in wages, taxes, and fees mainly pushed inflation higher since June.

Inflation is expected to continue rising and peak in May 2024 at around 70-75%, according to the central bank which on Thursday raised its year-end inflation forecasts for this year to 65%.

The median of the forecasts of economists polled by Reuters saw inflation rising to around 69.5% at the end of the year.

“Despite the latest fall in the annual CPI rate, the long-term outlook remains worrisome,” said Bartosz Sawicki, a market analyst at Conotoxia fintech.

Deeply negative real rates will continue to undermine disinflation efforts, Sawicki said, adding recent circumstances require a bold policy response from the central bank.

An independent economist who wishes to remain anonymous told to PA Turkey: “There is a very basic yet fundamental question – that of why inflation should be decelerating to 36% by end-2024, after peaking at 70-75% around May, leaving aside base effects”.

“Inflation has become stickier than the Bank is willing to accept, which means that steering or anchoring inflationary expectations toward the Bank’s forecast, may prove elusive under the current policy mix — of a relatively loose fiscal policy combined with a rather gradual tightening of monetary policy, assuming that this mix will not change much after the local elections, either.

”All in all, it is good to see better analysis and more realism from the Bank, but we think that at the end, as we’ve last argued in yesterday’s note, the Bank is suffering from too much gradualism, which is unlikely to work when inflation is hugely elevated and entrenched”.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/