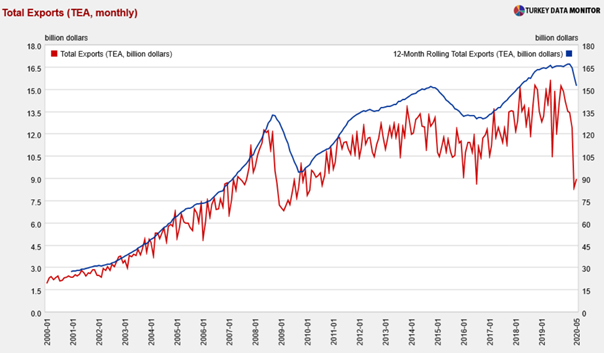

According to Turkish Exporters Assembly (TİM), exports increased by 7.6% to 9 billion dollars in May compared to the previous month but fell by 42% year-on-year. 12-month rolling total exports fell to 152.4 billion US dollars in May due to the Covid-19 related weakness. Historical peak of 167.2 billion US dollars was recorded in February 2020.

A considerable monthly improvement in exports is not a surprise since manufacturing PMI figures of Turkey’s main exports market, Europe, exposed a slight improvement in May following a solid decline in April.

On a sectoral base, exports of industrial goods increased by 19% to 5.4 billion US dollars in May compared to the previous month. Exports of automotive industrial goods doubled on monthly basis to 1,2 billion US dollars. Besides, exports of clothing and apparel goods increased by 46% to 0,8 billion US dollars. On the other hand, export figures of iron and steel products, which are third largest industrial export goods of Turkey, sustained to decrease for the last four months to 0,8 billion US dollars in May, which is the lowest level since October 2017. As can be seen in the graph below, trade war started by Trump administration in March 2018 continues to have a negative impact on Turkey’s production and exporting of both Motor Vehicles and Spare Parts and Iron and Steel Products apart from Covid-19.

In 2019, Turkey’s top ten export markets are listed from the most to the least as follows: Germany, Italy, USA, Spain, United Kingdom, France, Israel, Netherlands, Saudi Arabia, and Iraq. The graph below shows export performance of Turkey in country basis. Bursting Covid-19 in March 2020 reflected isolation and thus sharp deterioration in production, service, and trade in April. However, manufacturing PMI figures of May showed a slight improvement in economic activity associated with easing in isolation measures. Consequently, this has created a positive impact on Turkey’s exports performance in May.

Since Turkey’s industrial production depends on importing intermediate goods, it will not be a surprise to see an increase in import figures in May. The import figures of May will be released by Turkish Statistical Institute (www.turkstat.gov.tr) at the end of June.

Fulya Gürbüz, Ph.D.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/