According to BBVA Garanti research, stable currency helped absorb some upward pressure from strong demand, but weakening but continuing cost push factors, second round effects and inertia kept the level high. Increasing populism in terms of expansionary policies and wage adjustments further boosts consumption, resulting in more sticky services prices. Therefore, the deceleration in annual inflation proved to be much lower than anticipated. BBVA Garanti economists expect annual CPI to come down to 55% on average in 1Q23 and decline further to 40-45% in May just before the elections. Inflation outlook in the second half of the year will depend on the adjustment in economic policies and therefore the exchange rate. Its tentative forecast for year-end inflation is 42%.

Main data points

Consumer prices rose by 6.65% in January, significantly above both our expectation of 4%, while annual CPI slowed down to 57.7% on favorable base effects, wrote BBVA Garanti economics team.

We expect annual CPI to come down to 40-45% just before the elections and reach 42% by year end.

Key points

Core inflation skyrocketed in January to 7.7% m/m (1.86% m/m prev.), recording the highest monthly increase since December 2021 (13.2% m/m).

Services inflation contributed to soaring core inflation with 12.7% m/m (62.4% y/y) mainly on the back of wage adjustments following minimum wage hike in the previous month, second round effects and strong demand.

While food prices drastically picked up with 6.6 m/m (1.9% m/m prev.), increase in energy prices was relatively limited with 1.6% m/m, which stemmed from some ease in regulated energy prices.

Despite an almost stable currency, robust demand and continuing cost push factors continue to keep inflationary pressures, which in turn feed second round effects and reinforce inertia further.

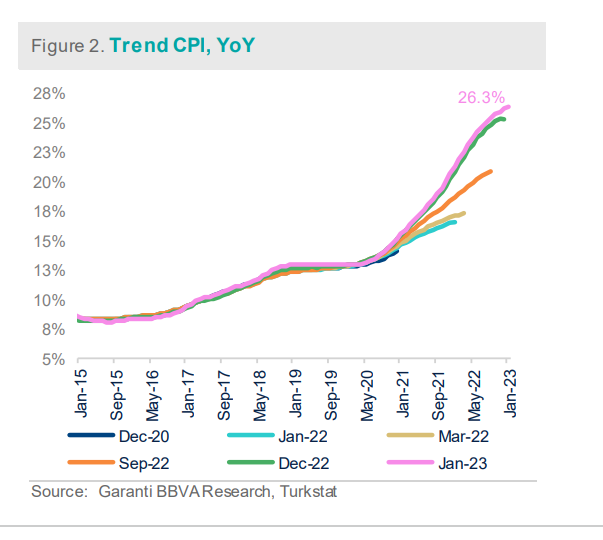

The deterioration in trend inflation continues and it already reached above 26% in January. This worsening may continue in the short term converging near 30%, which signals that decreasing inflation below 30% would be very challenging without a strictly clear commitment against inflation.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/