After the release of June inflation data, disappointment spread among economists, some of whom began to update 2020-2021 forecasts. The first salvo came from prestigious Is Invest, which added to its year-end CPI forecast 100 basis point, up to 10.5%. Seker Invest predicted that Central Bank will have to halt its marathon rate cutting exercise for the time being.

Seker Invest: CPI inflation greatly exceeds market expectations (as in May)

TURKSTAT has revealed June CPI inflation at 1.13% greatly exceeding the 0.7% median market expectation (in the Bloomberg survey, it was 0.6%), albeit closer to our 1.0% estimate. As we had witnessed a mere 0.03% print in the same month of last year, YoY CPI inflation rose to 12.62% from 11.39%. Core CPI inflation (group C) was 2.13% MoM and increased to 11.6% from 10.3% on a YoY basis. D-PPI inflation was 0.69%, which brought YoY D-PPI inflation to 6.2% from 5.5%.

Highlights of June inflation

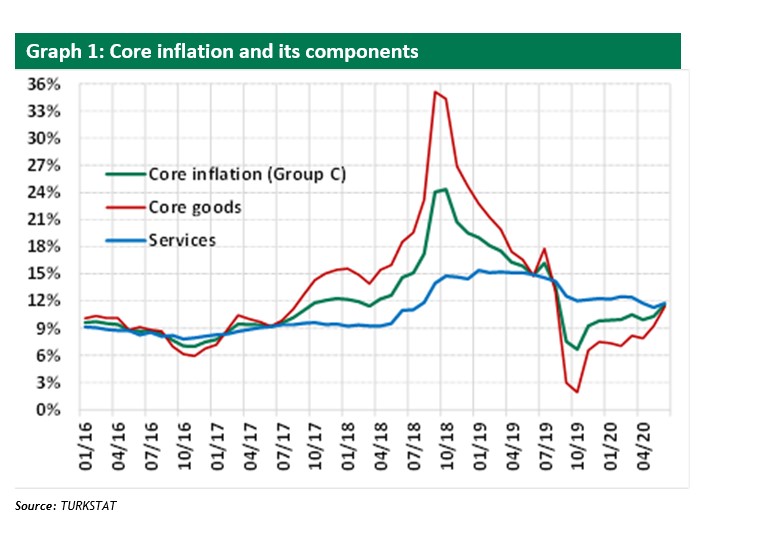

In our daily bulletin, we had guesstimated the likely reason behind the divergence between our estimate and market expectations as us expecting a greater FX pass-through impact and higher services inflation (i.e. our higher core inflation expectation), which seems to have been confirmed by the actual data. In fact, headline CPI inflation came in higher, despite food inflation printing better than our projection (-1.6%, vs. -0.7%) and core inflation (group C) at 2.1% has turned out to be even higher than our projection of 1.9%. Looking at the breakdown of core inflation, we see that the traces of normalization measures and going back to business after two months of lockdowns are reflected to services inflation, and additionally, that ongoing FX pass-through and potentially demand pressures have pulled up core goods inflation, as well.

Food inflation; MoM food inflation turned out to be -1.6%, somewhat lower than our -0.7% projection. The negative print is mainly attributable to unprocessed food prices, which fell by -3.8% (both due to fruit-vegetable and meat prices), while processed food prices rose by 0.6%. YoY food inflation remained flat at 12.9%.

Services inflation: As mentioned above, the traces of normalization measures and going back to business after two months of lockdowns are reflected to services inflation, which came in at 2.1% MoM, and led to an increase in YoY services inflation to 11.8% from 11.3%.

Core goods inflation: The TRY’s depreciation, recent import tax hikes and potentially demand pressures (as a result of easing lending conditions) have all led to price hikes in automotive, white goods and cell-phone prices, resulting in a 2.9% MoM increase in the durable goods component. As a result, there was also a material increase on a YoY basis to 15.5% from 12.9%. Other core goods prices (mostly fast consumer goods), which were rather constrained in recent months, also witnessed a 2.0% MoM increase, leading to a rise on a YoY basis to 6.6% from 5.6%. Clothing inflation at 1.1% MoM was also above past year’s averages (e.g.: Jun 19: -1.6%, Jun-18: -1.2%, Jun-17: -1.3%).

Core inflation (group C): As a result of the above mentioned factors, YoY core inflation spiked to 11.6% from 10.3%, which might (should) be a factor hindering the CBRT from further policy rate easing (at least over the short-term).

Energy inflation: The retreat in global Brent oil prices from trough levels of about USD20/bbl continues to exert upside pressure on headline CPI inflation, with the MoM energy inflation turning out to be 2.6%, in line with expectations. Note that the energy component saw some 4.8% increase over the past two months, after witnessing an 8.5% deceleration between January and April.

Tobacco& alcoholic beverages component: There was a 0.9% MoM increase here, with the lingering impact of the tax hike implemented in mid-May, which was also as expected.

CBRT likely to adopt a wait-and-see approach for a while

The CBRT’s expectation that supply side factors would phase out as the normalization process continues, and that demand driven disinflation process would accelerate in 2H20 might imply that it maintains its easing bias. Yet, its more cautious stance on inflation with further stressing of potential risk factors, such as increased core inflation indicators, (tentative) supply side factors and food prices means that it is more likely to adopt a wait-and see approach for a while, which is also supported by today’s print.

Serkan Gonencler, Economist, Research Dept

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/