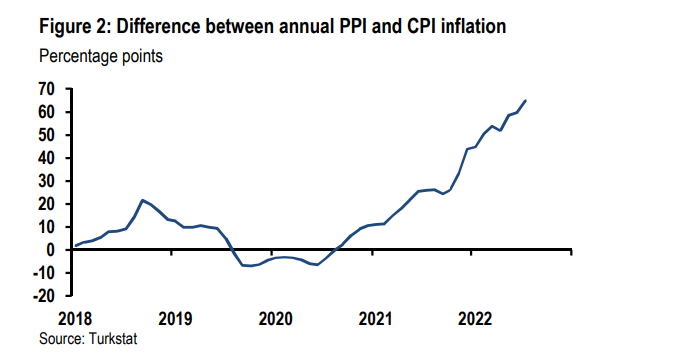

For what it’s worth, Turkish CPI surprised marginally to the down side, rising 2.4%m/m in July (JPMorgan forecast: 2.5%, market consensus: 2.6%). This kept the annual inflation just below the 80% mark (79.6%, to be precise), a level that should be appreciated by policy makers. There was no major surprise in core CPI either. The 3.2% increase in core CPI pushed the annual core inflation to 61.7%. While the fall in global prices resulted in monthly declines in local energy prices, price pressures were observed in all of the remaining subcategories.

Ozlem Derici Sengul: Inflation rate almost 80%

Given the excessively loose monetary policy, continued lira weakening and ailing policy credibility, it is no surprise to see price pressures continue to strengthen. When inflation is at such unprecedented levels, it gets even more difficult to measure and to forecast inflation and surprises matter little in this context. Still, in our base case, we expect inflation remaining elevated for the rest of the year.

The end-year forecast remains unchanged at 63.1%, but as has been the case in recent years, the risks to the forecast are skewed to the upside. The timing and the results of the upcoming elections along with pre-election policies constitute the main sources of uncertainty on inflation and monetary policy while the policies of the post-election government and the timing of the return to orthodox policies will most likely determine the course of the inflation in the medium term.

As inflation continues to rise, the real policy rate offered by the CBRT gets more deeply negative. Currently, the policy rate stands at 14.0%; this is a level difficult to explain in a country where inflation is 79.6%. The CBRT is in no rush to normalize its policy stance while demand remains robust, cost-led inflationary pressures are strong and credibility weakening continues. In this environment, lira stability – that has at least partly been secured by the FX-protected lira deposit scheme and will likely be supported by strong tourism revenues – will be the main tool to restrain inflationary pressures in the short run. Further lira weakness could worsen the inflation outlook.

EM, Economic and Policy Research

Yarkin Cebeci, J.P. Morgan Securities

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/