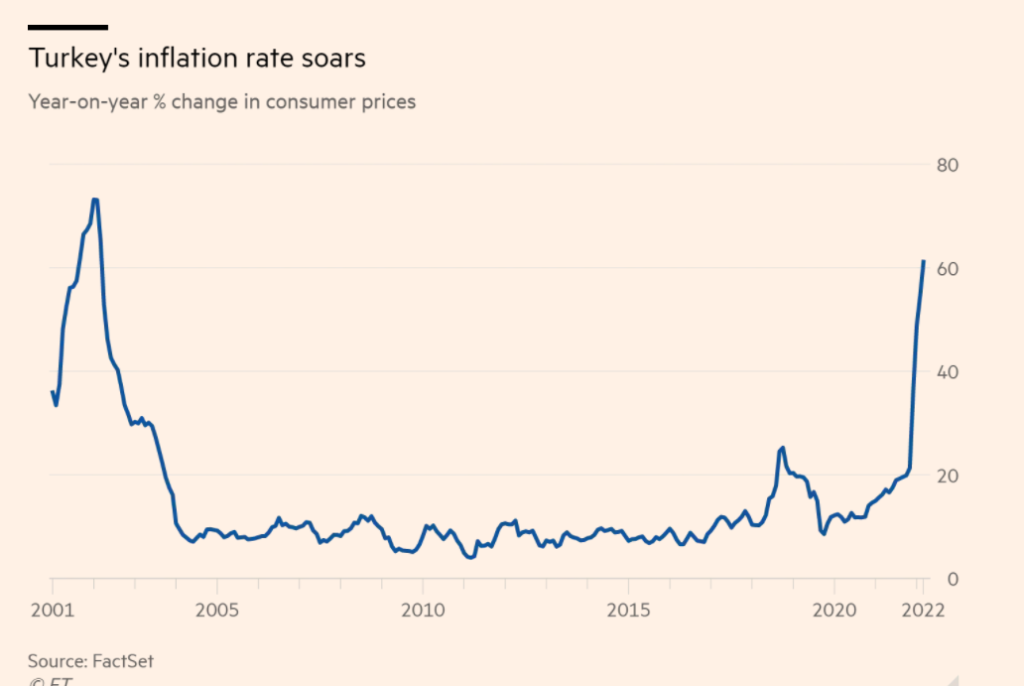

CPI inflation at 5.46% comes broadly in line with expectations in March and rises to 61.1% in YoY terms

TurkStat revealed March CPI inflation at 5,46%, broadly in line with our 5.3% estimate, which is also the median expectation at the Foreks survey. With this result, YoY CPI inflation increased further to 61.1% from 54.4% (36.1% at end- 2021). Yet, core CPI inflation (group C) at 4.4% exceeded our 3.9% estimate, leading to a rise in YoY terms to 48.4% from last month’s 44.1% (31.9% at end-2021). D-PPI inflation was 9,19%, leading to a further rise to 115.0% from 105.0% (79,9% at end-2021).

Broad based rise in inflation lingers into March

Although high inflation seems to be broad based, the biggest contribution to CPI inflation came from the energy component, which registered a 11% MoM increase due to roughly 35% rise in pump petroleum prices. Food inflation at 4.7% remains high although this is somewhat below our 5.5% projection.

On the other hand, core-CPI inflation also exceeded our expectation (4.4% vs. 3.9%), implying a greater FX passthrough particularly for durable goods and other core goods prices, which registered respective 5.1% and 5.4% MoM rise, while clothing inflation at 1.8% was in fact lower than our projection. Services inflation was 4.1% MoM, with lingering FX passthrough and deterioration in pricing behaviour.

Steep inflationary trend likely to prevail for few months more with the CPI inflation testing 70% levels by May (at the latest)

The steep rise in inflation trend is likely to linger for few months more despite the recent VAT cut to 8% from 18%, with prolonged FX passthrough, persistently high food inflation and as rising energy costs will continue to reflect into inflation subcomponents. As a result, we would expect CPI inflation to test levels in excess of 70% mark by May (at the latest).

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit

Average CPI inflation for 2022 may turn out to be 60-65%

Thereafter, global energy prices and the currency will surely be the major determining factors. In the meantime, we are also concerned that the notorious spiral between inflation and the currency may also pose significant upside risks on inflation. As such, with optimistic assumptions, such as stable trend in TL and energy prices, we would expect CPI inflation to remain between 65-70% until November/December.

Although a significant base effect may lead to a deceleration in CPI inflation particularly from December onwards, we now expect CPI inflation at 45-50% by end-2022, with potential risks to the upside (e.g.: inflation-currency spiral and/or Global energy prices). In fact, a lower CPI inflation outcome may also be probable under a scenario of an easing in Global energy prices (e.g.: a decline in Brent oil price to USD80-90/bbl), due to a resolution in the Russia-Ukraine debacle and/or slowdown in Global growth.

In any case, we would expect CPI inflation to remain above 40% by end-2022, even under this optimistic scenario. All in all, with such an inflationary trend in the remainder of the year, average CPI inflation for 2022 may turn out to be 60-65%.

Serkan Gonencler, Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng