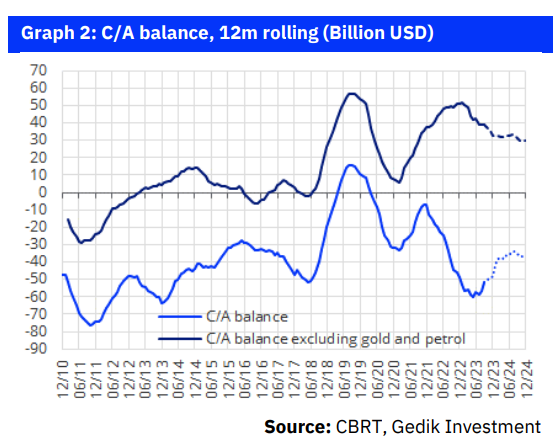

There was a swift decline in 12-month rolling C/A deficit in September…

In September, there was a USD1.9bn C/A surplus, which led to a swift decline in the 12-month trailing deficit to USD51.7bn from USD56.6bn. The September’s C/A balance posted a surplus of USD1.9bn, which was well above the USD1.4bn median market expectation, and our USD1.1bn projection. There was a USD3.0bn C/A deficit in the same month of last year. As a result, the 12-month rolling C/A deficit decreased to USD51.7bn from USD56.6bn.

Over the January-September period, the C/A deficit reached USD40.8bn compared to the USD38.2bn deficit registered in the same period of last year.

Central Bank reserves increasing rapidly

While the recovery in official reserves persisted in September, the increase in the last four months amounted to USD27bn. Official reserves registered a USD7.7bn increase in September, which was facilitated by a capital inflow of USD5.6bn and a surplus of USD0.2bn in the net errors and omissions item on top of the USD1.9bn C/A surplus. As such, after roughly declining by USD38bn in the first five months, official reserves rebounded by USD27bn in the subsequent four months.

There was a notable uptick of USD15.6bn in net errors and omissions during this period, indicating that the reserve increase is largely attributable to this source. In this four-month period (June-September), other significant financing items included a USD8.0bn increase in deposits, a USD4.9bn inflow from net international loans, and another USD4.9bn from net portfolio investments, while there was a decrease of USD3.4bn in net trade loans.

Private sector easily rolling-over maturing FX debt

Breaking down the portfolio inflows, USD2.0bn originated from banks’ Eurobond issuances, USD1.4bn from inflows into equities, and USD0.5bn found its way into government bonds.

Current account deficits are set to shrink

We anticipate a sustained improvement in the C/A deficit for an extended period, projecting a 12-month rolling deficit of less than USD40bn by the end of 1Q24. The foreign trade deficit, which averaged USD10bn monthly during the January-August period due to robust domestic demand, eased to USD5.0bn in September and USD6.7bn in October. Yet, given the ongoing surge in capital and consumption goods imports, we find it hard to attribute this easing to a slowdown in domestic demand.

For instance, the September’s retail volume index, which was also announced today, pointed to a 13.8% YoY increase despite a 0.7% MoM deceleration. While this suggests a softening compared to the 31.8% and 17.3% YoY increases in July and August, respectively, it also demonstrates that domestic demand remains robust. We may easily argue that the ongoing robustness in domestic demand has been restraining the pace of the improvement in C/A deficit, as well as delaying the disinflation process.

Domestic demand beginning to cool down

Although the domestic demand slowdown has not yet reached desired levels, we expect that the improvement in the 12-month rolling C/A deficit would continue over the coming months, just due to the expected decline in net energy and net gold imports. Consequently, we project that the 12-month rolling C/A deficit may retreat to below USD50bn (USD48-49bn) by end-2023 and fall below USD40bn by the end of 1Q24.

Serkan Gönençler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/