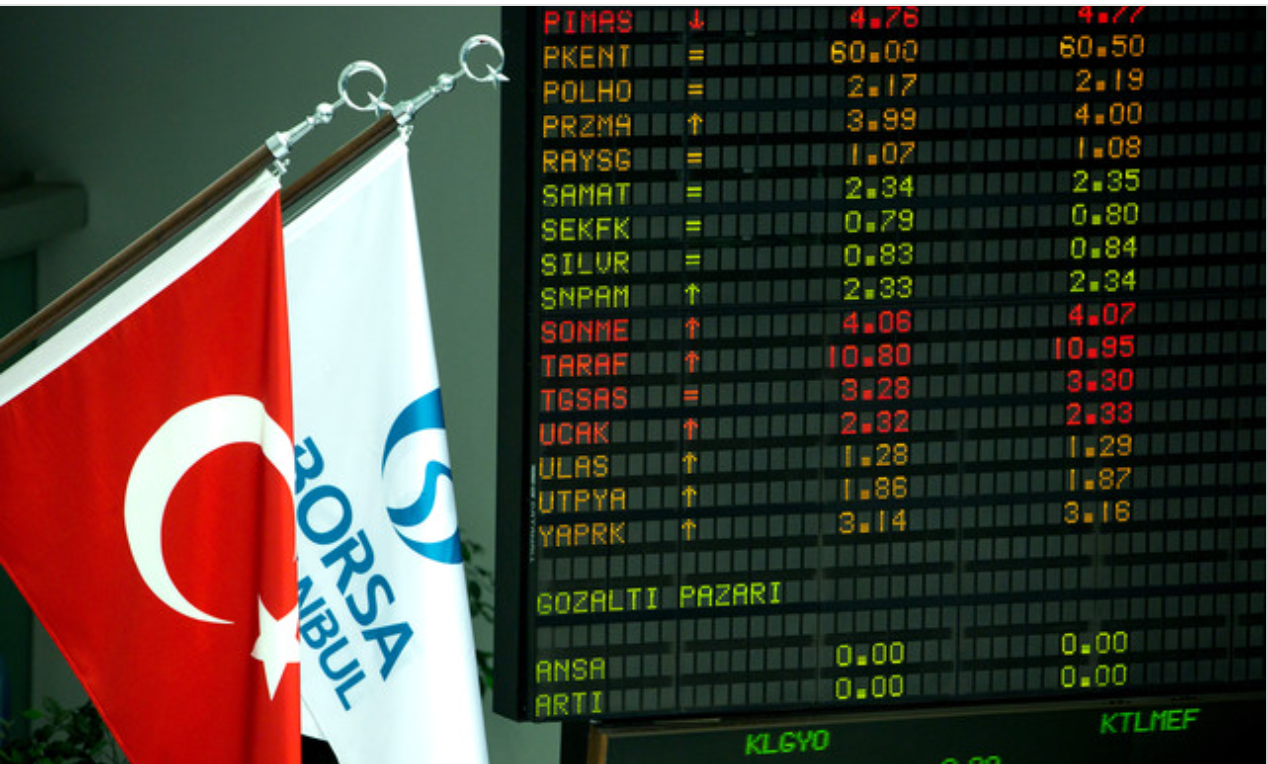

Risk Mode On: Why Turkish Markets Are Entering a New Sweet Spot for Stocks and Bonds

stock

stock

Turkey’s financial markets closed 2025 with a clear message from professionals who live and breathe price action, risk, and macro signals every day: confidence in TL-denominated assets is not only intact, it is strengthening. According to the year-end Market Professionals Survey (PPA) conducted by Spinn Danışmanlık, December marked a decisive tilt toward Turkish stocks and domestic bonds, as falling inflation momentum and renewed expectations of CBRT interest rate cuts reshaped portfolio strategies.

TL-Denominated Assets Gain Ground in December

Survey results show that TL-based assets continued to dominate portfolios, with their overall weight rising from 65.5% in November to 67.2% in December. This shift signals growing conviction that domestic monetary conditions are moving into a more supportive phase for risk assets. Notably, this level represents the second-highest TL allocation since the survey began in January 2023, trailing only the peak of 73% recorded in December 2024. For market professionals, this is not a short-term trade but a strategic rebalancing aligned with improving macro fundamentals.

Disinflation and Rate Cut Expectations Drive Risk Appetite

A key catalyst behind this shift was the slowdown in monthly inflation, reinforcing expectations that the Central Bank of the Republic of Turkey (CBRT) will continue its easing cycle. As confidence in disinflation increased, so did appetite for assets that typically benefit from declining interest rates. Equities and both short- and long-term domestic debt instruments emerged as the primary beneficiaries of this renewed optimism, reflecting a broader “risk-on” mindset across professional portfolios.

Equities Take Center Stage

Domestic equities stood out as one of the most favored asset classes in December. The proportion of respondents recommending “increase weight” in Turkish stocks rose from 50.9% to 55.2%, while those advocating “strongly increase weight” jumped from 11.4% to 14.9%. This upward trend highlights a growing belief that corporate earnings, valuation dynamics, and easing financial conditions are converging in favor of equities. Portfolio data confirms this sentiment, with domestic equities recording the largest monthly increase, rising 1.9 percentage points to 29.3%, the highest gain among all asset classes.

Domestic Bonds Regain Their Appeal

Interest in domestic government bonds also strengthened notably. For short-term domestic debt instruments, the share of professionals recommending an increased allocation climbed from 50.0% to 59.8%, while neutral views declined sharply. A similar shift occurred in long-term domestic bonds, where the long-dominant neutral stance gave way to a majority favoring increased exposure. The weight of long-term bonds in portfolios rose by 1.8 percentage points to 7.9%, reflecting improved inflation expectations and confidence in the medium-term rate outlook.

Deposits Lose Momentum

In contrast, TL deposits experienced the most pronounced decline in portfolio weight, falling by 3.5 percentage points in December. For the sixth consecutive month, the prevailing recommendation for deposits remained “neutral”, supported by expectations that ongoing rate cuts will gradually erode their relative attractiveness. The share of respondents favoring increased deposit exposure slipped further, underscoring a strategic shift away from passive yield toward assets with higher total-return potential.

FX-Based Assets Remain on the Sidelines

Foreign–currency–denominated instruments, including spot FX, FX-protected deposits (DTH), gold, foreign equities, and foreign bonds, largely maintained a neutral allocation stance. In most of these categories, “neutral” recommendations exceeded 50%, signaling caution rather than outright pessimism. Gold saw a modest decline in interest, with its portfolio weight dropping to 10.6%, while overseas equities and foreign bonds also lost ground. Despite declining CDS premiums and expectations of U.S. rate cuts, 63.2% of professionals still recommended a neutral stance on foreign bonds, reflecting a preference for domestic opportunities over global alternatives at this stage.

What the Portfolio Shifts Really Say

The December survey paints a coherent narrative. Market professionals are positioning for a continuation of disinflation, supportive monetary policy, and improving financial conditions within Turkey. The rotation out of deposits and selected FX-based assets into equities and domestic bonds reflects a calculated embrace of risk rather than speculative exuberance. Importantly, this transition appears data-driven, grounded in macro trends rather than sentiment alone.

With 87 professionals participating anonymously via WhatsApp and email during the final week of December, the PPA offers a credible snapshot of institutional thinking. As Turkey enters 2026, the message is clear: risk mode is on, and for now, stocks and bonds are the preferred vehicles for navigating the evolving economic landscape.