January Budget Signals Relative Strength in Primary Balance, Analysts Say

budget jan2026

budget jan2026

Türkiye’s January budget data showed a widening deficit on an annual basis, but the outcome came in below expectations. Strong tax revenues and a relatively solid primary balance supported the fiscal outlook. Analysts broadly expect the 2026 budget deficit-to-GDP ratio to hover around 3.4%–3.5%, while cautioning that interest expenditures and spending dynamics remain key risks.

Deficit Widens, But Below Expectations

According to official data, in the first month of the year:

-

Budget revenues rose 55% year-on-year to TRY 1,421.2 billion.

-

Budget expenditures increased 49% to TRY 1,635.8 billion.

As a result, the January budget deficit widened 54.1% year-on-year to TRY 214.5 billion, though it undershot market expectations.

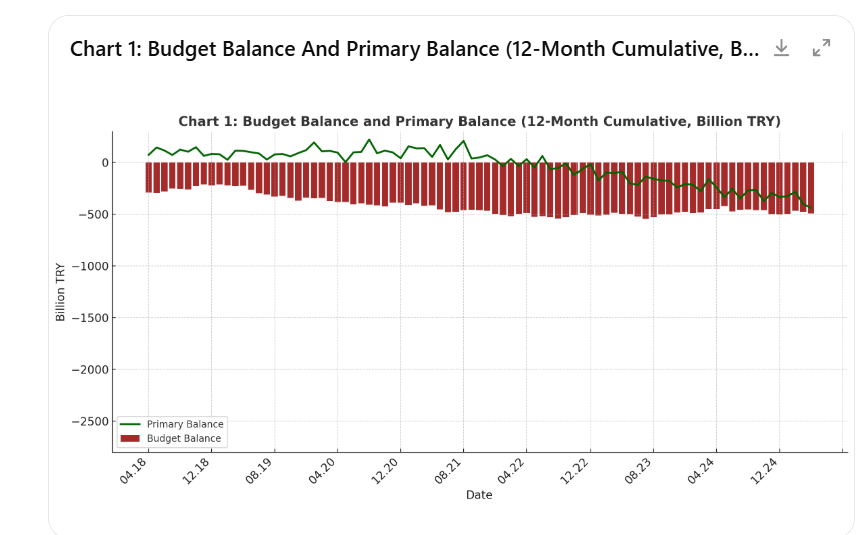

On a rolling 12-month basis:

-

The cumulative budget deficit reached TRY 1.874 trillion.

-

The primary balance recorded a TRY 473 billion surplus.

The data suggest that relatively contained real growth in primary expenditures helped preserve a degree of fiscal resilience.

Al Baraka Türk: Primary Spending Relatively Contained

Al Baraka Türk highlighted that limited real increases in non-interest expenditures signaled a comparatively firm fiscal stance.

In January:

-

Current transfers rose 27% year-on-year to TRY 513.6 billion, accounting for 44% of non-interest spending.

-

Personnel expenditures climbed nearly 40% to TRY 502.3 billion, representing 43% of non-interest outlays.

-

Capital expenditures contracted 35%, easing pressure on the expenditure side.

On the revenue front:

-

Tax revenues increased 49% (14% in real terms) to TRY 1.181 trillion.

-

Income tax revenues surged nearly 72% to TRY 338.3 billion.

-

Domestic VAT jumped 81% to TRY 298.7 billion, marking the strongest increase among major tax categories.

-

Special consumption tax (SCT) and fees rose below the annual inflation rate.

The bank underscored that robust tax performance was a key factor supporting the budget balance.

Şeker Yatırım: Stronger Policy Coordination

Şeker Yatırım described the primary balance performance in January as relatively positive.

The brokerage noted that revenue-enhancing and expenditure-constraining fiscal measures are reinforcing coordination with monetary policy. After a stronger-than-expected fiscal outcome in 2025, similar alignment could continue in 2026 in support of the disinflation process.

The firm added that potential policy rate cuts may ease interest cost pressures on short-term borrowing instruments. Re-establishing a credible fiscal anchor would help reduce macro vulnerabilities and enhance resilience against external shocks.

However, it cautioned that revenue and expenditure increases above inflation may raise questions regarding the disinflation path. Strong VAT collections also point to continued resilience in domestic demand.

Tacirler Yatırım: Spending Dynamics Require Close Monitoring

Tacirler Yatırım said January data indicate relatively strong primary performance but stressed that spending trends must be closely monitored to ensure fiscal sustainability.

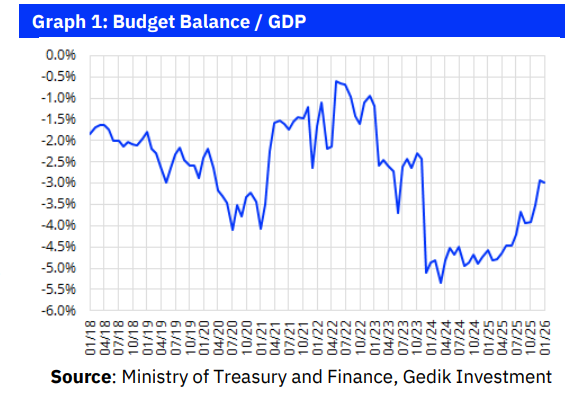

The firm projects the 2026 budget deficit at:

-

TRY 2.8 trillion,

-

Equivalent to approximately 3.4% of GDP.

In 2025, the overall deficit stood at TRY 1.8 trillion, below the TRY 2.2 trillion target set in the Medium-Term Program (MTP), while the primary balance posted a TRY 255.2 billion surplus.

Tacirler noted that stronger-than-expected revenues drove the outperformance relative to official targets, but there is limited evidence of broad-based and structural fiscal tightening. Instead, recent improvements appear to reflect temporary shifts in spending composition rather than a durable consolidation.

Gedik Yatırım: Deficit-to-GDP Ratio Around 3.5% in 2026

Gedik Yatırım expects the 2026 budget deficit-to-GDP ratio to align with official MTP projections at around 3.5%, potentially slightly below.

The firm highlighted that tax revenues exceeded projections in 2025 and may again outperform targets in 2026.

On the downside, upward deviations in interest expenditures could offset this positive revenue trend.

Additionally, the 2026 budget allocates more than TRY 600 billion for earthquake-related spending, suggesting that reconstruction costs will continue to weigh on public finances.

Assuming controlled growth in non-interest expenditures, Gedik expects the central government deficit to close the year near MTP projections.

Overall Assessment

January data point to a relatively strong primary balance supported by buoyant tax revenues. While fiscal discipline appears broadly intact, analysts emphasize that the sustainability of this stance hinges on spending control and interest cost dynamics.

Most projections converge around a 2026 deficit-to-GDP ratio in the 3.4%–3.5% range, with risks tilted toward interest expenditures and ongoing earthquake-related spending.

Tax revenues like to overshoot projections, but contrary to government claims earthquake related spending continues, with TL600 billion budgeted for 2026.

Significant surge in income tax revenue suggests Simsek’s efforts to collect from evaders is showing some success.

Interest expesnes already 22% of outlays, Turkey is now extremely vulnerable to a new surge in inflation, which will drive up bond yields.

Maintaining fiscal discipline will be critical for supporting Türkiye’s disinflation process and reinforcing macroeconomic stability.

Erdogan is expected to keep fiscal policy relatively constraint, to save ammo for the next election cycle, expected to take place around November 2027.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/