Turkey’s Consumer Confidence Rises Sharply in November on Black Friday Boost

tuketici-guven

tuketici-guven

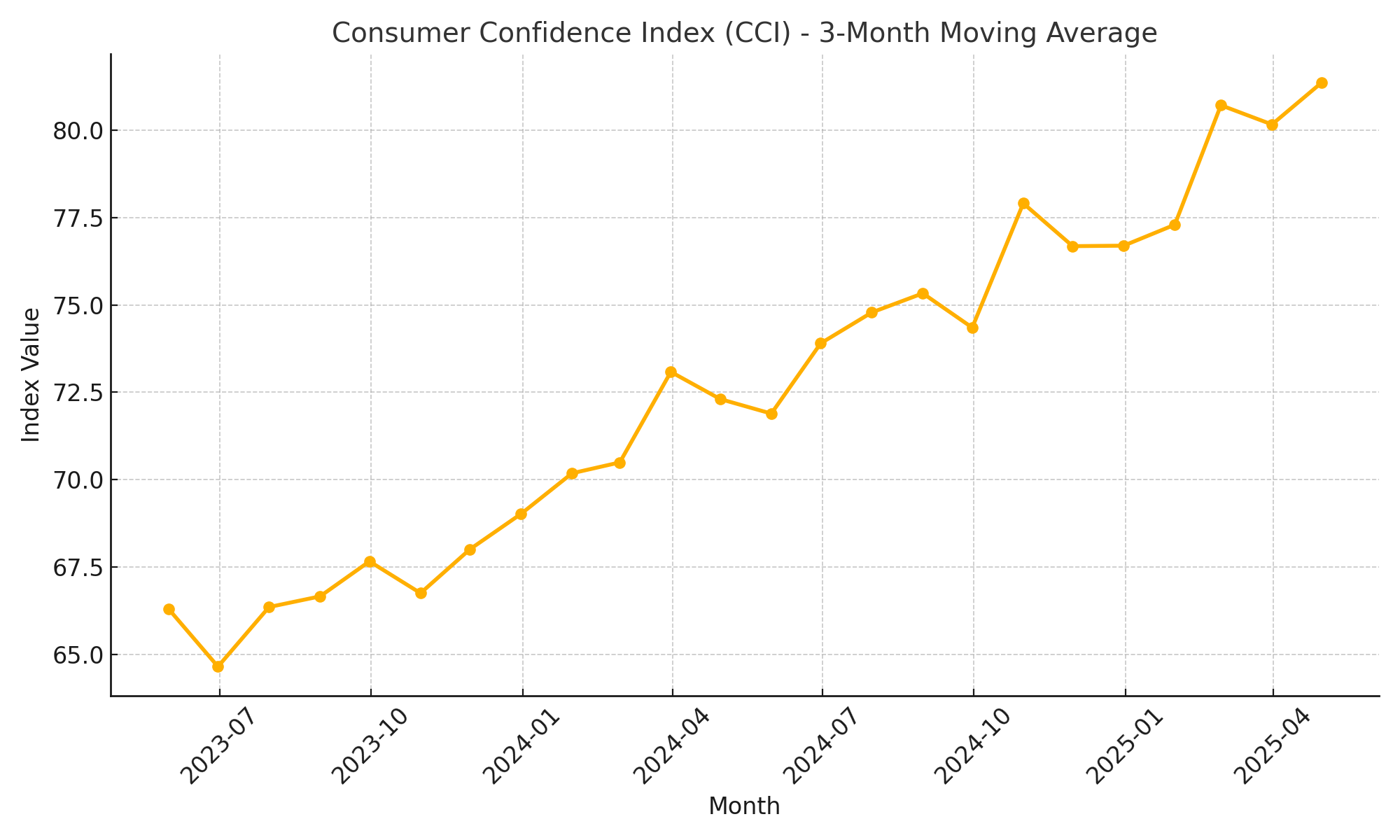

Turkey’s consumer confidence indicators climbed in November, supported by widespread “Black Friday” discounts, improving sentiment on future economic conditions, and expectations that interest-rate cuts in 2026 will revive growth. Bloomberg HT indices showed strong gains across all components, while official data from TÜİK confirmed that overall economic confidence reached its highest level since March.

Bloomberg HT Consumer Confidence Index Jumps 9.4%

Turkey’s consumer sentiment strengthened visibly in November, with the Bloomberg HT Consumer Confidence Index rising 9.43% month-on-month to reach 74.79.

The increase reflects improvements in:

-

Perceptions of current economic conditions

-

Expectations for the coming months

-

Households’ willingness to spend

Analysts attribute the surge primarily to Black Friday discount campaigns, which expanded across retail, electronics, household goods, and automotive sectors during November.

Future Expectations Improve as Markets Price in 2026 Rate Cuts

Consumers are also becoming more optimistic about the economic outlook. Expectations that the Central Bank of Turkey (CBRT) will continue cutting interest rates in 2025 and into early 2026 are feeding hopes of stronger economic activity in the medium term.

The Bloomberg HT Consumer Expectations Index climbed 8.79% from the previous month, reaching 72.70.

According to economists, households increasingly anticipate that lower borrowing costs will ease financial pressures and support stronger disposable income next year.

Spending Appetite Rebounds to Highest Level Since Late 2024

The strongest improvement was recorded in the Bloomberg HT Consumption Tendency Index, which rose 14.08% to 87.14.

This index tracks the perceived suitability of the current period for major purchases such as:

-

Durable goods

-

Automobiles

-

Housing

Black Friday promotions and expectations of additional discounts in December — especially in automotive — significantly boosted spending intentions. The index has now reached its highest level since December 2024, indicating a notable rebound in consumption appetite.

TÜİK: Consumer Confidence Rises to 85.0 in November

Turkey’s national statistical agency TÜİK also reported an improvement in household sentiment.

The official Consumer Confidence Index increased 1.6% month-on-month to 85.0 in November.

Detailed data show broad-based improvement:

-

Current financial situation of households: up 2.7% to 69.6

-

12-month forward financial expectation: up 1.9% to 85.7

-

General economic outlook expectation: up 1.3% to 79.6

-

Spending tendency on durable goods: up 0.9% to 105.0

Consumer confidence indices range from 0 to 200. Readings below 100 indicate pessimism, while values above 100 show optimism. Turkey’s index remains below the neutral level, but the steady rise signals improving sentiment.

Economic Confidence at Highest Level Since March

TÜİK also published the broader Economic Confidence Index, which aggregates sentiment across households, businesses, services, and construction.

The index rose 1.3% in November to 99.5, up from 98.2 in October — the strongest reading since March.

The breakdown shows steady gains across almost all sectors:

-

Consumer confidence: 85.0 (+1.6%)

-

Real sector (manufacturing): 103.2 (+1.2%)

-

Services confidence: 111.8 (+1.0%)

-

Retail trade confidence: 114.2 (+0.9%)

-

Construction confidence: 84.9 (+1.5%)

Economists note that although consumer confidence is still in the pessimistic zone, the combination of rising industrial sentiment, stronger retail activity, and heightened service-sector confidence supports the outlook for modest fourth-quarter GDP growth.

What Is Driving the Improvement?

Analysts point to three key factors behind the jump in confidence indicators:

1. Seasonal Discounts Stimulating Consumption

The widespread adoption of Black Friday promotions across Turkey boosted foot traffic, online sales volumes, and household optimism about purchasing power.

2. Expectations of Lower Interest Rates Ahead

Markets increasingly believe that the CBRT will continue its easing cycle in 2025, with the impact felt more clearly in 2026, when growth is expected to accelerate.

Lower borrowing costs typically support consumer credit, durable goods purchases, and housing demand.

3. Stabilizing Macroeconomic Indicators

While inflation remains elevated, monthly price momentum has softened compared to earlier in the year.

At the same time:

-

Retail sales remain resilient

-

Industrial confidence is improving

-

Turkey’s economic confidence index is approaching the neutral 100-point threshold

These trends collectively strengthen the perception that economic conditions may gradually normalize over the next year.

Outlook: Cautious Optimism

Economists warn that consumer sentiment in Turkey remains highly sensitive to:

-

Inflation surprises

-

Exchange-rate fluctuations

-

Interest-rate decisions

-

Wage adjustments

-

Volatility in global markets

However, the synchronized rise in both Bloomberg HT and TÜİK indices supports the view that the Turkish economy is entering the final quarter of 2025 with cautious but improving momentum.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English-language YouTube videos @ REAL TURKEY, Twitter @AtillaEng, and Facebook: Real Turkey Channel.