ANALYSIS: Inflation Expectations Deteriorate Sharply as TCMB Survey Signals Upward Risks

inflation-expectations

inflation-expectations

Summary:

The Central Bank of Turkey’s (TCMB) Market Participants Survey for October 2025 shows a significant deterioration in inflation expectations following a stronger-than-expected September CPI print. Both short- and medium-term inflation forecasts were revised higher, suggesting Turkey is unlikely to close the year below the 30% threshold. Market participants also expect the central bank to continue cutting rates at its upcoming policy meetings, while exchange rate and growth projections indicate persistent macroeconomic imbalances.

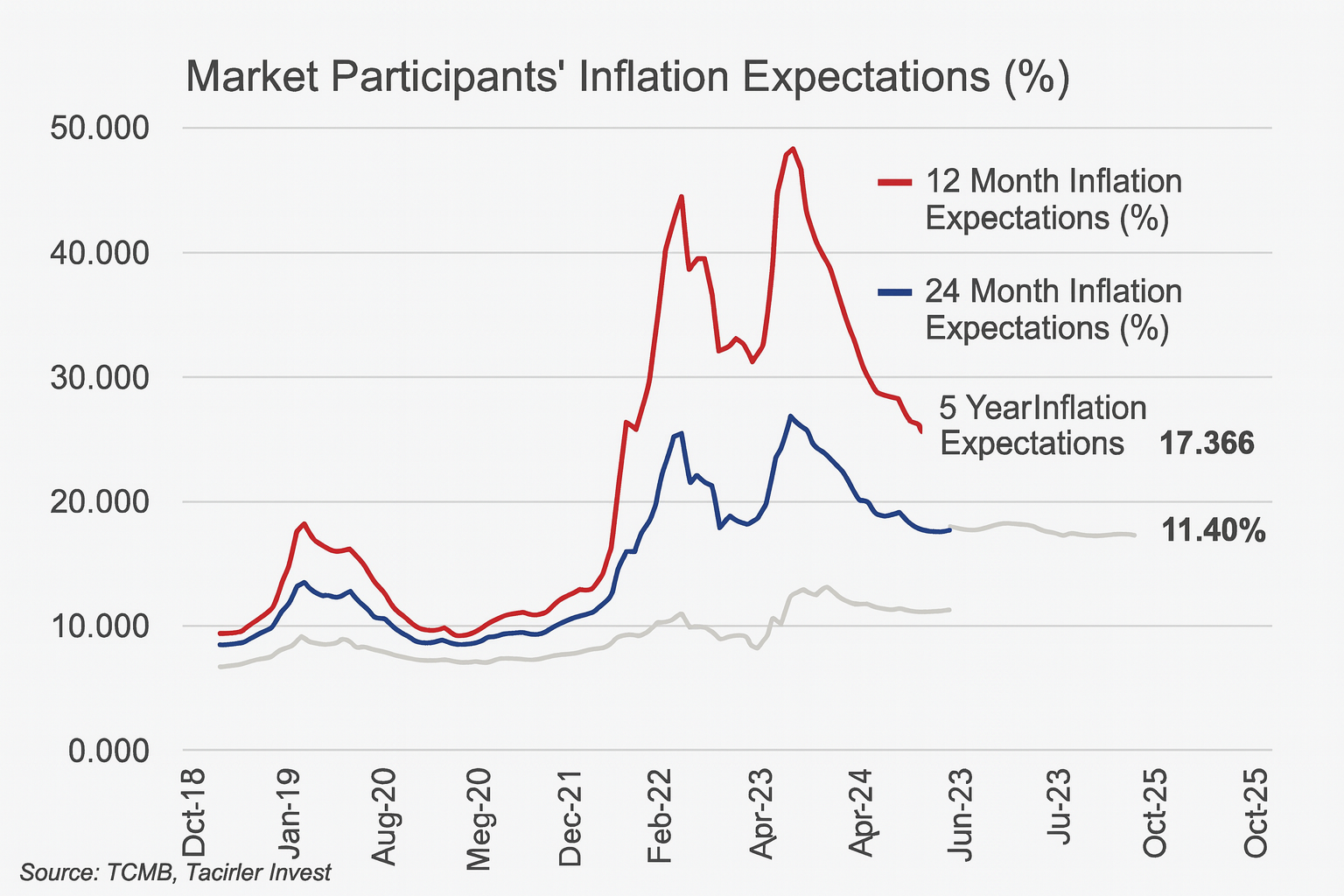

Inflation Expectations Rise Across All Horizons

According to the October TCMB survey, year-end 2025 CPI expectations rose to 31.77% from 29.86% in the previous month.

Similarly, 12-month inflation expectations increased from 22.25% to 23.26%, while 24-month projections climbed from 16.78% to 17.36%.

Market participants expect monthly inflation in October to reach 2.34%, though analysts at Tacirler Invest forecast a slightly higher figure of 2.71%. The firm notes that seasonal factors are likely to push clothing and footwear prices into double-digit territory, while food inflation remains sticky.

Tacirler Invest concludes that “the probability of ending the year with inflation below 30% has largely disappeared,” and accordingly revised its year-end CPI forecast upward from 29.7% to 31.5%. For 2026, the institution expects inflation to ease to around 23%.

Policy Rate Outlook: Further Easing Expected, But Risks Are Tilted Upward

The survey also reveals that market participants anticipate another 150 basis point rate cut at the upcoming October 23 Monetary Policy Committee (MPC) meeting.

They expect the central bank to continue its easing cycle in December with another 150 bp reduction, bringing the year-end policy rate to around 37.66%.

Tacirler Invest shares this expectation but warns of potential policy caution:

“We project a 150 bp cut in the October MPC meeting, but do not rule out a smaller move. Our year-end policy rate forecast remains at 37.5%, though risks are clearly tilted to the upside.”

For 2026, the institution maintains a policy rate projection of 28%, signaling gradual monetary normalization.

Lira Outlook: Depreciation Expected to Continue

Survey participants forecast the USD/TRY exchange rate at 53.56 by end-2025, and 49.75 on a 12-month horizon.

Tacirler Invest remains more conservative, maintaining a year-end 2025 USD/TRY forecast of 44, reflecting expectations of a slower depreciation path under active TCMB intervention and improving reserve dynamics.

Growth and Current Account Expectations Remain Stable

Economic growth projections were revised slightly higher.

-

2025 GDP growth forecast: up from 3.2% to 3.3%

-

2026 GDP growth forecast: up from 3.7% to 3.8%

Tacirler Invest expects GDP growth of 3.4% in 2025 and 3.7% in 2026, reflecting a modest recovery supported by domestic demand and export normalization.

Meanwhile, current account deficit projections widened slightly to $20.8 billion for 2025 and $25.4 billion for 2026. Tacirler Invest’s own forecast stands at $22 billion (1.5% of GDP) for 2025, citing import resilience and energy price risks.

Conclusion: A Higher Inflation Plateau Ahead

The October TCMB survey confirms that inflation expectations have become entrenched at elevated levels, challenging the central bank’s credibility and complicating monetary policy transmission.

With inflation stickiness, exchange rate pressures, and global risk aversion all in play, Turkey’s monetary path looks set to balance between policy normalization and political constraints ahead of 2026.

IMPORTANT DISCLOSURE:

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English-language YouTube videos @ REAL TURKEY: YouTube Channel

Twitter: @AtillaEng

Facebook: Real Turkey Channel