Atilla Yeşilada: Forecasting Turkish Politics in 2026 — Tension at Home, Relief Abroad

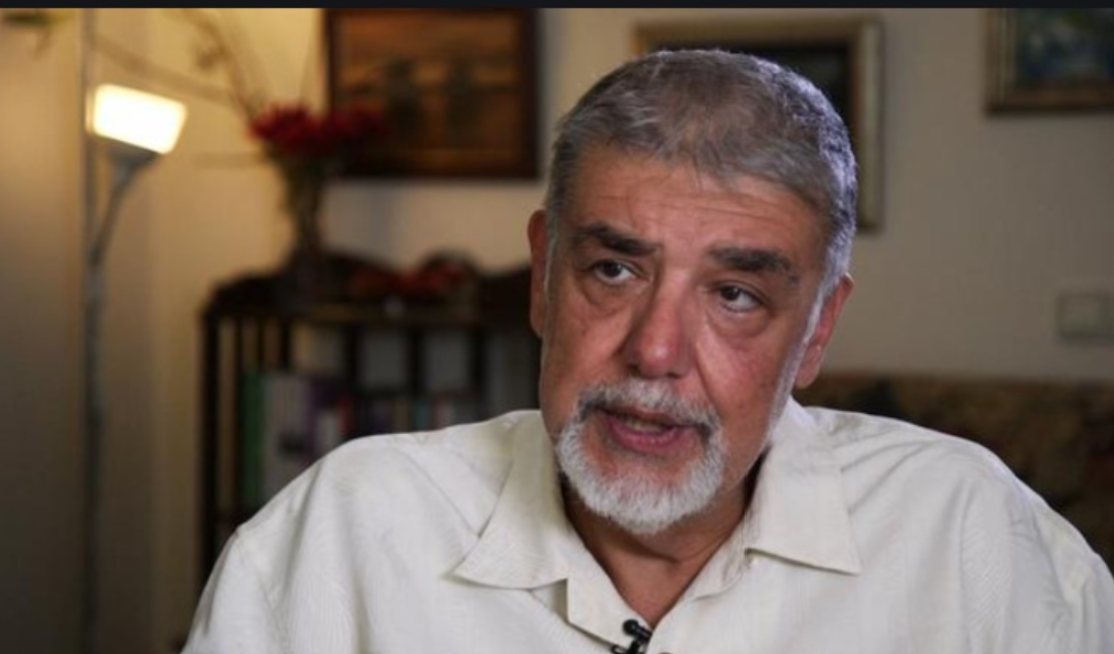

atilla7

atilla7

As I look ahead to 2026, Turkish politics appears set to follow a stark dual trajectory. Domestically, I expect rising confrontation with the opposition and a more aggressive use of state power. Externally, however, new opportunities may emerge in relations with the United States, Europe and regional neighbors. How financial markets digest these opposing narratives may prove to be the defining question of the year.

The strange passage of time and my 2026 prophecy

Is it really already mid-December? Time passes astonishingly fast. The last moment I remember being sober, cherry blossoms were in full bloom. After that? A complete blank. I was probably propelled into an alternative reality by mind-altering substances. As I enter my traditional pre-Christmas sobriety and detox period — so that I can celebrate Christmas, the New Year and my birthday without completely destroying my liver — I once again devote my energy to forecasting the year ahead.

This is a masochistic ritual I have imposed on myself for the past 25 years.

Theory tells us that financial markets are inherently unpredictable. Thanks to social media and Donald Trump, the world has also become fundamentally non-linear. We truly live in the age of the Chinese butterfly: tiny events at one end of the world can trigger massive consequences at the other.

So why do I persist in writing these forecasts? Because they are small streams feeding into the vast river we call the flow of information. Without that flow, people — and businesses — cannot form opinions. Efficient markets require efficient information, and I am simply doing my part.

Normally, I begin with geopolitics and the global economy, gradually transitioning to Türkiye and markets in a five-part series. This year, however, I need at least another week to fully assess what is driving the world and to form informed views. In the meantime, I am sharing my outlook for Turkish politics in 2026: war at home, opportunities abroad. How will markets absorb these conflicting stories?

The 2026 framework: harsh domestic politics, surprise foreign policy

In 2026, I expect President Recep Tayyip Erdoğan to make significant progress in his effort to weaken the main opposition CHP, but to fail in persuading both the CHP and the DEM Party to legislate a new constitution. From a market perspective, the real surprises are likely to come from foreign policy.

Chief among them is the possible lifting of U.S. CAATSA sanctions, alongside several other foreign-policy developments that could support a more positive narrative for Türkiye.

The main downside risk for the year, in my view, is Erdoğan resorting to asset seizures and “corporate raids” against companies he deems unfriendly.

Domestic politics: Erdoğan vs. the CHP and the Kurdish peace process

To clear my conscience, I must begin with two low-probability but extremely disruptive risks. The first is a major earthquake in the Marmara Basin — hitting Istanbul, Bursa or Kocaeli — which could cost Türkiye more than $200 billion and depress output for years. The second is a health-related retirement of either Erdoğan or his key ally Devlet Bahçeli; both appear visibly exhausted and unwell.

Turning to more concrete scenarios, I expect Erdoğan to continue using the judiciary to sideline the main opposition CHP ahead of the next elections. Ankara Mayor Mansur Yavaş may be dismissed from office or pressured into resigning from the CHP. If his polling performance against Erdoğan continues to improve, CHP leader Özgür Özel could also be expelled from parliament and hit with a political ban.

This scenario, however, is largely already priced in by both domestic and international investors. Thanks to the Central Bank of the Republic of Türkiye’s strong reserves and tight lira policy, I do not expect a lasting currency shock.

The Kurdish peace process: slow, but irreversible?

Both domestically and abroad, the Kurdish peace process is making very limited progress. Erdoğan remains unwilling to release Selahattin Demirtaş, while the PKK and the Syrian Kurds — whom I refer to as the SDF for the purposes of this essay — refuse to disarm.

Nevertheless, I expect parliament to draft legislation granting amnesty to PKK militants in order to appease Abdullah Öcalan and the pro-Kurdish DEM Party.

In Syria, if Kurdish forces continue to resist integration into the national army, a joint military operation with Ahmad al-Sharaa’s forces remains a real possibility. In my view, such an operation would proceed only with the blessing of the White House. It is equally possible that, under intense pressure from Washington, Kurdish forces will ultimately comply.

Sometime in the second half of 2026, the complete disarmament of the PKK and the SDF may be achieved one way or another, paving the way for the peace process to reach its intended conclusion: a new constitution granting Kurds limited rights and enabling Erdoğan to seek another presidential term.

I believe, however, that the minimum demands acceptable to the Kurds and the CHP are far greater than what the Erdoğan–Bahçeli alliance is willing to concede — particularly on equality and judicial independence. As a result, the constitutional push is likely to fail in 2027, at which point Erdoğan may attempt to secure enough parliamentary defections to call early elections toward the end of the year.

The biggest domestic risk: corporate raids

I want to reiterate that the political scenario outlined above is already largely digested by markets and should have only limited and temporary effects on asset prices. The far greater downside risk lies in the expanding scope of state crackdowns targeting:

-

Companies suspected of tax evasion and/or money laundering

-

Illegal gambling

-

Local mafia networks

-

Stock market manipulation

-

Drug use and trafficking

These activities have existed for years, but the state previously lacked the will to pursue them aggressively. Why the sudden change? There is no single explanation. FATF pressure over money laundering is certainly one factor, as is the desire to tax the enormous revenues generated by illegal gambling. Internal power struggles within the ruling coalition also play a role.

I include drug-related operations in this risk category because some of the key figures arrested are employees of, or linked to, Ciner/Park Holding. I suspect this, along with the broader crackdown on local crime groups, reflects a quiet tug-of-war between the AKP and the MHP.

More worryingly — though I lack hard evidence — I fear Erdoğan may once again use the judiciary to cherry-pick valuable assets from less-friendly corporate groups and redistribute them to loyal cronies.

The risks here are threefold:

-

Investigations into market manipulation could spread to hedge funds, asset managers and even listed companies, causing investor confidence in equities and FX-denominated corporate bonds to evaporate.

-

Probes into local mafia networks could expose links to the MHP and even the AKP, undermining the stability of the People’s Alliance.

-

In the worst-case scenario, Erdoğan may attempt to forcibly redraw Türkiye’s corporate landscape as budgetary resources dry up.

Foreign affairs: a few victories could lift market sentiment

Let me start with Syria, and state clearly that I oppose war. That said, the defeat of Syrian Kurdish forces could stabilize the country and accelerate reconstruction aid. Turkish companies have already secured around $12 billion in reconstruction contracts in Syria, a figure that could rise gradually and meaningfully, boosting construction materials production and exports.

U.S. Ambassador to Türkiye and Special Envoy for Syria Tom Barrack has stated publicly that Ankara and Washington are working on a solution to end CAATSA sanctions. The White House’s condition is clear: Russian-made S-400 systems must be removed from Turkish territory. If this happens, Congress could be asked to lift sanctions and Türkiye could be readmitted to the F-35 fighter jet program.

In my view, the S-400 dispute is not insurmountable. President Putin may want the systems back to reinforce Russian defenses against Ukrainian strikes, or the weapons could be transferred to a friendly third country such as Azerbaijan.

Once CAATSA is lifted, I would also expect the Halkbank case to be quietly shelved. I do not want to oversell the “new chapter in Turkish–American relations” narrative, but it would not surprise me if Trump eventually takes an interest in Türkiye’s reported rare earth reserves and encourages U.S. firms to invest in their extraction and processing.

Europe and the region: doors are opening

A final peace agreement between Armenia and Azerbaijan could open the Zangezur Corridor — the so-called “Trump Road” — diverting trade from China and Central Asia away from the Russian route.

I can now state with confidence that, despite objections from Greece and the Greek Cypriot administration, Turkish companies will be able to bid — albeit with limits — in EU SAFE defense tenders. If I am right, this would signal a shift in Brussels’ approach toward Türkiye, favoring carrots over sticks as Europe seeks allies against what it increasingly views as a looming confrontation with Russia.

Recent developments in Cyprus also suggest that Türkiye and the Turkish Cypriot administration may end their boycott of intercommunal peace talks. This would remove one of the key barriers the EU uses to delay negotiations on an expanded Customs Union — Türkiye’s long-standing Holy Grail.

Final word

In 2025, investors’ focus on political risks stemming from the persecution of the CHP and corporate crackdowns is understandable. In 2026, however, I believe this grim narrative may give way to a more balanced story — one that places greater emphasis on opportunities emerging from foreign policy.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel — https://www.facebook.com/realturkeychannel/