Turkey’s Economy in 2026: Consolidating Disinflation, Structural Transformation and Multi-Dimensional Risks

tr economy

tr economy

Summary:

Turkey enters 2026 with inflation falling sharply and a policy framework aimed at consolidating disinflation, rebalancing growth and delivering the first tangible results of structural reforms. However, global uncertainty, domestic political risks, exchange rate dynamics and institutional challenges continue to cast a shadow over the outlook, making 2026 a decisive test for economic credibility.

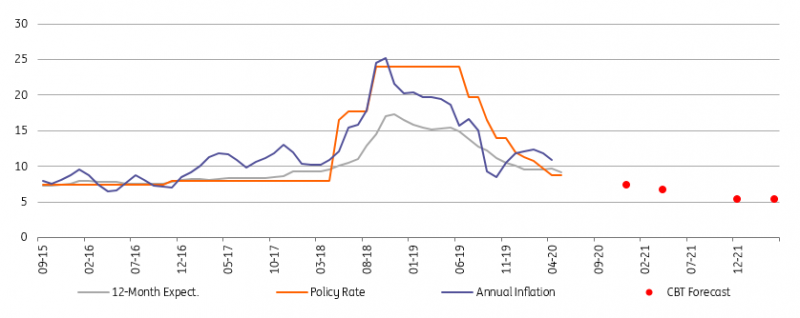

With annual consumer price inflation easing to 30.89% in December 2025, Turkey is entering 2026 at a moment when the disinflation process has clearly gained momentum. From a policy perspective, this marks a transition from emergency stabilization toward consolidation.

According to the Medium-Term Program (MTP) for 2026–2028, 2026 is framed as a strategic threshold year in which the downward trend in inflation becomes permanent, growth attains a more balanced composition, and the first concrete outcomes of long-awaited structural reforms begin to materialize.

Yet the optimistic scenario drawn by the MTP is increasingly clouded when viewed from a late-2025 perspective. Global economic and geopolitical uncertainty, exchange-rate pressures, tax and informality risks, weaknesses in the legal framework, income inequality and the political environment inherited from 2025 all pose significant challenges to policy execution.

Inflation and Growth Targets

Official targets for 2026:

-

Inflation: 16%

-

Growth: 3.8%

International forecasts:

-

World Bank: Inflation ≈ 18%, Growth 3.7%

-

OECD: Inflation ≈ 20.8%, Growth 3.4%

The authorities’ core policy choice is to restrain domestic demand while prioritizing export- and investment-led growth. However, sticky services inflation and persistent wage–price pass-through effects continue to pose upside risks to inflation targets.

Structural Reform Agenda

The MTP aims to lift potential growth by around 0.5 percentage points over the medium term through reforms in four main pillars:

Human Capital and Employment

-

Aligning vocational education with Industry 4.0 and green transition needs

-

Expanding childcare and care infrastructure to boost female labor force participation

-

Targeted active labor market programs for NEET youth

Total Factor Productivity

-

Technology-driven localization in industry (HIT-30 program)

-

Expansion of smart agriculture technologies and organized agricultural zones

Investment Climate

-

Broadening one-stop investment mechanisms

-

Accelerating judicial processes

Green and Digital Transformation

-

Launch of an Emissions Trading System (ETS)

-

Expansion of renewable energy capacity

Economic Impact of the Green Transition

In the short term, the green transition is expected to raise production costs in carbon-intensive sectors such as cement and steel. Over the longer term, however, it should reduce energy import dependency, narrow the current account deficit, and create new export opportunities through alignment with the EU Green Deal.

Exchange Rate Dynamics

From an estimated USD/TRY level of around 43 at end-2025, projections for the 2026 average point to a 50–55 range. A controlled nominal depreciation—largely limited to inflation differentials—combined with gradual interest rate cuts by the central bank (policy rate seen at 25–28% by year-end) could lead to a gradual appreciation in the real effective exchange rate, easing import costs and inflationary pressures.

Manufacturing Sector Outlook: PMI Signals

The Istanbul Chamber of Industry Turkey Manufacturing PMI rose to 48.9 in December 2025, its highest level in the past 12 months (November: 48.0). While still in contraction territory, the marked slowdown in declines across new orders, output and employment suggests that a recovery impulse may emerge in the first quarter of 2026.

Tax Policy and Fiscal Risks

The 2026 budget strategy aims to reduce reliance on indirect taxes, broaden the direct tax base and combat informality using AI-assisted tools such as KURGAN. However, the inflationary impact of tax hikes, potential mission drift in AI-based audits, and weak taxpayer compliance could complicate efforts to maintain fiscal discipline.

Risks from the Informal Economy

With informal employment still estimated at 25–30%, tax revenues remain constrained and the social protection system weakened. If digital enforcement and incentive-based formalization succeed, the tax base could widen significantly. Failure, however, would deepen fiscal sustainability concerns and income inequality.

Legal Reforms and Investor Confidence

Accelerating judicial processes, expanding alternative dispute resolution mechanisms and strengthening intellectual property rights are critical for improving the investment climate. Yet persistent concerns over legal predictability and perceptions of judicial independence continue to limit foreign direct investment inflows.

Wages and Income Inequality

Although minimum wage policy is being aligned more closely with inflation targets, the risk of a wage–price spiral remains. Elevated income inequality—reflected in a persistently high Gini coefficient—is increasing social tension and threatening the inclusiveness of long-term growth.

Political Risks Carrying Over from 2025

Political tensions in 2025, including legal cases involving opposition figures and frictions between central and local governments, have weighed on investor confidence and pushed up Turkey’s risk premium. If these uncertainties spill over into 2026, capital inflows may remain limited, the lira could face renewed pressure, and reform momentum may weaken.

Reducing politically driven risks will require transparent judicial processes and outcomes that are not open to political, legal or economic reinterpretation. Without this, economic vulnerabilities are likely to intensify.

Conclusion: A Defining Year

2026 represents a clear and measurable turning point for Turkey’s economy.

Positive scenario (policy consistency and reform commitment maintained):

-

Inflation falls well below 20% by year-end

-

Growth stabilizes in the 3.5–4.0% range

-

PMI recovery evolves into gradual manufacturing expansion

-

Controlled exchange rate path supports disinflation

-

Green investments deliver early gains in the current account and exports

-

Broader tax base and reduced informality strengthen fiscal sustainability

If AI-based tax enforcement tools such as KURGAN enhance tax fairness without damaging trust between the state and taxpayers, they could significantly boost revenues while reducing informality.

Negative scenario (political uncertainty, global shocks or reform delays):

-

Inflation stalls in the 22–25% range

-

Growth slips below 3%

-

Exchange rate pressure intensifies and PMI recovery is delayed

-

Income inequality and informality deepen

-

Weak legal predictability further deters foreign investment

Bottom line:

End-2026 will be the ultimate stress test for the credibility of Turkey’s medium-term reform strategy. If monetary–fiscal coordination, reform commitment and effective management of political risks are preserved, a transition toward higher, more stable, inclusive and green growth from 2027 onward remains a realistic prospect. Failure to do so, however, could expose the economy to recessionary fragility, stagflation or even “slumpflation” risks.

By Mücteba Onurhan Özmumcu

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY): https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/