2026 Predictions for Turkish Economy – video by Atilla Yesilada

as good as gets

as good as gets

Atilla Yeşilada’s 2026 Outlook: A Year of “Less Pain” but No Prosperity

In his latest strategic briefing, economist Atilla Yeşilada breaks down the trajectory of the Turkish economy for 2026. While he dismisses the threat of a full-blown balance of payments crisis, he warns that structural institutional decay and “sticky” inflation will prevent the average citizen from feeling a true sense of prosperity.

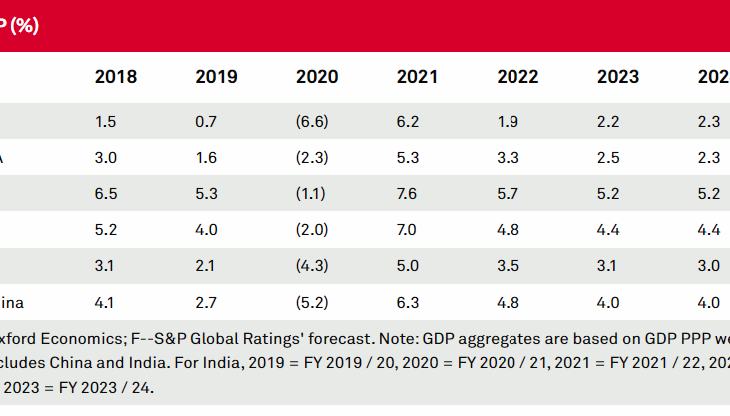

GDP Growth and Domestic Demand

Yeşilada forecasts a slowdown in GDP growth, dropping from approximately 3.75–4% in 2025 to 3% in 2026. This cooling is attributed to a “K-shaped” recovery where the top 10% continue to thrive while the rest of the nation struggles with purchasing power. Private consumption, which has been the engine of Turkish growth since the pandemic, is expected to moderate as real wage hikes are capped and the “buy now before prices rise” mentality loses some momentum.

The Inflation Trap and Monetary Policy

Inflation remains the “bane” of the economy. Yeşilada predicts CPI will close 2025 around 30% and drop only modestly to 25% by the end of 2026.

-

The Policy Rate: He expects the Central Bank (CBRT) to maintain a restrictive stance, targeting a real interest rate of roughly 7% above inflation, likely ending 2026 with a policy rate near 32%.

-

Strong Lira: A key pillar of the disinflation effort will be a “Strong Lira” policy, with the USD/TRY expected to appreciate by only 20% throughout the year—significantly below the rate of inflation.

Current Account and External Financing

In a rare optimistic note, Yeşilada suggests that the current account deficit will not be a trigger for turmoil in 2026.

-

Deficit Outlook: The deficit is projected to stay at a manageable 2% of GDP, aided by lower global energy prices (with Brent potentially dropping toward $50).

-

Syria Factor: A potential “peace dividend” from stabilization in Syria could boost Turkish construction and export revenues by billions of dollars.

Employment: The “Gig Economy” Refuge

While official unemployment may hover around 10%, Yeşilada highlights the “broad-based” unemployment rate stuck at a staggering 30%. Discouraged by a lack of meritocracy, millions are expected to remain in the untaxed gig economy rather than seeking formal employment.

Final Verdict: “As Good as It Gets”

Looking toward 2027, Yeşilada quotes Jack Nicholson: “This is as good as it gets.” Without radical regime change or painful structural reforms, Turkey is likely to remain stuck in a low-growth, high-inflation equilibrium.