November Budget Performance Sends Positive Signals, but Interest Costs Remain the Key Risk

budget balance november

budget balance november

Türkiye’s central government budget delivered a strong performance in November, supported by robust tax revenues and restrained growth in non-interest spending. The monthly surplus helped reduce the rolling 12-month budget deficit, reinforcing expectations that year-end fiscal outcomes will remain broadly aligned with the Medium-Term Program (OVP). However, analyses from Gedik Investment, Akbank and İş Bankası underline that rapidly rising interest expenditures continue to be the main structural risk to the fiscal outlook.

Strong Monthly Surplus, Rolling Deficit Narrows

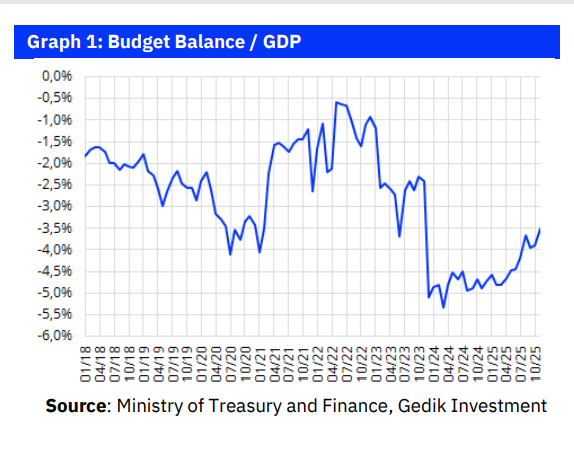

According to Gedik Investment, the central government budget posted a TRY 169.5 billion surplus in November, while the primary balance recorded a surplus of TRY 287.4 billion. With this result, the 12-month cumulative budget deficit declined from TRY 2.29 trillion to TRY 2.10 trillion, and the cumulative primary deficit narrowed sharply from TRY 245 billion to TRY 87 billion.

This marks a significant improvement compared with the same month last year, when the budget recorded a deficit. Inflation-adjusted figures also point to a meaningful real improvement in fiscal performance.

Tax Revenues Outpace Spending Growth

Analysts broadly agree that strong tax collection was the main driver of November’s favorable outcome. Gedik Investment notes that tax revenues rose 55% year-on-year in nominal terms (around 17% in real terms), while growth in non-interest expenditures was contained at 40% nominally (around 5% in real terms).

İş Bankası reinforces this assessment, highlighting that tax revenues continued to grow faster than non-interest spending in November. On a 12-month cumulative basis, the bank points out that real growth in non-interest expenditures has converged toward zero, suggesting improved expenditure discipline and a more supportive fiscal stance.

Turkey’s Treasury Faces Intense Start to the Year, Relief Expected in 2026

Primary Balance Shows Sharp Improvement

Looking at the January–November period, Gedik Investment emphasizes the scale of improvement in the primary balance. While the primary balance posted a TRY 82 billion deficit in the first 11 months of last year, it has shifted to a TRY 667 billion surplus over the same period this year.

Despite this strong primary performance, the overall budget deficit has remained broadly flat at around TRY 1.27 trillion, underscoring the growing weight of interest expenses in the fiscal equation.

Interest Expenditures Remain the Main Constraint

All three institutions identify interest expenditures as the key factor limiting a more pronounced improvement in the headline budget balance. Interest payments reached TRY 1.94 trillion in the first 11 months of the year, up from TRY 1.2 trillion in the same period last year, representing a 62% increase.

The Medium-Term Program has already acknowledged this pressure, revising interest expenditure projections upward. The 2025 estimate was raised from TRY 1.95 trillion to TRY 2.05 trillion, while the 2026 projection increased from TRY 2.28 trillion to TRY 2.74 trillion. Analysts note that higher domestic borrowing needs and upcoming redemptions of inflation-linked bonds (CPI-indexed) will continue to weigh on interest costs in the period ahead.

Seasonality and Year-End Outlook

İş Bankası cautions that December typically sees elevated budget figures due to seasonal factors, recalling that expenditures reached TRY 829.2 billion in December last year. Even so, the bank expects full-year budget outcomes to remain consistent with official targets.

Akbank echoes this view, estimating that as of November, the 12-month rolling budget deficit stands at around 3.5% of GDP, while the primary deficit has declined to roughly 0.1% of GDP. According to Akbank, recent data suggest that the year-end budget balance can be finalized in line with OVP projections.

Budget Deficit-to-GDP Ratio: 3.0–3.5% Range in Focus

The OVP sets the 2025 year-end budget deficit-to-GDP ratio at 3.6%. Gedik Investment argues that stronger-than-expected tax revenues could allow the deficit to settle closer to 3.0% of GDP if spending remains within appropriations. However, should limited spending overruns materialize, the ratio is more likely to end around 3.5%, still broadly consistent with the program’s framework.

İş Bankası’s emphasis on alignment with OVP assumptions further supports this range as the most plausible outcome.

Overall Assessment: Discipline Improving, Interest Costs Still a Challenge

Taken together, the November data point to a strengthening fiscal position, driven by solid revenue performance and tighter control over non-interest spending. The primary balance has improved markedly, providing reassurance on fiscal discipline. Nevertheless, elevated and rising interest expenditures remain the dominant medium-term risk and will continue to shape Türkiye’s budget dynamics going forward.

Sources: Gedik Investment, Akbank, İş Bankası

Author: WS37

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel — https://www.facebook.com/realturkeychannel/