Budget and tax package merge: Turkey sets out tough fiscal path for 2026

butce3

butce3

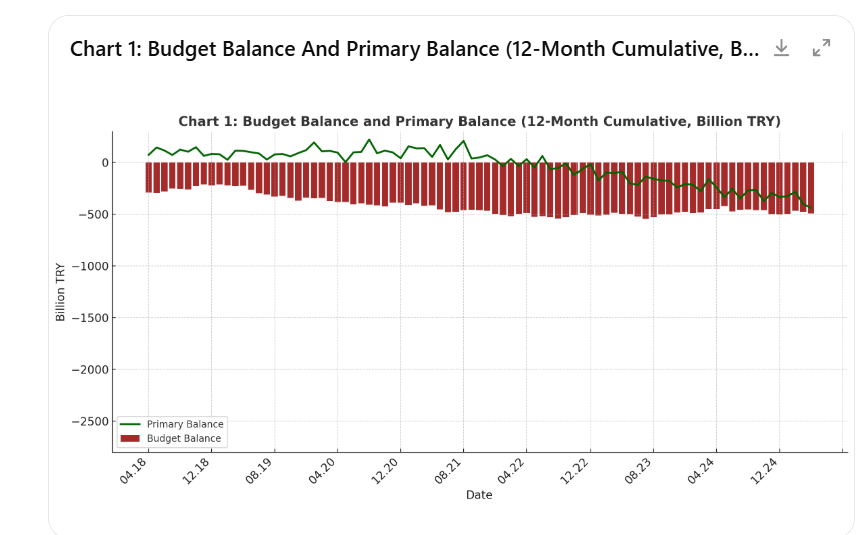

Ankara – The Turkish Parliament (TBMM) is now debating a combined economic package that includes the 2026 Central Government Budget Bill and a New Tax Regulation Proposal. This move underscores the Government’s dual strategy: to deepen fiscal discipline and substantially boost public revenue to bring down inflation and curb the expanding budget deficit.

💰 2026 budget targets and deficit outlook

The 2026 Budget Bill, presented by Vice President Cevdet Yılmaz, outlines significant financial targets, indicating continued pressure on public finances despite disciplined spending goals:

| item | projected amount (billion tl) |

| total expenditures (central government) | 18.929 billion tl |

| total revenues (central government) | 16.216 billion tl |

| budget deficit target | 2.713 billion tl |

The projected 2.7 trillion TL deficit highlights the strain on the budget. Notably, the projected interest expenditures (approximately 2.741 billion TL) are nearly equivalent to the entire deficit figure, illustrating that debt servicing remains the heaviest single burden on the national finances.

Macroeconomic goals

The key macroeconomic targets for 2026, aligned with the Medium-Term Program (OVP), are:

- Growth target: 3.8%

- Year-end inflation target: 16.0%

- Per capita income target: $18,621 USD

🔎 tax package: a 250 billion tl revenue injection

The New Tax Regulation is vital for meeting the aggressive revenue goal—a nominal 28.4% increase in tax revenues for 2026. The package aims to generate an estimated 200 to 250 billion TL in additional revenue and savings, primarily by broadening the tax base rather than steeply raising existing rates.

Critical revenue and savings items

- Reduction in employer premium incentives: The largest saving is expected to come from reducing the Treasury’s social security premium support for employers from 4% to 2%. This measure alone is projected to save the public budget over 97.6 billion TL.

- Removal of rental income exemption: Eliminating the income tax exemption for residential rental income (excluding pensioners) is expected to contribute approximately 22 billion TL in new revenue.

- Increased fees and penalties: New fees, such as a stamp duty on vehicle sales/transfers (not less than one thousand TL, or 0.2% of the sale price), increased penalties for understating property values in title deed transactions, and various other fee adjustments are set to boost revenue.

⚖️ Combined analysis: burden shifts to consumption

The combined strategy reveals that achieving fiscal discipline hinges heavily on real tax revenue growth and expenditure cuts (like the reduction in social security incentives). However, critics argue that relying heavily on indirect taxes (like Special Consumption Tax – ÖTV, and various fees/duties) and expanding the tax base disproportionately affects low- and middle-income citizens, potentially undermining the goal of achieving equitable economic stability.