Türkiye’s Net Reserves Rise $2.3 Billion in the Week of October 10 — Gold Price Effects Mask Underlying Decline

dth-english-15oct

dth-english-15oct

Summary:

In the week ending October 10, Türkiye’s Central Bank (CBRT) recorded a $2.3 billion increase in net reserves excluding swaps, though adjusted for the impact of higher gold prices the figure indicates a $0.9 billion decline. Non-resident investors were net buyers of government bonds, while FX deposits and mutual fund assets continued to grow. Analytical Balance Sheet data through October 15 point to further moderate reserve gains but underscore the outsized effect of gold revaluation.

Net Reserves and Gold-Price Adjustment

CBRT data show that in the week of October 10, net reserves excluding swaps rose by about $2.3 billion, reaching $61.8 billion. After adjusting for a $3.2 billion positive valuation effect from gold prices, reserves actually declined by $0.9 billion. Gross international reserves increased from $186.2 billion to $189.7 billion, while total net reserves climbed from $75.2 billion to $79.2 billion.

At end-March 2024, net reserves excluding swaps had fallen to a record low of –$65.5 billion, before peaking at $71 billion in mid-February 2025. As of October 15, the Analytical Balance Sheet indicates that gross reserves increased by $2.5 billion, net reserves dipped by $0.1 billion, and reserves excluding swaps rose slightly by $0.2 billion. However, excluding a $5.4 billion gold-price effect, the underlying change shows a $5.3 billion decline. Over the past eight weeks, cumulative gold revaluation gains have contributed roughly $22.5 billion to CBRT reserves.

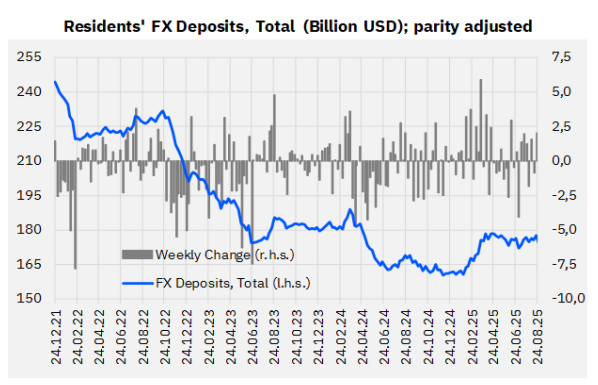

FX Deposits and KKM Outflows

Parity-adjusted foreign-currency deposits (DTH) rose $1.4 billion during the week, driven by $0.6 billion from households and $0.8 billion from corporates. Since the start of 2025, FX deposits have increased by $17.8 billion.

FX-protected deposits (KKM) declined by TRY 27 billion ($0.7 billion) to TRY 239.5 billion, extending the unwind from the August 2023 peak to roughly TRY 3.2 trillion ($131.1 billion). The combined share of FX deposits and KKM in total deposits stood at 40.7%, down sharply from 68.4% at the 2023 peak.

TRY deposits fell TRY 141 billion during the same week to around TRY 14.9 trillion, marking continued tight liquidity conditions.

Loan Dynamics

Foreign-currency loans decreased $1 billion on a weekly basis but remain 44% higher since end-March 2024, reaching $194.1 billion.

On a 13-week annualized basis, commercial loan growth edged up from 21.4% to 21.6%, while consumer loan growth eased slightly from 42.2% to 42.1%, reflecting moderate lending momentum and restrained household credit appetite.

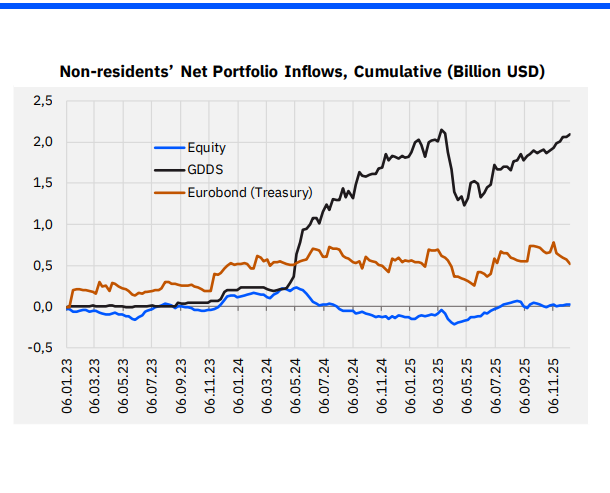

Foreign Investor Flows

Non-resident investors bought roughly $308 million in government domestic debt securities (GDDS) during the week, lifting their holdings to $15.4 billion. Between mid-March and end-April, foreign investors had withdrawn about $9.3 billion, but since early May inflows have totaled more than $6.7 billion.

In equities, foreigners sold $110 million, reducing stock holdings to $32.5 billion. Eurobond holdings fell by about $119 million to $81.8 billion.

Fund Flows and Dollarization

The Money Market Fund (MMF) sector expanded by TRY 39 billion in the week of October 10, reaching TRY 1.28 trillion. Within the Free Umbrella Fund, MMF assets grew by TRY 12 billion to TRY 1.08 trillion.

The FX-denominated mutual fund universe increased by $892 million, bringing total assets to $73.2 billion — up from roughly $25 billion at the beginning of 2024 and $50 billion at the start of 2025. Including investment funds, the dollarization ratio rose from 42.9% to 43.3% in the week of October 10, still well below the mid-2023 peak near 70%.