ANALYSIS: Economy Slows Sharply in Q1 2025: Domestic Demand Weakens, Net Exports Offer Temporary Relief

ekonomi-secim

ekonomi-secim

Turkey’s GDP growth moderated to 2.0% year-on-year in the first quarter of 2025, falling short of market expectations and confirming a broader trend of economic deceleration under tight monetary conditions. Brokerages İş Yatırım, Gedik Yatırım, and Şeker Yatırım agree: growth is losing steam, and the outlook remains uncertain.

Headline Growth Misses Expectations

The Turkish Statistical Institute (TÜİK) reported that GDP grew 2.0% annually and 1.0% quarter-on-quarter (seasonally and calendar adjusted). These figures missed market forecasts of 2.5% and 1.4%, and İş Yatırım’s 2.4% estimate. Apart from the COVID-19 contraction, this marks the slowest annual expansion in nearly six years.

When adjusted for working-day effects, annual growth improves to 2.7%, but the underlying quarterly momentum suggests a slower trend. İş Yatırım and Gedik Yatırım both view the figures as signs of cooling domestic activity.

https://www.youtube.com/c/REALTURKEYOFF%C4%B0C%C4%B0AL/videos

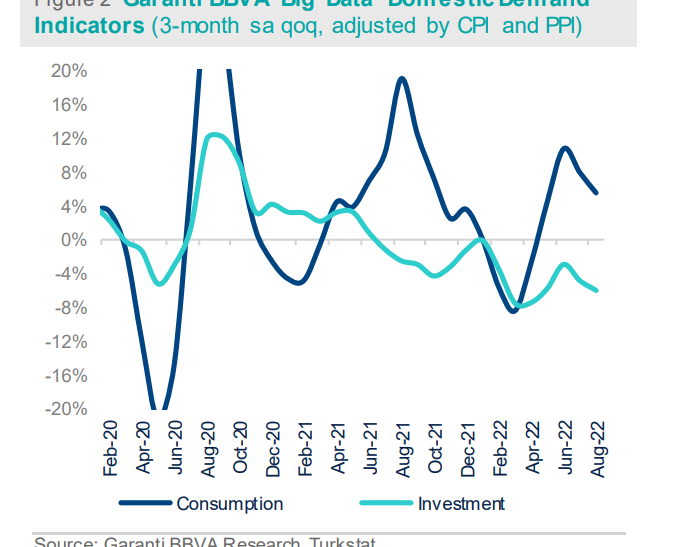

Consumption Contracts, Investment Falters

Private consumption, previously the engine of growth, contracted 0.4% on a quarterly basis, contributing negatively to headline growth. This correction follows an unsustainable 4.3% surge in Q4 2024. Investment spending also shrank by 1.4%, with machinery and equipment particularly weak. Only construction showed resilience, supported by ongoing reconstruction efforts and urban transformation projects.

Gedik Yatırım highlighted a divergence within consumption: durable goods consumption plunged 6.5% year-on-year, while non-durables grew 7.7%, suggesting households are becoming more selective under financial pressure.

Net Exports Offer Temporary Support

Net exports provided a rare bright spot. Exports grew 3.9% quarter-on-quarter, while imports fell 1.1%, making external demand the main contributor to GDP growth in Q1. However, this trend may not last. İş Yatırım warns that Chinese competition, driven by the U.S.-China trade conflict, and weakening global demand could weigh on Turkish exporters in the coming months.

Services and Construction Outperform, Industry Stagnates

On the production side, the picture is mixed. Industrial output stagnated, especially in manufacturing, while services like trade, transport, and tourism grew only modestly. The best performing sectors were information and communication (+4.7% QoQ) and construction (+2.2%), with agriculture being the biggest drag, contracting 2.8%—its worst performance in over a year, likely due to adverse weather.

Gedik Yatırım also noted that the services sector’s contribution is narrowing, with annual growth in the trade, transport, and tourism categories slowing to 1.3%.

Outlook for Q2: Growth to Slow Further

All three brokerages foresee continued slowing in the second quarter. Tighter monetary policy, weaker consumption, declining corporate profits, and rising global headwinds are expected to dampen growth further. İş Yatırım sees additional downside risks from political uncertainty at the municipal level and a weakening in tourism and export competitiveness.

High-frequency indicators support the bearish outlook: PMI, SAMEKS, capacity utilization, and business sentiment have all deteriorated. Although consumption appears to be rebounding slightly in May, Gedik Yatırım cautions that the overall demand environment remains subdued.

Full-Year Growth Forecasts Diverge

-

İş Yatırım has cut its 2025 GDP growth forecast from 2.8% to 2.5%, citing tighter financial conditions and rising Chinese pressure in export markets.

-

Gedik Yatırım expects growth to land between 2.0% and 2.5%, reflecting a fragile recovery in consumption and persistent industrial weakness.

-

Şeker Yatırım maintains its more optimistic 2.9% forecast, but concedes that weaker production dynamics pose downside risks.

Policy Implications: Balancing Disinflation and Growth

The slower growth may help support disinflation goals, but broader risks to program continuity and political support are rising. While net exports offer some cushion, sustained economic momentum will require a careful recalibration of fiscal, monetary, and industrial policies. With external risks mounting and domestic demand faltering, policymakers face a difficult balancing act in the months ahead.

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/