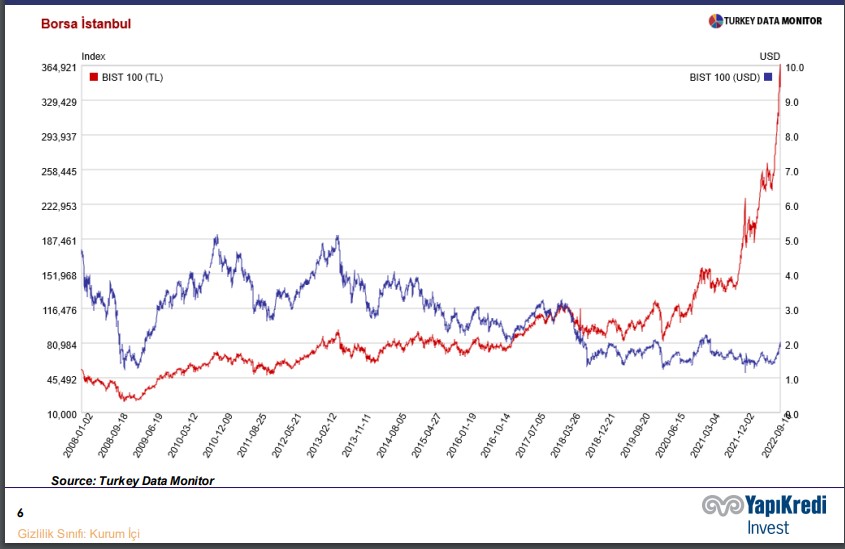

Around three months ago while the risk assets were under pressure and pessimism prevailed, we called for a rebound and argued that we expected a rise in the markets and the S&P500 index, which we accept as the global risk benchmark, until mid August, but added that we didn’t expect the index to exceed the 4200 level, which it briefly surpassed. As we wrote at that time, we saw this mainly as a counter trend move led by tech stocks that had fallen the most. We expected Turkish equities to outperform but performance has surpassed even our bullish expectations.

While we think Turkish equities could continue to outperform, especially in TL terms, whether they will be able to deliver positive returns in USD in our expected global risk off move, predicted to start in late September/early October and test June lows, remains to be seen. Our humble advise remains the same: Be careful in your stock picking.

WATCH: Global Economy and How FED’s Actions Can Effect Emerging Market Economies

A recession in Europe and growth recession in the US looks almost inevitable, but sticky inflation will delay the policy response. Markets, especially equities, have still not priced in this outcome.

Bottomline, in the S&P500 (as our benchmark for global risk assets), we expect another downleg to start soon and test previous lows. Our strategic view remains the same since the beginning of the year: We are in a DM bear market, thus sell into strength in DM while remaining tactical and opportunistic about countertrends. Remain selective in EM. Our view remains that it will take a much bigger sell off for the Fed to throw in the towel.

By Chief Strategist Murat Berk

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/