The Governor of the Central Bank, Hafize Gaye Erkan, announced her resignation, seemingly confirming speculations. Mehmet Şimşek commented on her decision stating it was personal. Just a few hours later, the decree appointing Fatih Karahan mentioned that Erkan had been dismissed. Her departure, like her arrival, was controversial.

IS KARAHAN THE NEW KAVCIOĞLU?

Gaye Erkan, recently more in the news for her family than her job, was a Central Bank governor who represented a “return to normalcy,” good or bad. However, the outgoing president was not a central banker. We cannot say the same for her successor, Fatih Karahan. He is a central banker with 10 years of experience at the New York FED.

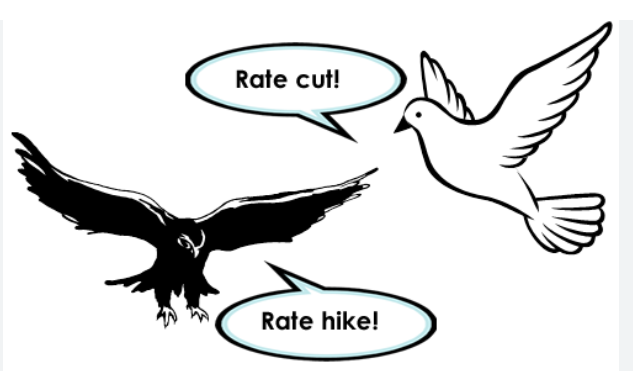

I believe Karahan, one of the three deputy governors appointed just before the interest rate hike process, will adopt a different stance on interest rates until the election. JPMorgan agrees with me; they published a statement saying that the likelihood of an increase, not a decrease, in the Central Bank of the Republic of Turkey’s (TCMB) rate move has risen.

JPMorgan added that the new governor would manage the fight against inflation better by improving coordination between fiscal and monetary policies, indicating that he has a more hawkish bias vis-à-vis Erkan. I don’t know how they came to this conclusion prematurely since following the trail of Mr. Karahan’s previous articles could lead to different conclusions.

The Missing Inflation Puzzle: “The Role of the Wage-Price Pass-Through” article claims that the increase in concentration and monopolistic tendencies in the US market, and the near-negligible effect of wage increases on inflation before the pandemic, are worth highlighting.

At first glance, this article may seem more in line with a dovish perspective.

WHAT IS A DOVISH PERSPECTIVE?

It is an approach that supports low inflation and high employment levels, generally favoring more expansionary monetary policies. From this perspective, the limited impact of wages on inflation indicates that labor costs do not create significant upward pressure on the general price level. This view can arguably be used in favor of keeping interest rates low or implementing other expansionary monetary policies. Since the main concern is keeping inflation under control, the limited effect of wage increases could be a sign that these policies will not significantly trigger inflation.

I believe we need to wait until the next interest rate decision. While there was speculation about a possible rate cut or steady rates in the scenario where Ms. Erkan remained, now, on the contrary, any interest rate hike made needs to compensate for the credibility lost due to her dismissal. Every opportunity to regain policy credibility is vital.