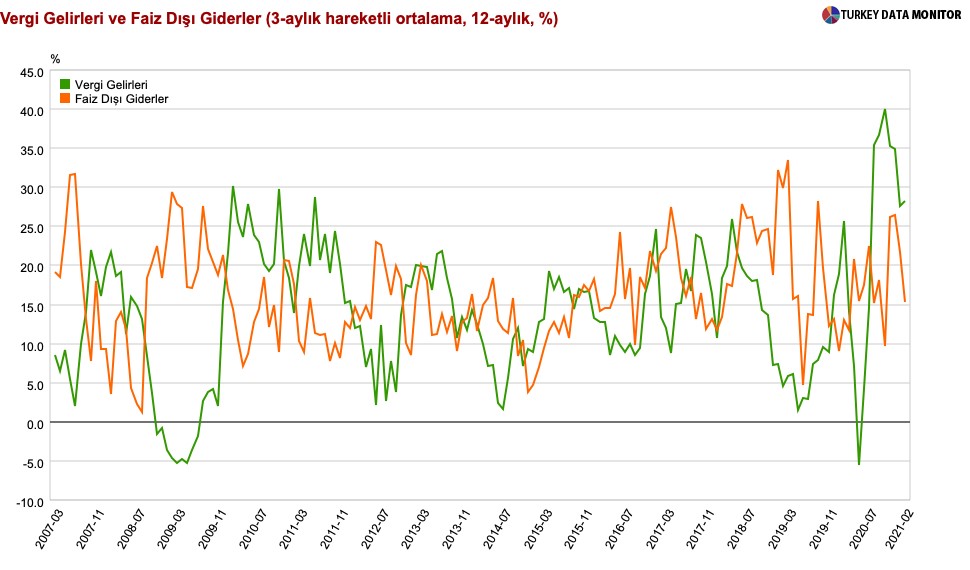

Cover chart: 3-mth rolling average of tax revenues vs. non-interest expenditures, annualized. Green: Tax revenues, yellow: expenditures

In February, Budget gave a surplus of TL23.2bn. Albeit there was no consensus available for the data, the Treasury’s cash balance, a leading indicator for the data, posted a deficit of TL3.5bn in February, decreasing by TL5.3bn compared to the same period in the previous year.

Budget gave a deficit of TL 7.4bn in Feb.20 (Jan.21: TL-24.2bn). Accordingly, the budget gave a deficit of TL1bn in 2M21 (2M20: TL+14.1bn). 12-month rolling budget deficit decreased from TL218.4bn in January to TL187.9bn in February (-3.7% of GDP, official target: TL -245bn, budget/GDP:-4.3%, revised budget/GDP target:-3.5%). Additionally, the primary balance posted a surplus of TL35.9bn in February (Feb.20: TL+6.8bn, Jan.21: TL-2.2bn). Hence, primary surplus was TL33.7bn in 2M21 (2M20:TL+41bn). 12-month primary deficit decreased from TL75.2bn to TL46.1bn (-0.9% of GDP, official target: TL-65.5bn, primary balance/GDP target: -1.2%).

Budget revenues increased by TL33.4bn YoY, up 20% YoY in real terms, to TL119.6bn. Tax revenues increased by TL26.7bn, 19% YoY in real terms, to TRY98.4bn, while non-tax revenues increased by TL6.7bn, up by 27% YoY in real terms, to TL21.1bn (mainly driven by the revenues from interest, shares and penalties). The main drivers on the YoY increases on the tax revenues were collections from Corporate Taxes and foreign trade. Additionally, SCT and VAT revenues continued to increase in yearly basis. This outlook could be seen as a reflection of the ongoing recovery trend.

Budget expenditures increased by TL2.9bn YoY, down 11% YoY in real terms, to TL96.4bn. Non-interest expenditures increased by TL4.3bn YoY, down 9% YoY in real terms, to TL83.7bn, while interest expenditures decreased by TL1.4bn YoY, down 22% YoY in real terms, to TL12.8bn. Under non-interest expenditures, personel expenditures, current transfers and capital transfers recorded YoY increases whereas goods and services purchases, capital expenditures and lending decreased YoY in nominal and real terms. Social security deficit financing was the key driver of the current expenditures.

There are still important difficulties on the budget outlook. According to the 2021-2023 Medium Term Program, annual budget deficit target is at TL245bn which refers to -4.3% of budget-to-GDP ratio. On the other hand, President Erdogan announced that the budget-to-GDP ratio target revised as -3.5%. Additionally, President Erdogan announced some measurements on public finance within the context of economic reforms. Accordingly, the government will mainly borrow in local currency and use Turkish lira-denominated bills, saving measures on the expenditures side to be provided and, tax breaks for small business owners.

Ongoing spending needs in the economy prevails simultaneously with the tight monetary policy necessities. This condition could continue to put a negative pressure on the budget outlook. We should also note that despite the recent strong course in the economic activity supported the tax revenues, the sustainability of this trend is uncertain due to the pandemic. Our year-end budget-to-GDO ratio estimate for 2021 at 4.3%.

By Erol Gurcan, Economist

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/