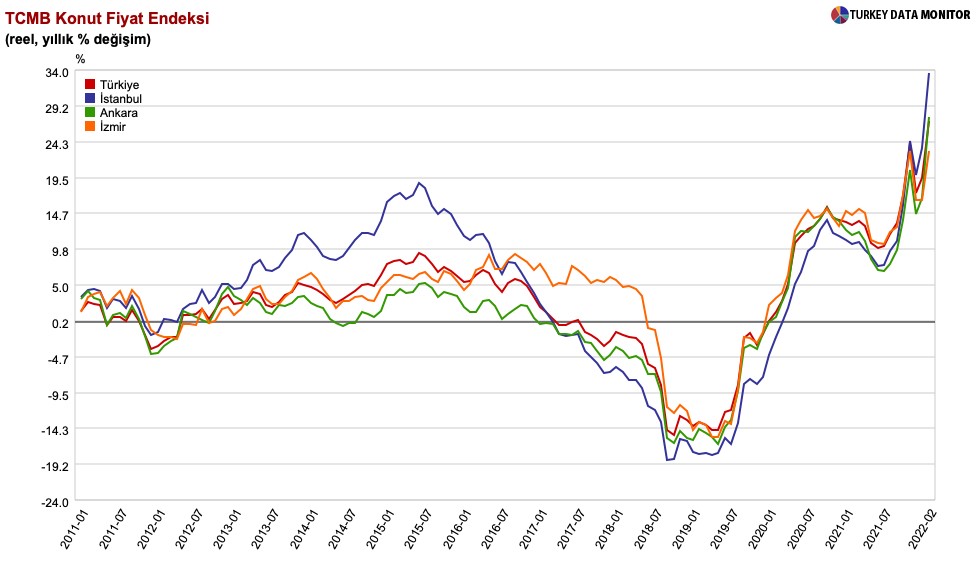

Cover chart in Turkish: Annualized house price increases

Spiralling construction costs and inflation have seen house and rental prices skyrocket over the last year, with some Turks blaming property-buying foreigners and refugees, reports Middle East Eye. While renters suffer, savings fleeing financial system are flowing into real estate, stoking a speculative boom. At the end, everybody is liable to lose.

Turkey’s Central Bank issued its monthly report on the housing index in Turkey last week, revealing that the country was facing one of its worst rental crises on record.

The bank reported that the average price of a property in Istanbul had reached 1.6m Turkish lira ($110,000) in 2022, up from 750,000 Turkish lira last year.

According to the bank, house prices in February had increased by an average of 96.4 percent across Turkey, year-on-year, while in Istanbul it was 106.3 percent.

Even in Kurdish-dominated cities such as Diyarbakır and Sanliurfa, in the southeast, considered the country’s least-developed region, the increase was 111 percent.

Inflation, increasing construction costs and the imbalance between supply and demand are all playing major roles in the skyrocketing property price crisis, experts say.

Middle East Eye reported in September 2021 that one tonne of cement cost 500 lira ($60). This month, one tonne of cement costs around 1,400 lira ($95).

“It is not only cement but anything, any material that you’ll use in construction is becoming more expensive every day,” Ibrahim Gozcu, a contractor, told MEE.

“Last year, one cubic metre of concrete was around 160 lira, or $20, according to the then currency rate. Now it’s not cheaper than 460 lira or $32.”

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit | Real Turkey

Inflation stood at around 19 percent last September, before spiking to 61.4 percent in March after the US dollar appreciated against the lira by more than 50 percent in a year.

The Russian invasion of Ukraine has also affected the construction sector as commodity prices keep rising.

“For instance, one tonne of construction iron was around 6,100 lira ($745) last April. Now, it is 15,000 lira ($1,022),” said Gozcu.

Dramatic price increases

The middle classes seeking homes have been hit hardest by the dramatic price increases.

Ugur Gurses, an economist and former Central Bank employee, published a graphic on Twitter showing the increasing gap between the consumer price index (TUFE), which includes the cost of items such as food, energy and transportation, and property prices.

His graphic effectively shows that property prices have increased two times more than salaries in line with inflation.

Ali Kurt, head of Kiptas, a construction company subsidised by the Istanbul municipality to provide cheaper homes for the lower and middle classes, said in a statement: “It becomes impossible for people to buy an apartment as one square metre of an apartment is around 14,000 lira ($955) in Istanbul. In other words, an average 100 square metre apartment is 1.4m lira ($95,000).”

Given that the monthly minimum wage in Turkey is 4,253 lira ($290), a low earner would have to work for over 27 years to be able to afford an average apartment – and that is assuming that they did not spend any of their earnings on anything else and that inflation did not get any worse.

Tenants hit hard too

Spiralling property prices have a direct impact on rental prices too.

According to the law, a landlord cannot impose an increase that surpasses the annual inflation rate.

However, Ibrahim Derin, a lawyer, said: “I’ve inspected 140 landlord-tenant cases since last September, as landlords want to re-rent their apartments with current prices, while tenants resist.”

The landlord-tenant fight has become so common that many lawyers started posting on Twitter and Instagram to inform tenants of their rights. However, the law also allows landlords to renew contracts after five years.

Turkish Real Estate: Worst Time to Buy! | Real Turkey

Anger at foreigners

The property crisis has also ignited another crisis, as thousands of Turks on social media have started calling on the government to repatriate refugees, stop the arrival of new ones and ban the sale of properties to foreigners.

Turkey currently grants citizenship to any foreigner who buys a property worth $400,000. Over the last nine years, 293,000 properties worth $41.3bn have been sold to foreigners.

This increasing antipathy towards refugees has forced the government to signal a change in its policy. On Monday, Turkey’s President Recep Tayyip Erdogan said that his government was working on ways to provide “a safe and honourable return” for refugees.

“Turkey is hosting five million displaced people, 3.5 million of which are Syrians,” Erdogan said.

“Although we were left alone, we are doing our best to provide a safe and honourable return for our Syrian brothers.”

Opposition parties, including the Republican People’s Party, have long promised that they would send Syrians back to Syria.

“I left Istanbul because in my neighbourhood the dominant language was Arabic. I came to Antalya, and here I hear more Russian than Turkish,” said Ahmet Erdem, a tailor, who left Istanbul’s Fatih district two years ago.

“This is not about being racist or whatever. But we [Turkey] don’t have money anymore. If we can’t help ourselves, how are we expected to host and take care of others?”

There is a flipside to the coin. Cheap mortgage rates, currently at 22% simple annual, 45% blow the going rate of inflation is attracting investors into the housing market. Buyers have to put up at least 60% of their own equity when buying a house. Yet, for those who have moderate to high savings, houses as investment have great appeal ,because sales are buoyant and the price momentum is likely to last until mortgage rates are tightened.

The problem with houses-as-investments is well-known. It has triggered at US leg of the Great Financial Crisis in 2007, and might soon dynamite China’s economy, as real estate development companies began filing for insolvency as a result of weak demand and falling prices. Turkey’s construction companies hold ca $50 bn debt to commercial banks.

All boom eventually bust and amateur investors are always left holding the bag. In Turkey history will repeat. The question is not if, but when.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng