Turkey’s consumer and commercial loan use has slowed down considerably in 2H2021, but the government wants to further limit banks’ ability to issue consumer loans. It appears that the administration has two objectives in mind. First, it wants banks to funnel their funds to commercial loans to boost employment and potentially capex. Secondly, it is afraid of a winter slow-down in the economy triggering socially devastating household bankruptcies which may also undermine its declining support ratings.

Treasury and Finance Minister Lutfi Elvan has told some members of the ruling Justice and Development Party (AKP) group in parliament that “There’s no problem in corporate loans and their repayments. But we are in contact with the banks to limit personal loans because they have increased significantly.”

According to Daily newspapers Sozcu, Hurriyet and others, Turkey’s banking regulator BRSA is currently working on a plan to establish a ceiling for each bank’s allocation of funds to consumer loans. Allegedly, the ceiling will be 15% maximum growth in consumer loan portfolio.

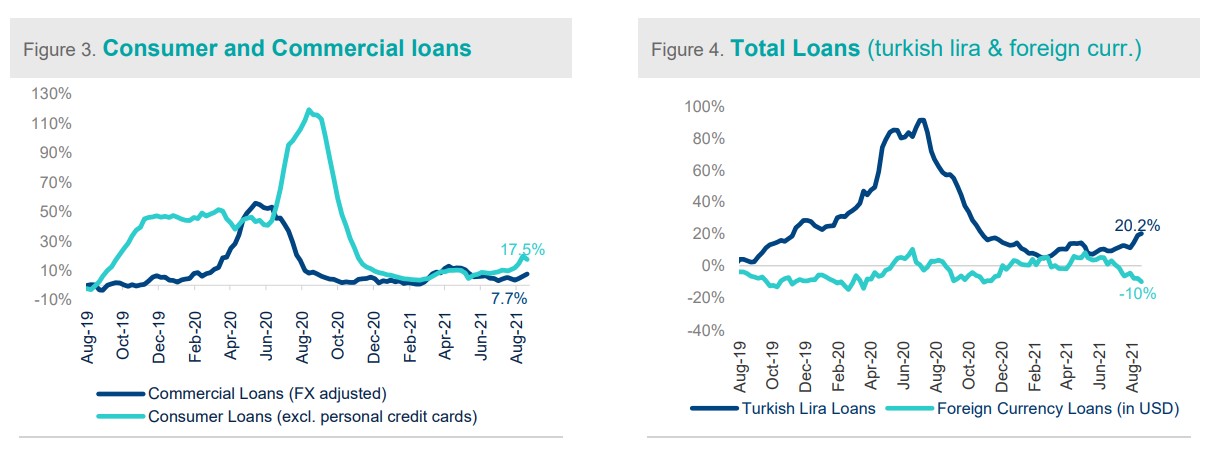

As of 20 August, annual consumer loan growth hovered around 15%, while YTD growth was 9%. Commercial loans, on the other hand, rose by 12.3% YoY, and 9% YTD. Turkey’s August CPI was 19% YoY.

Yatirim Finansman investment house analyzed loan growth patterns in August:

According to BRSA weekly bulletin for the week of August 20, total loans decreased by 0.2% w/w in TL terms. TL loans increased by 0.3% while FX loans decreased by 0.7% on weekly basis. TL loans increased by 6.7% y-t-d, while FX loans decreased by 1.5%. Retail loan growth stands at 3.0% quarter to date (2Q: 3.2%, 1Q: 2.4%) on sharp growth in personal finance loans (3.1%, 2Q: 3.2%) and consumer credit cards (6.7%, 2Q: 8.2%).

ANALYSIS: Another example of bad policy making in the works

While consumer loan defaults do pose an imminent and serious threat to banking system and social stability, a sudden reversal could exacerbate the problem. The Turkish economy is expected to lose momentum in winter months, which will raise the unemployment rate. Unable to roll their maturing loans thousands of newly-unemployed could face devastating family finances crunch.

WATCH: Turkish Economy: The Good, the Bad and the Ugly | Real Turkey

One reason why consumer loans rose so rapidly since 2019 is the public’s perception of actual CPI being much higher than the numbers published by Turkstat. As a result, the average Turkish household believes it is losing purchasing power in TL savings deposits, while consumer loans are priced very cheaply.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

The corporate sector is even in a deeper bind. As the administration preferred cheap loans to direct financial aid to abate the economic pain of the Covid-19 pandemic, a very large number of S&ME and services sector companies were forced to borrow to tide over the curfews and low demand.

It is not clear that the corporate sector will take out more loans even if banks ease credit restrictions. At the end, since limiting consumer loans will also crimp domestic demand, they have less of an incentive to borrow for working capital.

Turkey is governed by a President whose knowledge of economics is dim, and clouded by ideology and superstition. The economy is managed to avert topical problems, without regard to longer-term side effects of myopic measures.

Commentary by Atilla Yesilada

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/