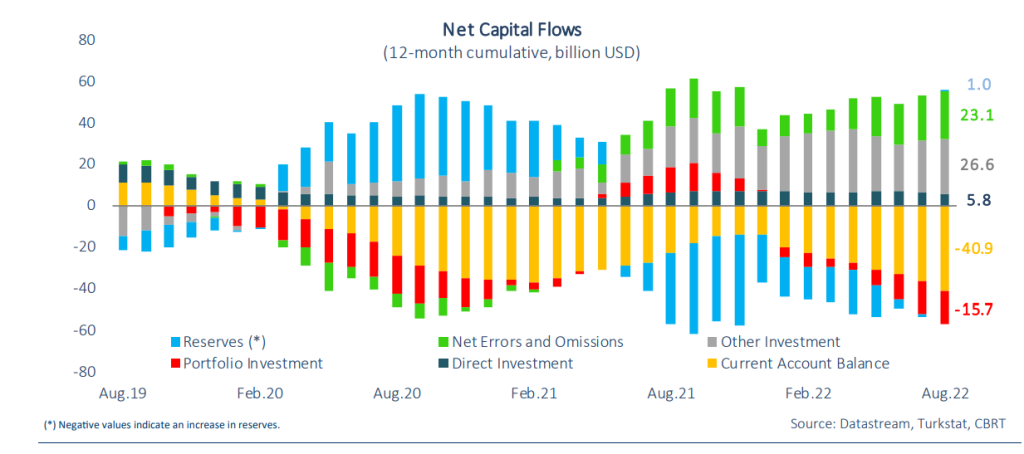

The current account deficit in August turned out to be US$-3.1bn, broadly in line with the market consensus, and led to further widening in the 12M rolling figure to $-40.9bn, the highest since the 2018 financial volatility (translating into 5.1% of GDP), from $-36.7bn in July.

While the data show no sign of the pressure easing in external accounts, the key drivers on the monthly reading were the continuation of higher net energy imports, which almost doubled in comparison to the same month of last year, the significant acceleration in net gold imports to $2.2bn from a mere $0.2bn a year ago, and the turning of the core trade balance (excluding gold and energy) to deficit this year from a surplus. Services income has remained strong and limited the current account decline, reports ING Bank in his research note.

WATCH: Ukraine Counter-Attack Will Have Daunting Consequences for Turkey | Real Turkey

According to recent surveys, barring major declines in energy prices and a recession in the economy, CAD is expected to hover around $50 bn for the next 12 months. Erdogan’s ongoing pork barreling, expected to inject $10-15 bn of income into the economy through June 2023 when presidential and general elections are to be held simultaneously is almost certain to keep import demand high, while exports are under severe pressure due to slump in Europe, the destination for 50% of Turkey foreign sales.

There is a large number of commentaries in opposition media and YouTube about CAD not being sustainable and another currency shock being underway. Indeed, Central Bank reserves are only 70% of the annual foreign debt payments, whereas a reasonable ratio is 100%. Additionally, experts point out that financing is extremely poor and narrow, largely relying on “unidentified flows,” or technically called “net errors and omissions”, which can change direction suddenly, if the political conditions in the country sour further.

Let’s see what two bank research reports reveal.

Details

Is Bank Economic Research Team highlights how the current account deficit was financed.

In August, the biggest contribution to the financing of the current account deficit came from other investments with 8.5 billion USD. The decrease in the effective and deposits held by residents abroad by 1.7 billion USD, as well as the expansion of 4 billion USD in the effective and deposits held by non-residents in Turkey played the decisive role in this development. 2.1 billion USD of the said amount was held by the CBRT.

Banks continued to be net loan re-payers in August, as they have been since May. In August banks made a net repayment of 260 million USD in loans that they had taken from abroad. Other sectors, whose long-term loan demand from abroad remained strong, used 2.4 billion USD worth of loans in this period. In the first eight months of the year, banks made a net loan repayment of 3 billion USD, while other sectors borrowed 8.5 billion USD. Thus, according to the 12-month cumulative figures, the long-term debt rollover ratio was 91% in the banking sector and 198% in other sectors.

Analysis

According to preliminary figures, the foreign trade deficit remained high at 10.4 billion USD in September, by nearly quadrupling compared to the same month of the previous year. Although it has been fluctuating recently due to global recession concerns, the high level of energy prices continues to put pressure on the current account deficit. In addition, despite strong tourism and transportation revenues, the slowdown of the economic activity in EU countries, which is expected to deepen, and the low levels of EUR/USD parity stand out as additional risk factors on the current account deficit, comment economists at Is Bank Economic Research Team.

WATCH: Special: Global Debt Crisis Beckoning!

“Overall, current account pressures did not abate in August given the higher energy bill, reviving gold imports, and domestic demand-driven factors, while the latest indicators suggest that it will likely continue in September given the monthly trade deficit is one of the highest on record”, adds ING Bank.

“We expect the current account to remain under pressure in the near term given the marked deterioration in the terms of trade, accommodative policy stance, and less supportive global outlook with increasing growth concerns. On the capital account, net errors and omissions which is not a stable source of funding has been the major financing item, raising concerns for sustainability. Official reserves on the other handed recorded an increase on a year-to-date basis. However, the Central Bank of Turkey’s recent rate cuts in a backdrop of high external finance requirements and a global risk-off mode can weigh on reserves as we already saw a decline in the second half of September”.

PAIntelligence staff

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/