As reported by Kerim Karakaya/Tugce Ozsoy – Bloomberg, Turkish regulators are seeking more information on trades made during a selloff the day after devastating earthquakes last week. Such trades are claimed to be carried out by an unknown investor or investors, referred to locally as “the Dude.”

Reportedly, according to people with direct knowledge of the matter Turkish regulators have been investigating transactions made Tuesday via Istanbul brokerage Yatirim Finansman, which has been linked to episodes of unexplained, outsized trading activity since at least 2016. The private probe process is expected to take time given the volume of trades.

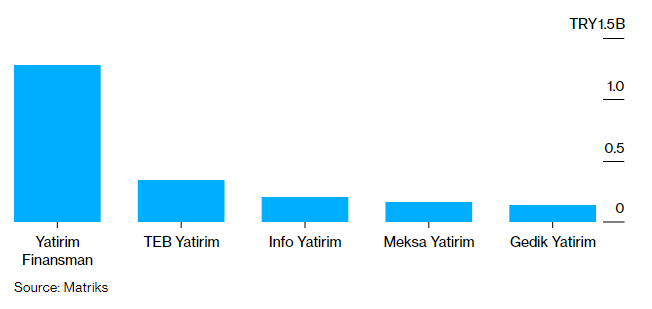

Yatirim Finansman was a net seller of 1.28 billion liras ($68 million) in stocks on Tuesday nearly quadrupling the second-most active net seller and it accounts to more than half of total net sales made that day as per the data from Matriks Bilgi. The Turkish index dropped almost 9%, sending it into a technical bear market.

Yatirim Finansman Led Selloff on Feb. 7

Bloomberg notes that including the transactions via Yatirim Finansman from Friday’s rally through Tuesday the Istanbul-based brokerage was still a net buyer of 297 million liras of stocks, suggesting that clients were reducing risk after 1.5 billion liras in purchases on Friday alone. On the last trading day before the natural disaster, the index surged 5.2%.

Who is the “The Dude” and the privacy rules

Bloomberg notes that Yatirim Finansman’s activity has become the stuff of legend to Istanbul traders since 2016, when locals noticed a series of huge bets steering the direction of the stock market at key times. Hence, the mystery client or clients, whose identity has never been revealed, is called as “the Dude.” Yatirim Finansman’s former chief executive officer, Seniz Yarcan, provided some insight into the trades in 2016, telling told business newspaper Dunya in 2016 that the abnormally large trades were “not an investor, but a big, new fund investor profile that trades with algorithms.”

Trading halted-Main Opposition Party Leader called the officials to resign

The regulators suspended trading on Turkey’s stock exchange suspended on Feb. 8, two days after the quakes, and canceled transactions executed on that day. Criticism was focused on the steep losses occurred in the two previous days, right after the earthquakes.

The leader of the main opposition party on Monday called on the heads of the exchange and the Capital Markets Board to resign. Officials are now considering extending the closure of the stock market past its scheduled reopening on Wednesday.

The Capital Markets Board and Borsa Istanbul declined to comment on any probe into stock-market transactions.