Potential

The new FX-protected TL deposits scheme is another step away from much-needed orthodox measures. The scheme, which protects retail TL depositors from TL depreciation, increases the Treasury’s contingent liabilities and FX risks and leads to further complexities in monetary policy.

However, the scheme, which is likely to be employed for a limited period (potentially until elections), may be successful in stabilising the TL if the government does not push further pro-growth policies. This is because: i) First and foremost, the government has now engaged with the level of the TL, both politically and economically; and can be more active in protecting the value of TL. ii) Further measures on banks and depositors may be imposed to accelerate conversions to the scheme and limit retail FX demand. iii) Market interest rates have significantly increased post the new scheme, which could be supportive for the TL. iv) Very low positioning by foreigners in Turkish assets limits outflow potential for the non-residents. v) And finally, the scheme’s cost to the Treasury would be high in case of a sharp TL depreciation, but appears manageable, as the government’s debt stock is relatively low (~40% of GDP).

We assume that 2022 will be a year of high inflation, decent economic activity, and a relatively stable TL

Our underlying assumptions for this year consist of high inflation (hitting above 40% in May 2022); decent GDP growth of 3.9% on the back of strong exports and loose fiscal policy; a relatively stable TL achieved via government measures; and, lastly, no election taking place in 2022.

Based on this macro backdrop, we are relatively constructive about Turkish equities into 2022, although expect the volatility to continue to be very high. Our view rests on three main pillars:

o Negative real interest rates to lure local retail investors into stocks: Faced with the negative real TL deposit rates and potential stability in TL, stock market may appear to be a viable alternative for local investors to hedge against the roaring inflation and earn positive real returns.

o Very cheap valuation limits downside risks. MSCI Turkey is currently trading at a 54% discount to EM on P/E.

Raising bottom-up index target to 2,579

In this report, we increase our risk-free rate assumption from 15.0% to 21.0% and incorporate our most recent macro assumptions into our models. We upgrade Turkish Airlines, Ford Otosan, Koza Gold and Koza Anadolu from Hold to Buy, while downgrading Erdemir, Turk Telekom and Turkcell from Buy to Hold.

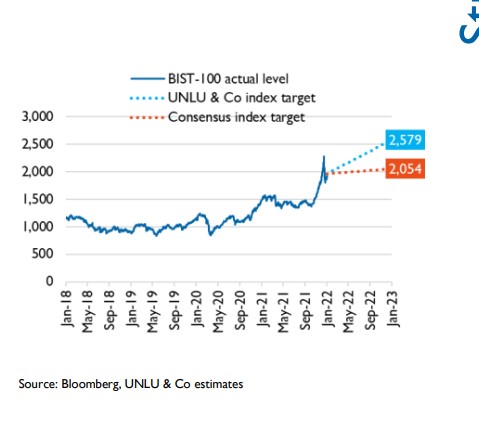

Plugging in our new price targets, our bottom-up index target for the next 12 months increases from 1,924 to 2,579, which implies ~29% upside potential vs current levels.

Top Picks – We remove MLP Care from our model portfolio, while adding Koc Holding, Sok Marketler, Turkish Airlines, Koza Gold and Garanti.

Accordingly, Arçelik, Turkish Airlines, Tofas, Sok Marketler, Garanti, Koc Holding, Kardemir, Enerjisa, Coca-Cola Icecek, and Koza Gold are the constituents of our portfolio.

By Ünlü & Co

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng