Reported by Bloomberg/Kerim Karakaya, Turkey has no plans to immediately intervene in its plunging stock market according to a senior government official said after an extraordinary meeting between regulators and brokerages late on Monday.

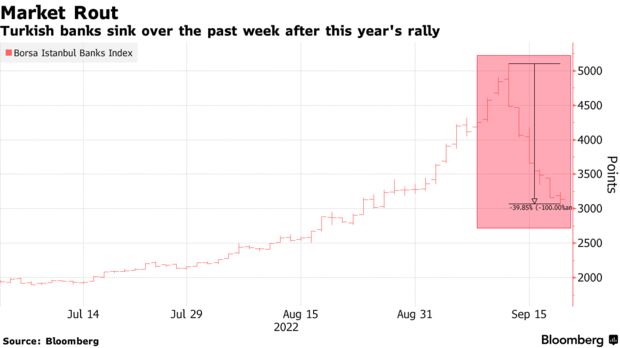

Last week’s rout has barely made a dent in one of the world’s biggest equity market rallies of 2022, but the selloff was disproportionately high in the banking index, which plunged as much as 35% through Monday, posting the worst weekly drop on record.

Still, regulators see no sign of systemic risk or a reason to intervene now, the government official said, asking not to be identified by name because the meeting was private.

Banks’ shares extended their daily gains to as much as 2.5% after the news and was trading 1.2% lower as of 12:01 p.m. in Istanbul.

Brokerage Distress

Authorities have started reviewing transactions in the market from the past 12 months and agree that some market moves are disruptive, the official said.

Monday’s meeting was organized to discuss possible risks as margin calls mounted with the sudden reversal in Turkish equities.

The rout was triggered by last week’s hotter-than-expected US inflation data and quickly spiraled as some institutions faced margin calls, which occur when investors are required by brokerages and regulators to add equity at times of sizable market moves.

When under distress, brokerage houses may have to pay the obligations on margin accounts to the stock exchange, using their own capital. Calls on margins surged to 1.8 billion liras ($98 million) on Thursday, a record according to Turkish data going back three years.

Bloomberg