Editor’s Note: On 18 May, at 8:00 am Turkish time, dollar/TL is trading at 15.82

The lira seems to be back in the firing line after half a year of relative stability – helped by that FX protected deposit scheme which seemed to change the narrative a bit, albeit raising longer term concerns about who is going to pay for it.

New found weakness reflects a range of well known and new factors:

First, challenging global beta, with global risk being bettered by concerns over stagflation, Fed rate outlook, China Covid, war in Ukraine, global food and energy price crises, et al, but this just focuses attention on the weaker credits, and Turkey fits the bill in anyone’s fragile few.

Second, and therein Turkey’s well known vulnerabilities of a wide current account deficit, large external financing gap, and crazy monetary policy settings, with Erdogan ruling out much needed rate hikes. In fact Erdogan seems to be pushing the policy settings the other way as elections approach, with more monetary and fiscal stimulus, not less. This will widen an already large current account deficit and boost the external financing gap. Added to this are the costs of the war in Ukraine, with higher energy and food import costs likely to push the current account deficit towards $50bn.

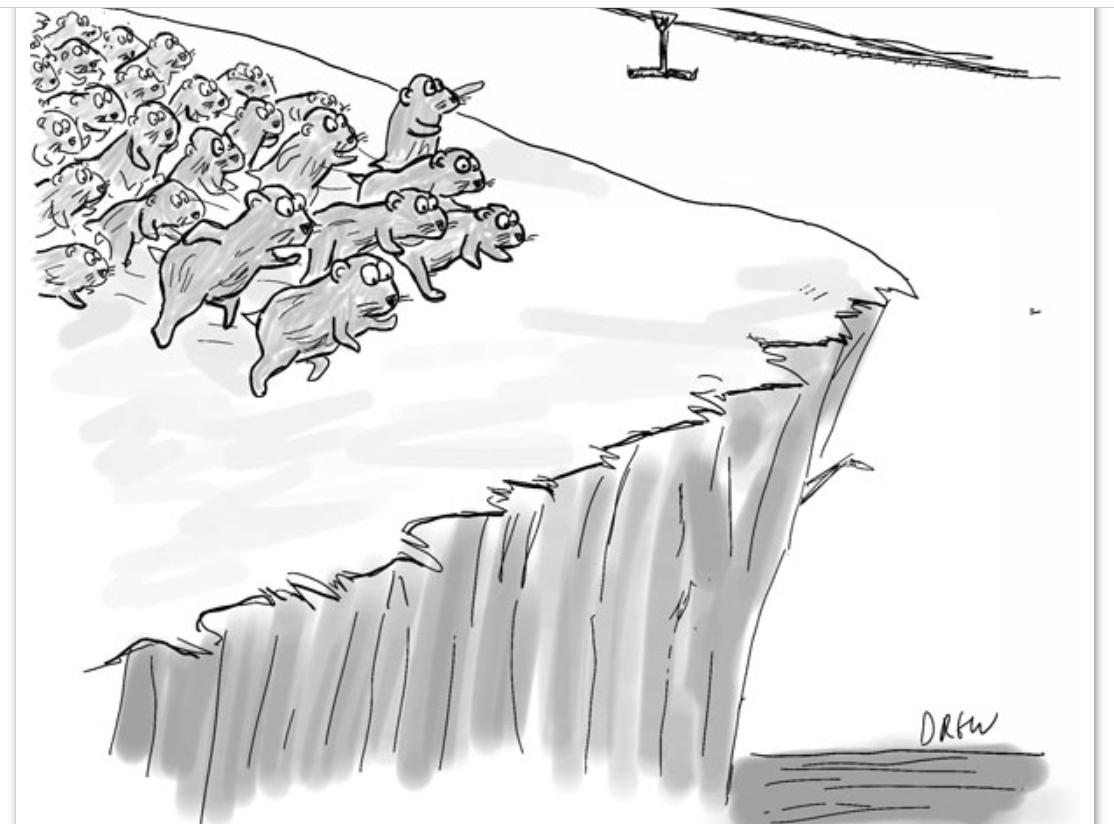

Turkey’s Slow-Motion Currency Crash

Third, as noted above the proper policy response should be higher rates, but under orders from Erdogan we know the CBRT will not do that, which leaves them dependent on FX reserve intervention and various schemes to try and cajole reduced demand for FX. But we all know the CBRT’s reserve buffers are limited, with just over $103bn in gross reserves, of which only $30bn is readily liquid, and an additional $40bn in gold. Most worrying is net reserves are now minus $60bn, meaning that the CBRT has been spending other peoples’ money. When the rope runs out, there could well be a systemic (banking) crisis in Turkey – but timing that is difficult still.

Fourth, Erdogan’s hope seemed to be to make friends with neighbours and get cash bailouts from the Saudis et al to keep the lira stable to elections. However, despite his trip to Saudi during Ramadan the Saudis have been slow to write cheques, which has left markets disappointed. Now Erdogan needs Russian capital and tourists to save his day. That might still fail to materialise as seemingly it’s proving difficult for Russian tourists to get flights given sanctions bans on airlines and insurance.

Fifth, Turkey’s decision to play tough over Finland and Sweden’s bid to join NATO could well backfire. I just don’t think that Turkey understands the depth of feeling on this from other NATO members, and blocking NATO membership would cause a(nother)crisis in Western – Turkey relations, just when there were signs of a thaw as reflected in the Biden team’s push to allow Turkey to buy new F18s.

Sixth, with elections fast approaching there is concern over a contested elections in Turkey – fears accentuated by a new election law which benefits the ruling party, and efforts to use the judiciary against the opposition.

Author’s personal opinion

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng