There is always focus on Turkey’s large gross external financing needs – the current account deficit plus the weight of ST (short term) debt falling due, the latter of which is somewhere north of USD180bn. Given a current account deficit likely of USD10-20bn, this puts the gross external financing need at around USD200bn in a good year. This assumes no further foreign capital flight and dollarisation – not a given, given recent trends.

Set this against USD110bn in gross FX reserves and likely USD60-70bn negative NIR (net international reserves) and the gross external financing to FX reserve coverage looks weak. Hence all the concern about heavy FX intervention, and how long the CBRT can continue intervening to prop up the lira – the answer is not very long if it continues to keep up the pace of intervention seen in December, which remember only held the lira flat over the month.

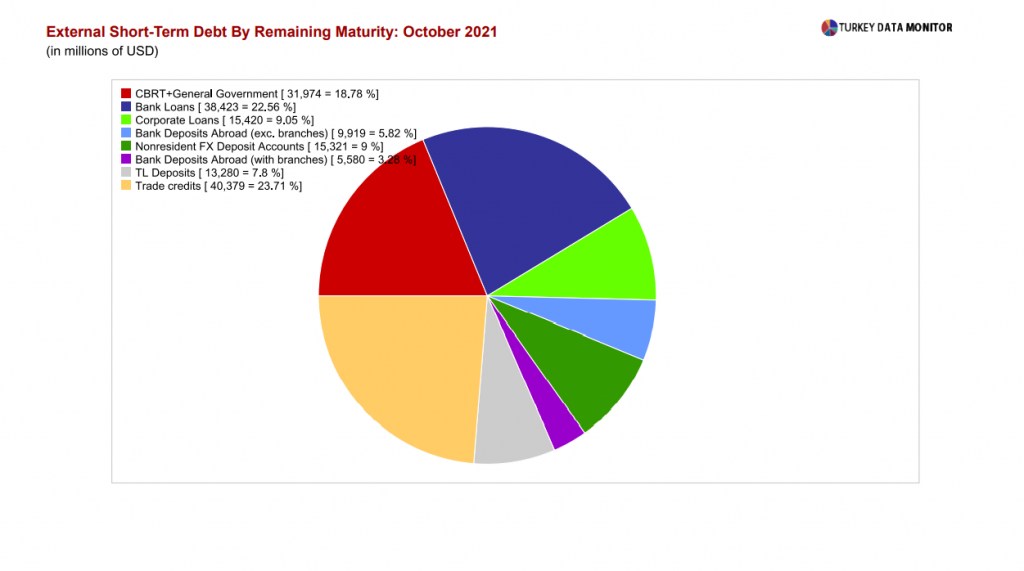

The rollover story on ST debt has always had caveats, or offsetting positive factors including: a weight (40-50%) of the ST debt is trade finance, and very roll-able, many FX debtors are exporters so naturally hedged, and those entities that have borrowed offshore tend to be Turkish blue chip banks and corporates with plenty of offshore FX liquidity and long standing international banking relationships built before thru various prior crises. Net-net international banks have tended to have long term faith in the Turkish story and Turkish borrowers, and have tended to be happy to roll Turkish FX liabilities even in the worst of times.

I worry that this might be changing for a number of reasons:

WATCH: Turkey’s Coming Debt Trap | Real Turkey

First, the profile of external debt is changing, with the share of the public sector increasing, and its roll-over risk is increasing. Note here that the Turkish Treasury has increased its target for international borrowing this year to USD10bn, where for many years it was held around the USD6-7bn mark. I would expect the Treasury to try and place more than USD10bn if it can get away with it.

Second, I worry about the messaging now to foreign investors. Erdogan is telling the world that Turkey does not need foreign capital, foreign portfolio investors are not welcome and Turks can finance their own economy. His economic policy mantra (the insane view that high interest rates cause inflation) is already not liked, and gives a reason for investors not to invest in Turkey. And investors I think are asking themselves why they should continue to finance bad policies from the Erdogan administration? Will any new issue money just disappear in ineffective and idiotic FX intervention, and is Turkey heading to a systemic crisis? I guess also given the terrible economic policy settings under Erdogan the reality is the IMF would not currently lend to Turkey, so the question is why should foreign investors?

It feels a bit like we are entering a situation where investors might begin to ask whether funding Turkey at this stage just sustains bad policies for longer – a situation where portfolio investors become part of the problem, a classic moral hazard play. Guess the concern here is that given the current terrible policy settings is there a risk of a buyer’s strike, or is Turkey 10Y over 8% just money good long term, given Turkey’s still great long term prospects, beyond elections, assuming that is a change in economic policy regime.

Author’s personal views

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng