Surpluses continued in August

In August, budget reported a surplus of TRY3.6bn (Aug.21: TRY+40.8bn, Jul.22: TRY-64bn). Even though there was no consensus available for the data, Treasury cash balance (a leading indicator), had yielded a TRY28.7bn of surplus in July, lower than TRY 35.5bn compared to same period in the previous year. Hence, we could say the budget surplus (lower than TRY 37.5bn in YoY basis) provided a similar outlook with cash deficit in August.

Additionally, the primary balance posted a surplus of TRY 26.2bn in August (Aug.21: TRY +54.5bn, Jul.22: TRY -47.3bn).

Tax revenue growth in double digits

Budget revenues increased by TRY 159.4bn YoY, up by 16% YoY in real terms, to TRY 305.9bn. Tax revenues increased by TRY 140.7bn, up by 15% YoY in real terms, to TRY 271.9bn, while non-tax revenues increased by TRY 18.7bn YoY, up by 23% YoY in real terms, to TRY 34.1bn. The highest contributions to the tax revenues came from corporate tax revenues and tax revenues on foreign trade. Value Added Tax (VAT) revenues decreased by 34% YoY whereas Special Consumption Tax (SCT) revenues increased by 19% in real terms.

WATCH: Global Economy and How FED’s Actions Can Effect Emerging Market Economies

We should recall that the VAT rates on basic goods were slashed recently to fight against inflation. Hence, indirect tax revenues indicate that economic activity still stays at the positive side.

Budget expenditures soar in preparation for 2023 elections

Budget expenditures increased by TRY 196.6bn YoY, up by 59% YoY in real terms, to TRY 302.3bn. Non-interest expenditures increased by TRY 187.7bn YoY, up by 69% YoY in real terms, to TRY 279.7bn and interest expenditures increased by TRY 9bn YoY, but down by 8% YoY in real terms, to TRY 22.6bn.

Under non-interest expenditures, the highest contributions came from lending (to SOEs), capital expenditures (real estate capital and production expenditures) and current expenditures (mainly driven by health, pension and social aid expenditures, transfers to FX protected deposits and shares for local administrations).

Outlays for the controversial FX Protected Deposit accounts by Treasury reached TRY 15bn in August and TRY 75.6bn in 8M22. Additionally, total transfers and lending to BOTAS (SOE in charge of NG imports and national grid) was TRY 26bn in August and TRY 101.9bn in 8M22 (8M21: TRY 2.1bn).

Deficits to expand rapidly for the rest of the year

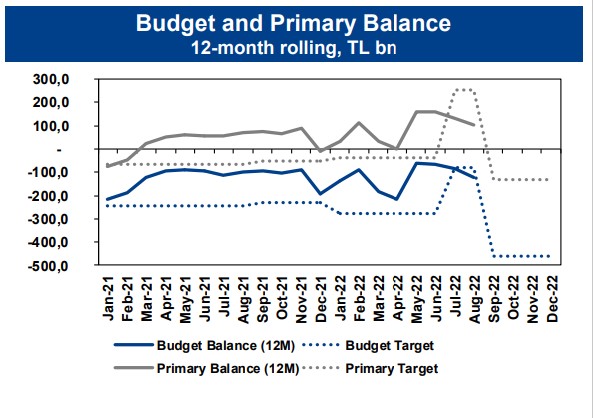

Year-end budget targets revised again with the new Medium Term Program. Year-end budget deficit target revised to TRY -461.2bn with 2023-2025 Medium Term Program. To recall, the initial target was TRY -278.4bn at the beginning of the year and this target was revised to TRY -78.3bn at the end of 1H22 with an additional budget. In 8M22, budget gave a surplus of TRY 33.1bn YoY (8M21: TRY -37.5bn), which refers to -7.2% of revised annual target.

As of August 2022, 12-month budget deficit was TRY 121.6bn (2021: TRY -192.2bn). It is fair to say that there could be a significant increase in non-interest expenditures in the rest of the year when we compare the year-to-date realizations and revised target levels.

WATCH: Turkish Economy Won’t Survive The Winter

Potential energy import bill and transfers to FX protected deposits could be the main drivers. On the other hand, there are significant uncertainties on the performance of tax revenues when we take in to account potential momentum loss on the economic activity. As the steady erosion in purchasing power, driven by inflation, puts downward pressure on the domestic demand, global slowdown also potentially limit external demand. In addition to the pace of the economic activity, the levels of the energy prices would continue be an important determinant for the budget performance.

YF Invest report, PA Intelligence staff

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/