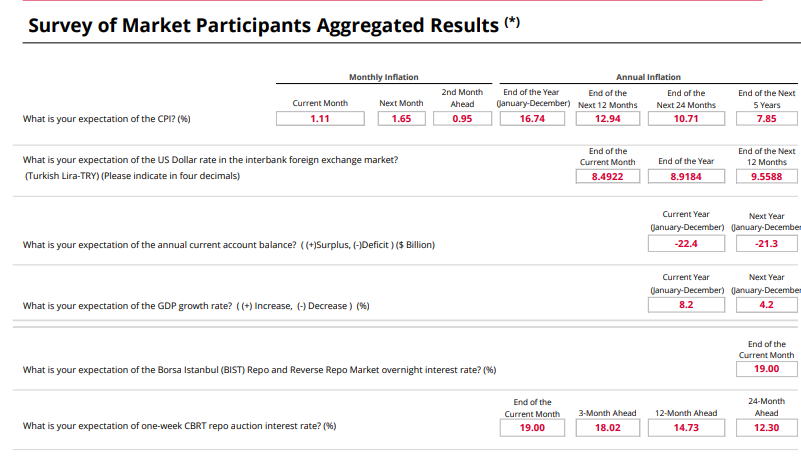

According to the “Market Participants Survey” published by the CBRT; the current year-end consumer inflation (CPI) expectation increased to 16.74%, up from 16.30% in the previous survey.

CPI expectations after 12 months increased to 12.94% during this survey period from 12.48% in the previous survey period. CPI expectations after 24 months increased from 10.52% to 10.71%.

The figures indicate that market participants have inflation expectations that exceed those of the central bank and mentioned in Turkey’s Medium Term Plan issued by the Treasury. Also, they do not expect to see single-digit inflation levels in Turkey even in the medium term.

The current month-end overnight interest rate expectation in the BIST Repo and Reverse-Repo Market and the CBRT one-week repo auction interest rate expectation remained 19%, as in the previous survey period. No interest rate change is expected at the PPK meeting on September 23rd. But the expectation for three months from now is 18%; hence 100 basis point interest rate cut is expected before the end of the year.

The year-end exchange rate (USD/TL) expectation decreased to TL 8.92 during this survey period from 8.94 in the previous survey. The exchange rate expectation after 12 months isTL 9.56 during this survey period, compared to TL 9.37 in the previous survey period.

The year-end current account deficit expectation fell to $22.4 billion from $23.5 billion in the previous survey period. Expectations for a current account deficit next year rose to $21.4 billion from $21.2 billion.

Growth expectations for 2021 increased from 6% to 8.2%. Growth expectations for 2022 increased to 4.2% in the last survey from 4% in the previous survey.

CBRT