Turkey’s new Wall Street-trained finance chief will kick off a global investment roadshow at the G20 summit in New Delhi on Friday to drum up support for his rescue plan for the troubled emerging economy.

Simsek is now armed with a three-year economic plan which envisages inflation dropping to single digits in 2026, while budget and current account deficits diminish significantly.

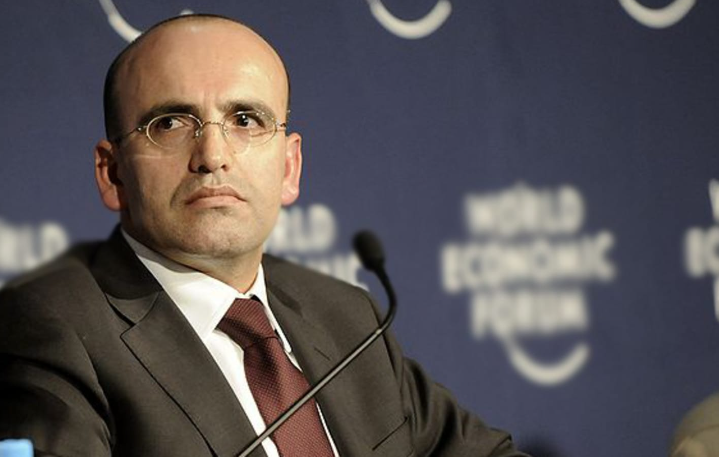

Finance Minister Mehmet Simsek told reporters he would then travel to New York and European economic powerhouses Germany and Britain to meet with dozens of top chief executives.

“There will not be an investor that we are not in dialogue with,” Simsek said.

The Merrill Lynch veteran’s attempt to talk up his reforms were boosted Thursday by a World Bank announcement that it was looking to hike its commitment to Turkey from $17 billion to $35 billion over three years.

“We are determined to accompany Turkey in the implementation of policies that will help its economy reach stability,” Anadolu quoted the bank’s Turkey program director Humberto Lopez as saying.

The twin announcements came a day after Turkish President Recep Tayyip Erdogan issued his strongest pledge of support yet for Simsek and his new economic team’s radically different approach.

In a recent interview with the press, Simsek predicted that FDI and loans promised by UAE will also “arrive soon”.

Turkey enjoyed booming growth during Erdogan’s first decade in power.

But the veteran leader’s second decade was marked by political upheaval and an increasingly unorthodox economic approach that eroded earlier gains.

Foreign investors began to leave the once promising market and now hold less than one percent of Turkey’s bonds — down from around 20 percent in 2015.

Turkey suffered a lira crash in 2021 that set prices spiraling by 85 percent over a year when Erdogan forced the central bank to slash the interest rate far below that of inflation.

The cost of living crisis pushed Erdogan into his first election runoff in May, which he won with the help of a massive spending pledge for his political base.

Turkey’s problems stem in large part from Erdogan’s conviction that high interest rates cause inflation — the opposite of conventional economics.

He pledged repeatedly on the campaign trail that Turkey would never raise interest rates while he was president.

But he turned to Simsek and a handful of other market-friendly figures to right the economy after the vote.

The central bank has nearly tripled its policy rates since then and is expected to raise them more at its next meeting on September 21.

Erdogan on Wednesday declared full support for the new approach.

“We will reduce inflation to single digits with the support of tight monetary policy,” he said in nationally televised remarks.

“I have a mandate from Erdogan” Simsek reportedly told investors during an earlier meeting. Recently, he repeated the same mantra, claiming Erdogan backs the program without hesitation.

Simsek’s world tour is crucial for Turkey’s financial stability. The country needs to attract foreign financial capital to boost Central Bank FX reserves and to stabilize the exchange rate to prevent another winter crash. Higher reserves and a stable currency could also make it easier to unwind the costly FX protected deposit scheme, which collected $125 bn of deposits, the dollar value of which is effectively guaranteed by Central Bank.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel