EEMEA oil & gas continues to benefit from a supportive macro backdrop with our revised average 6% higher TPs boosted by stronger oil and gas price forecasts. We maintain a positive sector outlook with top picks in Russia of Gazprom, Rosneft and Tatneft. In CEE we like OMV Petrom and Tupras. Among the small caps, we prefer Gulf Keystone, Seplat and Vivo Energy.

In this report, we upgrade Petkim to BUY (from Hold) and downgrade LUKOIL to HOLD (from Buy), reflecting their recent share price performance.

Commodity prices remain supportive

We have increased our 2021 Brent oil price estimate by 4% to $67.3/bl (from $64.8/bl) to reflect higher actual oil prices in 2Q21 and lower-than-expected OPEC+ production levels in the short term due to the group’s failure to agree on higher production quotas. Our outlook for international gas prices has improved substantially with our 13% increase in Gazprom’s average 2021 non-FSU export price of $244/mcm, driven by the combined effect of a demand rebound and supply restrictions leading to record-low gas storage levels in Europe. We also expect a gradual revival in EE refining margins, helped by recovering demand, although we model that average margins will stay below historical levels for now.

Attractive dividend yields

We forecast an average 2021 dividend yield of 7.1% for Russian oil & gas stocks, led by Gazprom (10.4%), Gazprom Neft (9.8%) and LUKOIL (8.8%). In CEE, the sector is led by OMV Petrom, with a current yield of 7.4%. In the E&P sector, Gulf Keystone leads the pack in shareholder distributions for 2021, with the special dividend pushing the yield to 9.4% for this year.

Our top picks offer 26% upside potential, on average

We maintain a positive sector outlook with top picks in Russia of Gazprom, Rosneft and Tatneft. In CEE we like OMV Petrom and Tupras. Among the small caps, we prefer Gulf Keystone, Seplat and Vivo Energy. In this report, we upgrade Petkim to BUY and downgrade LUKOIL to HOLD, reflecting their recent share price performance.

We increase our TPs by an average of 6% across the sector. We upgrade Petkim to BUY (from Hold) with an unchanged TP of TRY6.65, and downgrade LUKOIL to HOLD (from Buy) with a 4% higher TP of RUB7,000/share, reflecting their recent relative share price performances.

Risks

Downside risks to our BUY rating on Petkim include 1) lower-than-expected petrochemical margins; 2) a delay in the resumption of dividend payments beyond 2022; 3) lower-than-expected refining margins affecting the profitability of STAR refinery. Key risks to our HOLD rating on LUKOIL include 1) oil prices and refining margins; 2) production forecasts; 3) M&A risks

Emerging European refining companies

Emerging European refining companies under our coverage generally benefit from above-average refining complexity, positive regional/in-land differential and petrochemical integration (in the case of MOL Group and PKN ORLEN). However, the current market environment still does not provide enough margin differentiation for higher-complexity refineries due to low diesel crack spreads, although a more favourable Urals-Brent differential and weaker HSFO crack spreads have generally supported profitability of complex refineries in recent months. For example, the difference between complex and average refining margins for MOL Group was $0.7-0.8/bl in May-June 2021, vs just $0.3-0.4/bl in January-February.

Offsetting weak refining margins have been very strong petrochemical margins in Europe, related to supply-side disruptions and higher shipping costs into short European markets amid strong demand based on the normalisation of major economies. We estimate that the NWE LDPE-Naphtha spread averaged $1,938/t in 2Q21, up 51% QoQ and 183% YoY. While the spread has declined 20% from its peak, its current level of c. $1,600/t is still more than 2x higher YoY.

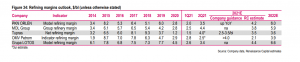

We expect some margin recovery vs the 2020 low, driven by a gradual recovery in oil demand and improving crack spreads; however, we model that average margins will stay below historical levels until the global refining supply/demand balance normalises.

Renaissance Capital, excerpt

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/