Prelude

Turkey’s shift towards a more conventional macro policy framework post-elections has involved significant tightening in monetary policy and financial conditions. Locals’ demand for FX has eased and domestic demand has shown signs of moderation, putting Turkey on a path towards gradual disinflation.

New economic policies aim to engineer a soft landing: Pre-election fiscal and credit stimulus pushed domestic demand well above trend during 1H23, at the cost of a wider current account deficit and a decline in official FX reserves. Following the appointment of a new economics team in June, Turkey has adopted a new macro policy framework to rebalance the economy and bring inflation down. Monetary and macro-prudential policies were tightened and a series of tax hikes were introduced. While a tighter macro policy mix has started to moderate domestic demand, planned fiscal stimulus related to earthquake reconstruction efforts will likely counteract some of these restrictive impacts in 4Q23 and into 2024.

The road to March 2024 municipal elections

We expect selective credit easing and front-loading of government spending to support growth ahead of municipal elections in March, but we see overall financial conditions remaining tight to contain risks to inflation and the external balance. Along with a projected slowdown in global growth, and more importantly in the euro area, we see real GDP growth slowing to 3.5%Y in 2024 from 4.1%Y in 2023. Gradual rate hikes and earthquake-related fiscal stimulus in 2024 mean that the adjustment in domestic demand will likely extend into 2025, which implies below-potential growth at 3.1%Y despite a projected recovery in the euro area.

Disinflation to start in 2H24

A combination of cost-push factors, i.e., spillovers from FX depreciation, fuel price hikes and minimum wages, coupled with strong domestic demand and higher inflation expectations, pushed inflation to 61.4%Y in October from 38.2%Y in June. Despite a declining monthly inflation trend, we see headline inflation rising to 66.5%Y by year-end, peaking at 73.5%Y in May 2024.

Price stickiness in services, another strong minimum wage hike in January and projected fiscal stimulus will likely put upside pressure on inflation until the effects of tightening steps and favourable base effects kick in from 2H24. We see headline inflation declining to 42.5%Y at end-2024 and 28.4%Y at end-2025.

Further tightening in the pipeline

The CBT brought the policy rate to 35% in October, delivering 26.5pp of hikes in five consecutive meetings since May, and signalled further tightening steps in rates and macro-prudential instruments until it achieves a significant improvement in the inflation outlook. At 35%, the policy rate is close to the CBT’s inflation forecast for end-2024 at 36%Y, but this implies a negative real rate relative to expected inflation, since 12-month ahead survey expectations currently stand at 45%Y. Given FinMin Simsek’s remarks that signalled a preference to reach a positive ex ante real policy rate relative to inflation expectations, we expect another 250bp hike to 37.5% in November.

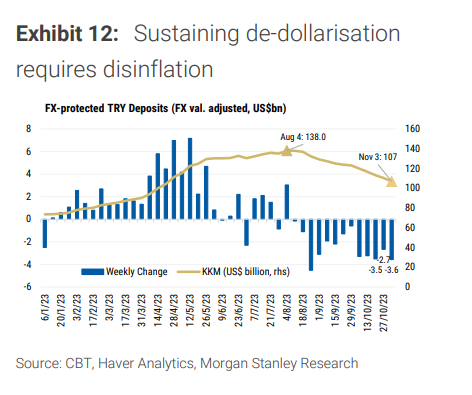

We then forecast a CBT pause to gauge the impact of the cumulative rate hikes on the determinants of inflation and inflation expectations. We expect the policy rate to reach a terminal 40% in April, as the CBT responds to potential inflationary pressures after March elections. Given a policy preference to unwind FX-protected deposits (KKM) and accumulate reserves, financial conditions should continue to be tighter than implied by the policy rate until there is a significant improvement in the inflation outlook.

As of November 3, the KKM stock declined by almost US$31 billion in the last three months, while locals’ FX deposits increased by only US$6.4 billion, indicating a preference for TRY assets supported by regulations that encourage conversions from KKM to regular TRY deposits, and rate hikes.

Current account deficit to narrow next year on the back of tighter financial conditions

The current account deficit (12-month sum), widened to US$57 billion (5.6% of GDP) as of August 2023 compared to US$34 billion last year. Despite a strong services surplus thanks to tourism revenues, at US$51 billion as of August, a high trade deficit, at US$98 billion, was the main driver of the notable widening. While the energy deficit declined to US$63 billion (-US$11 billion compared to last year), the rise in the non-energy trade deficit to US$36 billion (+US$40 billion) dwarfed this decline, reflecting a surge in gold and non-gold imports due to loose financial conditions prior to the recent policy pivot.

External deficits to balance gradually

Despite a notable recovery in official reserves after May, reserve drawdown and CBT borrowing have been the main sources of financing year to date as of August. Going forward, tighter financial conditions, along with lower energy imports, should gradually reduce the current account deficit. We see the current account deficit in 2023 at US$45 billion (4.2% of GDP), declining to US$33 billion (2.8% of GDP) in 2024. We think that inflows to the financial account will increase conditional on continued steps towards policy normalisation, supporting official reserves.

Budget deficit to widen due to earthquake reconstruction

The budget balance stood at -2.9% of GDP as of September, up from -0.9% at end-2022. The medium-term program (MTP) projects the budget deficit/GDP ratio to rise to 6.4% in 2023, and to remain at that level in 2024. According to the MTP, 3pp of the 6.4% budget deficit projection for 2023, i.e., TRY 762 billion, is due to earthquake-related spending, which we think will undershoot the budgeted amount, hence our forecast for a 5.8% budget deficit in 2023 – still implying notable stimulus until year-end. Despite an emphasis on fiscal discipline excluding earthquake-related expenditures, the projected increase in the primary expenditure/GDP ratio to 23.9% in 2024 from 17.5% in 2022 will likely put upside pressure on indirect taxes and administered prices, and consequently on inflation, especially in 2024.

Where are the risks?

In an upside scenario, the cushion from stronger external demand emboldens the CBT to adopt a tighter monetary stance, implying credibility gains. But higher growth and higher oil prices relative to the baseline slow disinflation and limit the improvement in the current account balance. In a downside scenario, prospects of a sharper downward adjustment in growth prompt policymakers to introduce measures to ease financial conditions, i.e., by relaxing credit growth caps and ending the hiking cycle at a lower terminal rate. This slows the adjustment in domestic demand, but lower oil prices driven by weaker global growth keep the pressures on inflation and the current account deficit contained.

Where do we differ?

In terms of growth, we are above the Bloomberg forecast for 2024 (2.7%Y) but slightly below the one for 2025 (3.4%Y) as we see a gradual slowdown. We see average inflation above consensus in 2024 (50.1%Y) and 2025 (27.1%Y).

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/