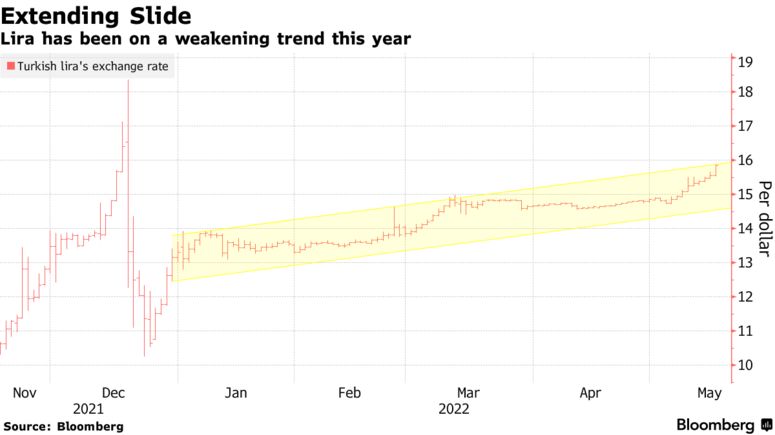

Turkey’s lira tumbled for a ninth day, hitting a new low for the year, as state lenders reduced the amount of dollar sales to prop up the currency.

State-owned banks sold more than $1 billion to support the currency over the past two days, but the pace of interventions slowed on Tuesday, according to traders who asked not to be identified because they’re not authorized to speak publicly. Lira weakened as much as 2.1% to 15.8838, the weakest level since December. The currency has retreated 16% this year, the worst performer in the world except Sri Lanka’s rupee and Ghana’s cedi.

The lira has come under pressure as a widening current-account deficit, soaring inflation and ultra-loose monetary policy sap investor confidence just when global risk sentiment has deteriorated. President Recep Tayyip Erdogan’s unconventional economic theory that higher rates drive inflation has underpinned the weakness.

“A weaker lira reflects vulnerabilities of the Turkish economy to high energy prices and growing risk of a global recession or at least a synchronized slowdown” said Piotr Matys, an analyst at InTouch Capital Markets Ltd. “The measures implemented by the Erdogan administration in cooperation with the central bank are not proving sufficient to keep the lira stable for an extended period.”

Instead of raising policy rates to contain risks, the government and the central bank introduced unconventional measures to stem the decline, including foreign-exchange-indexed deposit accounts. Treasury and Finance Minister Nureddin Nebati said this month Turkey will issue inflation-linked bonds for individual investors as another step to increase the appeal of lira assets.

Meanwhile, the cost of insuring Turkish government bonds against default for five years rose above 710 basis points, hovering near the highest level since 2008, a sign of growing investor unease over the risks facing the nation’s assets.

State banks don’t comment on their currency interventions, but a former central-bank governor said in 2020 that government-owned lenders carry out transactions in line with regulatory limits and may continue to be active in the currency market.

Bloomberg