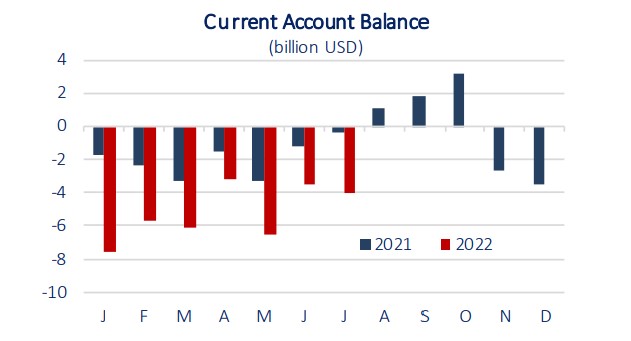

In July, current account deficit was 4 billion USD

In July, current account deficit expanded by 3.7 billion USD compared to the same month of the last year and became 4 billion USD. According to the Reuters survey, current account deficit was expected to be 3.6 billion USD in this period. Net non-monetary gold and energy imports continued to be the leading factor in the widening of current account deficit.

According to balance of payments figures, foreign trade deficit was 9.3 billion USD in July, 6.1 billion USD of which stemmed from net energy imports and 1.7 billion USD of which was net non-monetary gold imports. On the other hand, the positive trend in transportation and tourism revenues significantly limited the increase in the current account deficit. In July, the total net income from those two items was 6.3 billion USD..

12-month cumulative current account deficit reached the highest level of the last 1.5 years with 36.6 billion USD in July

Excluding net energy and gold imports, 12-month cumulative current account surplus exceeded 40 billion USD..

Weak course in foreign direct investments…

In July, foreign direct investments FDI showed a poor performance. In this period, FDI declined by 79.4% yoy to 252 million USD. In this period, non-residents’ net capital investments became 387 million USD, while net real estate investments decreased to 306 million USD, the lowest level of the last 14 months. In the January-July period, net FDI contracted by 17.6% yoy and became 3.2 billion USD.

WATCH: Turkish Economy Won’t Survive The Winter

As of the first 7 months of the year, investments in the food sector rose by 339% on an annual basis.

Other investments posted a net capital inflow of 3.4 billion USD.

The mystery of huge unidentified flows

In July, portfolio investments gave a net capital outflow of 631 million USD. During this period, non-residents made net sales of 222 million USD and 173 million USD, from the equity and government securities markets, respectively. As of January-July period, a capital outflow of 12.1 billion USD was recorded in the portfolio investments.

In July, net capital inflows in other investments was 3.4 billion USD. In this period, Turkish banks’ currency and deposits within their foreign correspondent bank accounts rose by 983 million USD, while non-resident banks’ deposit accounts held within domestic banks increased by 698 million USD in total. In addition, the effective and deposits held by non-residents in Turkish banks went up by 1 billion USD.

In July, banks realized a net repayment of 801 million USD in total for the loans they used from abroad, while other sectors realized a net loan use of 3.5 billion USD.

Thus, in July, the 12-month cumulative long-term debt rollover ratio was 89% in the banking sector and 178% in other sectors.

Official reserves rose by 4.4 billion USD in July

In July, official reserves increased by 4.4 billion USD. Thus, the decline in official reserves since the beginning of the year decreased to 7.9 billion USD. Net errors and omissions, which recorded a capital inflow of 5.5 billion USD in July, posted a capital inflow of 24.3 billion USD in the first seven months of the year.

Expectations…

Although the deceleration in global economic activity limits the upward pressures to some extent, energy prices remain high due to the increasing supply concerns.

According to the preliminary data released by the Ministry of Trade, the rapid expansion in the foreign trade deficit continued in August. In this period, exports rose by 13.2% on an annual basis, while the imports increased by 40.8% yoy. Thus, the foreign trade deficit, which expanded by 161.8% yoy to 11.3 billion USD in August, reached 73.5 billion USD in the January-August period with an annual increase of 146.4%.

In the upcoming period, besides energy prices, the course of economic activity in EU countries and the EUR/USD parity will be closely monitored in terms of the current account balance outlook. The positive performance in tourism revenues despite geopolitical developments is expected to continue in the winter months due to the energy crisis in European countries and will continue to support the current account balance.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/