Business conditions were broadly stable in the Turkish manufacturing sector during July as recent sequences of expansion in output and new orders came to an end amid strengthening inflationary pressures. Firms continued to expand their staffing levels, however.

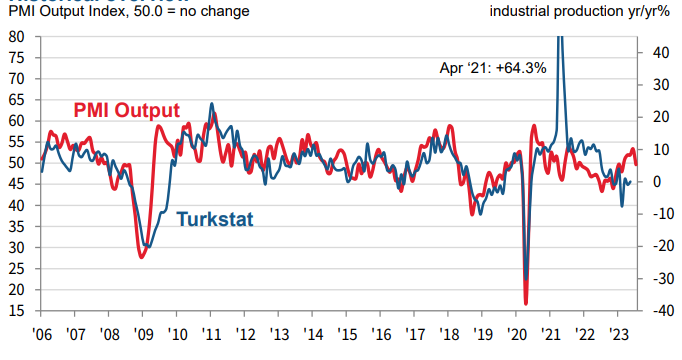

The headline PMI dipped fractionally below the 50.0 no-change mark in July. At 49.9, down from 51.5 in June, the index signalled broadly stable business conditions and ended a six-month sequence of expansion.

The end of the run of growth in the sector was often attributed by firms to strengthening inflationary pressures. The pace of input cost inflation accelerated sharply for the second month running in July and was the fastest since March 2022. More than half of all respondents (52%) indicated that their input prices had risen over the month, which they often linked to currency weakness. There were also some reports that higher wages had added to overall input costs.

In turn, output prices were also raised, with the pace of inflation at a 16-month high and well above the series average.

Stronger price pressures weighed on customer demand in July, leading to a first slowdown in new orders in five months. Similarly, new business from abroad also moderated.

The impact of price rises on demand was also felt in terms of production as a four-month sequence of growth came to an end. That said, a continued recovery from the earthquake earlier in the year meant that output was broadly unchanged overall.

Employment increased for the third month running as firms attempted to expand capacity, although the pace of job creation was only slight.

Meanwhile, manufacturers scaled back their input buying in response to softer new order inflows. Reduced demand for inputs, coupled with delays in the delivery of items from suppliers, meant that stocks of purchases were scaled back to the largest extent since May 2020.

Commenting on the Istanbul Chamber of Industry Türkiye Manufacturing PMI survey data, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“Resurgent price pressures dampened demand for Turkish manufactured goods in July. Both input costs and selling prices rose at much stronger rates at the start of the third quarter, making it harder for firms to secure new business. As a result, a four-month

sequence of production growth came to an end. Manufacturers will be hoping that inflation starts to level off again to aid in the pursuit of new business.”

ISO