Turkish manufacturers saw no change to their export climate during July, thereby ending a 17-month sequence of improvement. While some key export markets saw activity continue to rise, most notably in the UAE, others saw demand soften amid the impact of inflationary pressures.

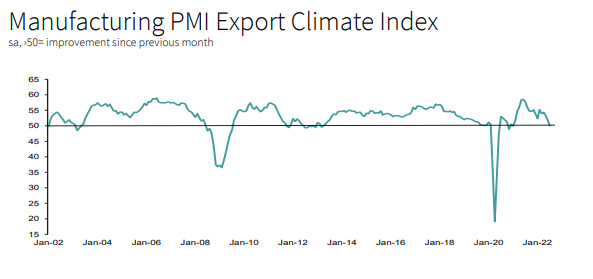

The Istanbul Chamber of Industry Turkey Manufacturing Export Climate Index posted exactly at the 50.0 no-change mark in July, signalling stable export demand conditions over the course of the month. The reading was down from 51.8 in June, thereby ending a period of improvement in the export climate stretching back to February 2021.

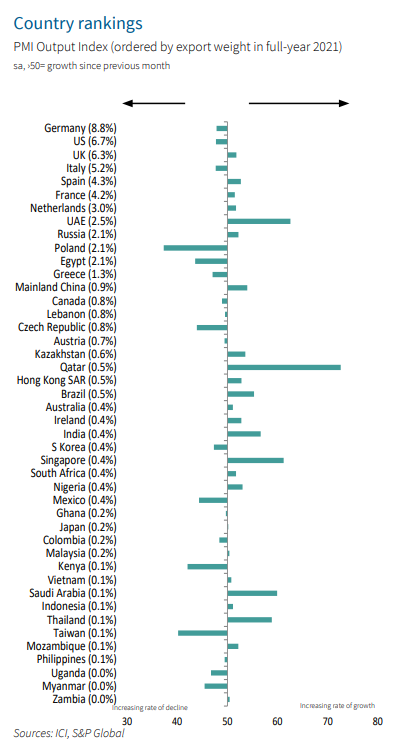

The main source of rising demand among the key export destinations for Turkish manufacturers was the UAE, where non-oil business activity continued to increase sharply. In fact, the latest rise was the joint-fastest in seven months. Elsewhere in the Middle East, sharp expansions were seen in Qatar and Saudi Arabia, but Egypt and Lebanon saw activity moderate.

Turning to Europe, there was a mixed picture for output at the start of the third quarter. Growth was maintained in the UK, Spain, France and the Netherlands, albeit with rates of expansion slowing in

each case.

Meanwhile, Germany, Italy, Poland and Greece all saw output fall in July. Activity in Germany decreased for the first time in the year-to-date, and to the greatest extent since the first wave of the COVID-19 pandemic. Germany is the single largest destination for Turkish manufacturing exports, accounting for around 9% of the total.

The US also posted a renewed reduction in business activity, seeing output fall for the first time in just over two years and at the fastest pace since May 2020.

Outside of the Middle East, the sharpest increases in output were seen in Asia, with marked expansions posted in India, Singapore and Thailand. Mainland China saw activity rise for the second month running following the loosening of pandemic lockdown restrictions.

The sharpest decline in output was the aforementioned reduction in Poland, with Taiwan, Kenya and the Czech Republic also posting marked slowdowns in demand.

“The global economy continued to feel the strain that inflationary pressures are putting on demand in July, with some key export destinations now having moved into contraction. Europe and the US are particular sources of weakness, with the Middle East currently likely to provide the main avenue of new work for Turkish manufacturers as activity continues to rise strongly”

The Turkey Manufacturing Export Climate Index is calculated by weighting together national PMI data on output trends from PMI surveys. Weights are derived from statistics on the relative importance of individual trading partners’ contributions to the exports of Turkish manufacturers.

ICI