- The TRY is likely to weaken regardless of the election result

- Deteriorated fundamentals and signs of TRY overvaluation could lead to a wider correction than we previously thought

- We now see USD-TRY rising to 24.0 by year-end compared to 21.0 previously

The presidential and parliamentary elections on 14 May could bring changes in the economic and monetary policies that might be pivotal for the TRY’s outlook over the medium and long term. However, we continue to believe the currency is likely to go through a significant adjustment in H2 regardless of the election results.

The TRY’s cyclical and structural vulnerabilities are well known. We have emphasised in numerous publications the challenges that the currency faces: deeply negative real rates, a sizeable current account deficit, the absence of stable capital inflows, low FX reserves and the risk around the sustainability of the lira-isation policy.

If anything, most of these key variables have deteriorated further since the start of the year. The current account dynamics show no sign of improvement with the trade balance posting an unprecedented deficit of USD35bn in Q1. The CBRT’s net foreign assets excluding swaps stay negative even if gross FX reserves are off the lows.

Meanwhile, residents’ renewed appetite for FX-protected deposits mechanically increases the financial risks for the government’s fiscal balance and the central bank’s liabilities (see Turkey: Policy challenges ahead, 3 April 2023).

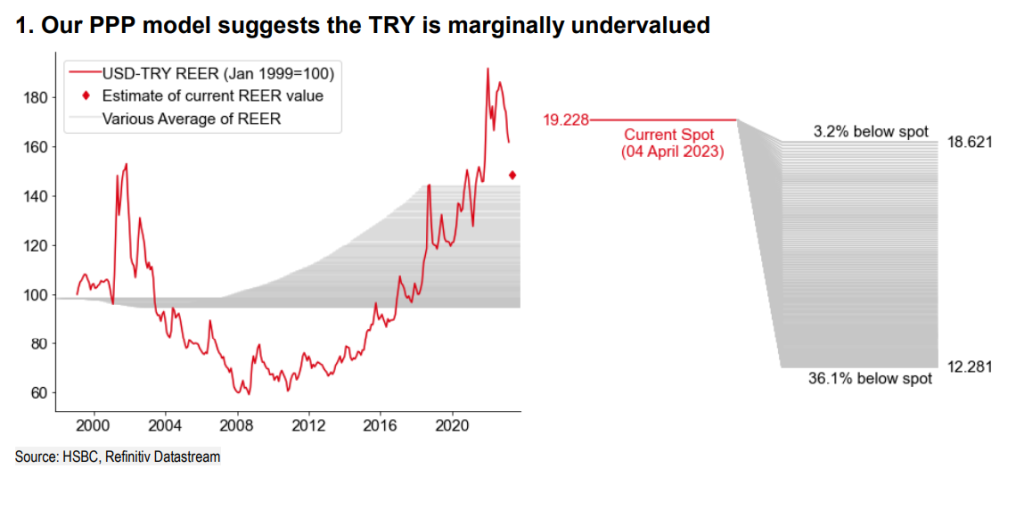

Therefore, the question for us is not if the TRY will weaken in the coming months but rather by how much it is likely to adjust. In light of the underlying deterioration of the currency’s fundamentals, we now believe that the USD-TRY move higher could be more pronounced than we expected previously. This is all the more likely since our V5 valuation model suggests that the TRY is now overvalued. As our V5 approach is qualitative, we use our PPP model (Little Mac) to estimate by how much USD-TRY is likely to rise in H2.

Regardless of who is in charge of the economic and monetary policies from May, we now see USD-TRY rising to 24.0 by end of 2023 vs 21.0 previously.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/