2Q21 GDP growth reaches 21.7%, in line with expectations

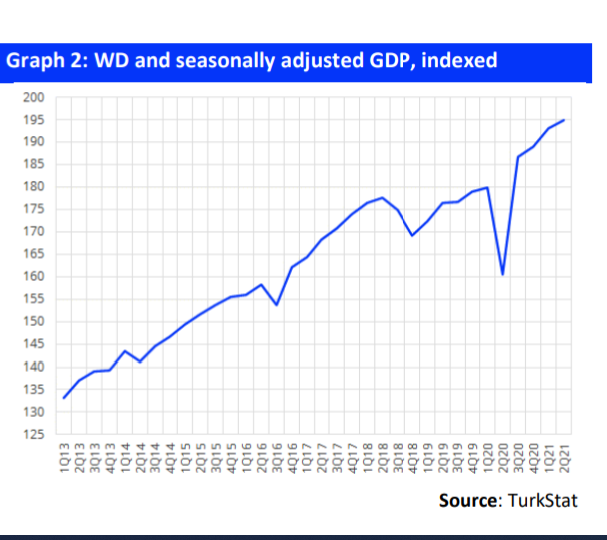

TurkStat announced that 2Q21 GDP growth reached 21.7%, in line with the 22.0% median market expectation, and our 21.0% estimate. The working-day and seasonally adjusted GDP pointed to a 0.9% QoQ improvement (on top of the 2.2% recovery in the previous quarter). Meanwhile, 12-month rolling GDP growth increased now reached 9.8% from 2.4% last quarter, after the withdrawal of the sharp 2Q20 contraction from the calculation.

WATCH: Turkish Economy: The Good, the Bad and the Ugly

Strong GDP growth is mainly attributable to both industrial and services sector activity, apart from the base effect

Although the low base of last year also backed the impressive growth figure, robust growth performance is mainly due to the strong industrial sector activity (40.5% YoY) with decent domestic demand and stellar export performance and the revival in services sector (domestic trade, transportation and tourism) activity, which witnessed a 45.8% YoY growth with the help of the normalization process. Other services sectors (information, financial services, and administrative services, etc.), were also generally strong, except for the financial services sector, which registered a 22.7 % YoY contraction due to a strong base effect (+32.7% in 2Q20). On a combined basis, we calculate that YoY growth in “other services” was roughly 6.8%.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

Domestic demand continues to be the major driver

Analyzing from the expenditure side, contribution from net exports increased markedly, but domestic demand continues to be the major driver. A favorable base effect combined with the reopenings in the economy (revival in services sector expenditures) has led to a 22.9% YoY growth in private consumption, which made a 13.6% to headline GDP growth. Strong investment activity seems to have been maintained with the 35.2% YoY growth in machinery-equipment investments, while construction related investments were relatively weaker with a 12.2% YoY growth. In sum, gross-capital fixed formation also made a significant contribution to GDP growth to the tune of 5.3%.

The contribution from government expenditures stood at a mere 0.7%. With the revival in goods & services exports over the past few months (+59.9% YoY), net exports also made a considerable 6.9% contribution. Combining these, we calculate the contribution of inventory accumulation to overall GDP growth as -6.1%.

We revise our 2021 GDP growth estimate to 8.3% from 5.2%

The economic activity had actually returned to sequential recovery in May and June after the slight retreat in April (which was partially attributable to lockdowns) and this recovery has pulled YoY GDP growth to above 20%, which is somewhat higher than our initial projections of about 17-18% 8 (which we had derived at the beginning of the quarter). Some early indicators, such as manufacturing PMI, capacity utilization, electricity consumption and most considerably the credit card spending actually suggest that the recovery in economic activity has lingered into 3Q as well, also with the help of the lifting of restrictions. Although we may still witness some slowdown in domestic demand going forward, the ongoing export performance and the y-t-d growth performance do suggest that 2021 GDP growth may end up at a respectable level of 8.0-8.5%, with potential upside risks. As such, we revise our 2021 GDP growth estimate to 8.3% from 5.2%.

Serkan Gönençler, Economist

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/