Recovery in February IP might be temporary

Monthly IP recovered in February on the back of capital and consumer goods (7.5% and 5.5%, respectively), whereas intermediate and energy goods production remained weaker (3.2% and 0.2%, respectively). Although the recovery (4.4% m/m) was enough to compensate the contraction in January (-2.3%), IP continued to slow down in the first two months of the year (2% q/q) compared to 4Q21 (4% q/q growth). If our March IP forecast is included, the overall q/q change will likely dip to as low as 0% in 1Q22.

Other transportation (mainly defense industry), motor vehicles, machinery, electrical equipment and clothing were the main drivers in January-February, differentiating positively on behalf of the exporting sectors. Looking ahead, despite the slight pick-up in manufacturing capacity utilization rate in March (+1pp to 78.2%), the decline in electricity consumption and the deterioration of manufacturing PMI to below 50 (49.4) confirm the deceleration in economic activity.

Also, our IP forecast of a 7.5% m/m contraction in March leads us to conclude that the recovery in February might be temporary, which is also confirmed by our big data indicators.

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit

Consumption continues to support domestic demand

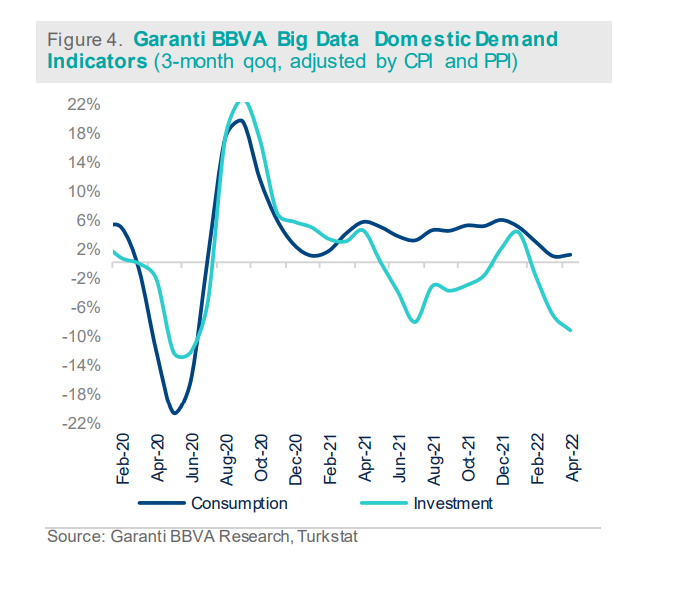

According to our big data demand indicators, private consumption is decelerating but remains relatively solid. In contrast, investment demand is shrinking at a faster pace, reflecting weakness in both construction and machinery.

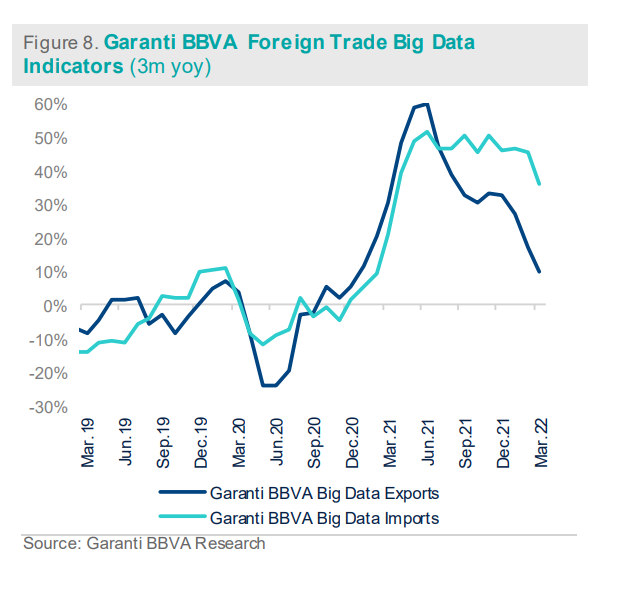

Likewise, the positive contribution from net exports is slowing down, mainly due to a recent jump in imports. All in all, the deceleration in economic activity becomes much clearer toward the end of 1Q22, given weaker domestic and external demand contributions.

In addition, the high inflationary environment with elevated policy uncertainty generates downside risks to domestic demand, while potential spill-over effects from the Russian invasion of Ukraine on global demand will likely reduce the expected contribution from exports and tourism.

Ukraine Crisis Could Cost Turkey $30 Billion

Negative pressures might be absorbed by counter-cyclical policies

Larger negative real interest rates, the recent push in commercial credit and loose fiscal policy remain supportive in the short term. However, current high financial volatility and uncertainty in global markets, and their potential impact on external demand are clear downside risks to the near term growth outlook. As confirmed by our GDP nowcast, economic activity started to decelerate after the currency shock experienced in December 2021, and before the war in Ukraine.

Nonetheless, the expansionary bias of government spending, other counter-cyclical policies and the pandemic-related reopening of the economy will help absorb some of the downward pressures. Although we do not expect GDP growth to be severely affected this year, 2Q22 GDP data will provide a clear test to understand both the magnitude of the slowdown and the resilience of the economy. Given the current information, we expect GDP growth to average 2.5% in 2022.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng