Moderate Resilience in Current Downturn

Captive Leasing Sector: The Turkish leasing sector is dominated by bank-owned companies offering finance leases. Fitch-rated companies account for about 75% of consolidated leasing assets. All of them are subsidiaries of banks with ratings based on institutional support.

Limited Liquidity Risks: Given the small sizes of leasing companies relative to their parent banks, we believe that support would be forthcoming if needed and liquidity risks are low. The sector mainly borrows from large Turkish banks. Refinancing risks are mitigated by the availability of parental funding if needed and the parents’ generally good access to funding markets.

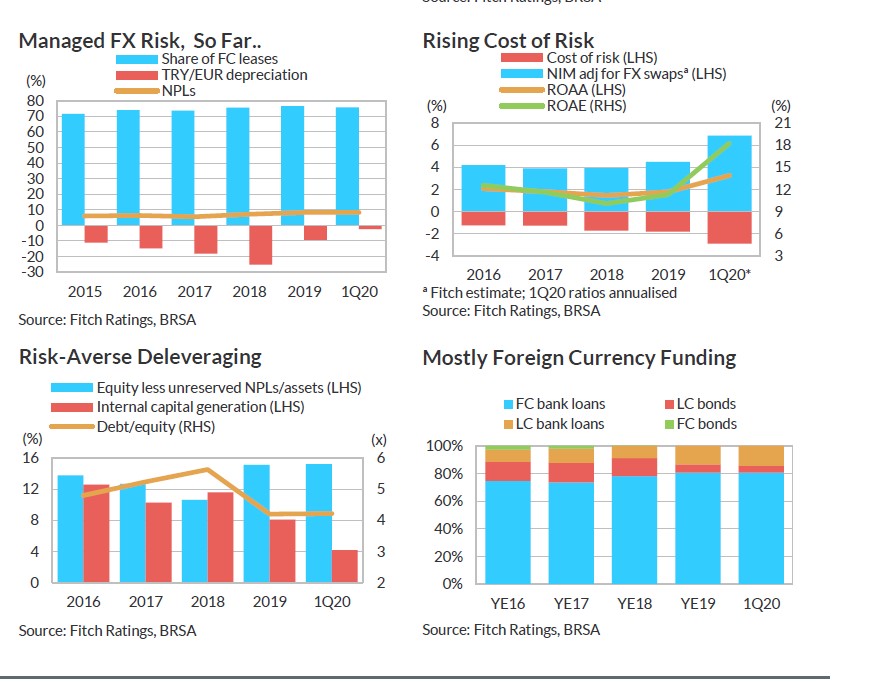

Significant Deleveraging: Leasing companies have sharply reduced risk appetite since the 2018 Turkish crisis which resulted in a reduction in aggregate net lease portfolios (estimated at minus 4% quarter-on-quarter in 1Q20, minus 26% in 2019 and minus 6% in 2018 on a foreign currency adjusted basis).

Elevated Asset Quality Risks: The sector is indirectly exposed to lira volatility given 76% of the portfolio was denominated in foreign currencies (primarily in euros) at end-1Q20. Risks are mitigated by adequate initial down payments, improved loan-to-value ratios (due to loan book seasoning) and good payment discipline. However, asset quality risks remain high.

Record of Resiliency to FX Risk: The sector has weathered many years of significant lira depreciation but maintained impaired leases ratios in single digits. Sound margins and improved capitalisation provide some buffers against another economic downturn.

Sound Profitability: Captive lessors benefit from the distribution channels of parent banks. This supports the sector’s operating efficiency, resulting in sound profitability. 1Q20 profits were boosted by higher gains from FX swaps, but rising impairment charges will moderate profits.

Equipment Financing: Growth in the sector is largely driven by the capital expenditure needs of the domestic economy. Almost 80% of financed assets represent a wide range of equipment. Real estate exposure is a major risk due to concentration, liquidity and residual value risk.

What to Watch

Further Deleveraging: Central bank rate cuts and stimulus programmes might support demand, but we expect further FX-adjusted lease book contractions in 2020.

Forbearance: We expect asset quality to worsen but regulatory forbearance (eg classifying leases as impaired beyond 240 days past due) will support reported asset quality and leverage.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/