For emerging-market debt (EMD), 2022 is shaping up to be a contest of conflicting forces. Investors will need to pinpoint pockets of resilience among the many macroeconomic challenges facing the asset class.

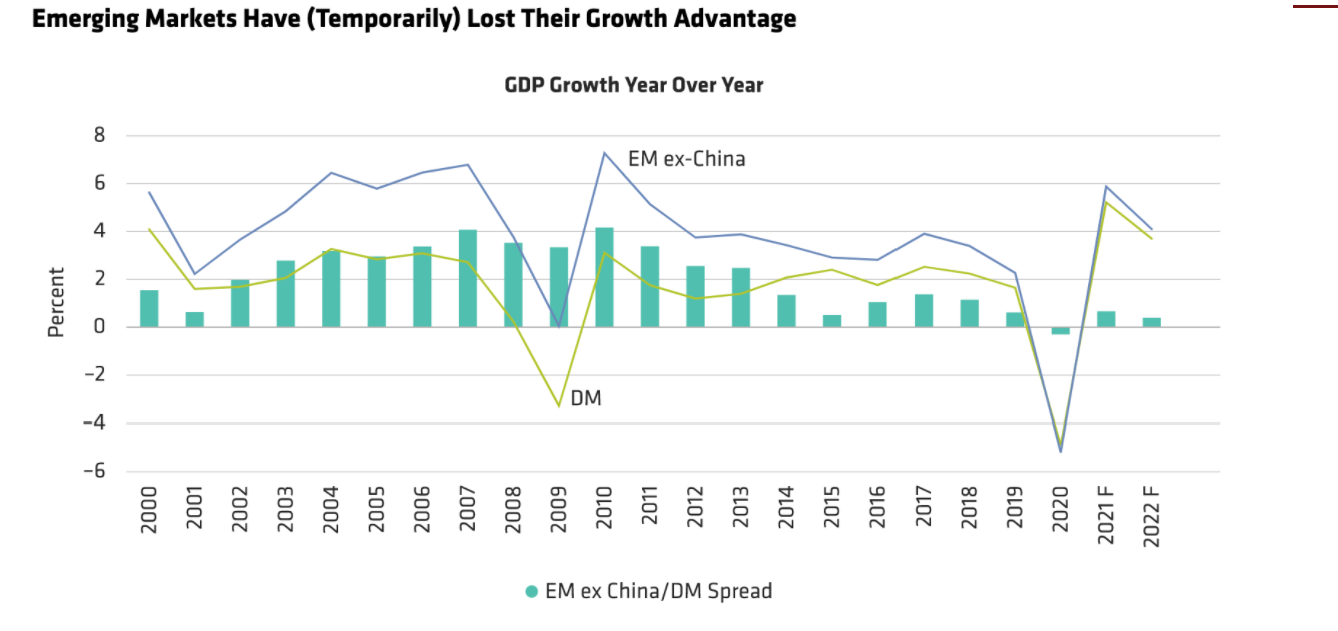

Among the obstacles in this asset class: a negligible difference in the GDP growth of developed markets (DM) and emerging markets (EM) excluding China; persistent inflation; populist pressures; and moderate near-term growth for China. Among the opportunities: China’s long-term growth plan and less external vulnerability for EM countries.

What does this climate mean for EM investors?

For now, hard-currency EMs—sovereign and corporate bonds alike—have more appeal than local-currency EMs. And selectivity is key. Here’s why.

Obstacles: Emerging Markets Lose Their Growth Edge

As economies reopened in 2021, pent-up demand generated strong global growth. We expect more of the same for 2022. Strong global growth satisfies one criteria for strong EMD returns. But another key criteria for strong returns—that EM economies grow faster than DM economies—no longer holds. Instead, developed markets are now growing much faster than before the pandemic, while EM economies continue to chug along at their pre-pandemic pace. The result has been a narrowing of the gap between EM and DM growth. Without a meaningful growth edge, EM has a harder time enticing investors into taking added risk.

What’s more, central bank rate hikes will likely slow EM growth. Inflation has remained higher and more persistent in EM, compelling most EM central banks to begin tightening monetary policy. We estimate that EM countries have completed less than half of their tightening cycle so far, leaving the lion’s share for 2022.

Slow vaccine rollouts across the emerging world are also challenging, and not only from the humanitarian perspective. Crises like the coronavirus pandemic intensify inequality and poverty, which could fuel public discontent and affect political and policy paths. Several emerging countries share features such as a young demographic that make them particularly vulnerable to populist pressures, delayed fiscal consolidation and eroded democratic standards. Investors should therefore take extra care when assessing countries facing elections in 2022—especially where socioeconomic conditions are fragile and economic scarring from COVID-19 is deep.

Finally, China’s growth has slowed, removing a historical tailwind for other EM countries. Pre-pandemic, China’s expansive growth drove commodity prices higher, which in turn helped drive growth in other commodity-rich countries. But China no longer sees itself as the world’s growth engine; instead, its broader policy framework prioritizes financial stability and the environment alongside growth. This has resulted in more realistic GDP growth targets, such as the 5%–5.5% target for 2022 (and in policymakers no longer having to drive higher-than-desirable growth in sectors such as property and manufacturing).

Opportunities: Green Economy to Fuel Demand for Commodities

China makes our list twice, as both an obstacle and an opportunity. That’s because the same policy framework that moderates overall growth also lowers the odds of a hard landing down the road. At any rate, China may no longer need to be the linchpin at the heart of a commodities surge. Over the next decade, the global drive toward net-zero carbon emissions will generate a huge increase in demand for copper, aluminum, cobalt and lithium—most of which come from EM countries—to upgrade electric power networks and make batteries. This strong demand is likely to fuel a commodities boom.

We also expect “just transition” financing—which looks to equitably distribute the costs of climate action—to supply large-scale multilateral support to developing nations for many years. For example, the recent United Nations Glasgow Climate Change Conference known as COP26 resulted in renewed pledges from developed countries to contribute at least US$100 billion annually to developing nations for transition financing, plus a deal to establish a centralized system for trading carbon offsets, with 5% of the proceeds earmarked for a climate adaptation fund for EM countries.

EM countries’ external vulnerability has declined

Meanwhile, EM countries’ external vulnerability has declined. Basic balances—the sum of current account balances and foreign direct investment—are as robust for EM countries as they’ve been in 20 years. A US$650 billion increase in the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) to help countries deal with the ongoing impact of the pandemic has also improved EM external positioning. Further, an additional IMF facility in 2022 that transfers the benefits of SDRs from rich countries to developing nations would also strengthen EM liquidity.

Uncertainty isn’t behind us

Risk markets love a clear picture, but uncertainty isn’t behind us. Indeed, EMD and other risk assets took a hit in late 2021 as markets reacted to the rise of the COVID-19 Omicron variant, renewed travel restrictions globally and a more hawkish Fed. However, compared with 2020, there’s been a marked reduction in fear of unknowns. Case in point: the implications around Omicron remain unclear, but the size and duration of the market response suggests observers don’t expect it to have a durable economic or market impact in 2022. (We agree.) We expect uncertainty to lessen, but not disappear, as the world heads into an environment of above average growth and reduced stimulus.

Not All EMD Is Equal

Given this mix of obstacles and opportunities, we favor hard-currency sovereign and corporate debt. Hard-currency assets are less vulnerable to cyclical downturns, and high-yield spreads are relatively wide, with room for narrowing.

In contrast, we remain cautious on local-currency assets over the near term, as these tend to bear the brunt in a sell-off. However, this sector may become more attractive later in 2022, once EM countries are further along in normalizing monetary policy and there is even more clarity around Fed tightening. Investors should closely monitor conditions and valuations and prepare to shift the portfolio mix as conditions warrant. It bears repeating: In this environment, selectivity is paramount.

By Alliance-Bernstein Advisors

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng