One of the unwelcome consequences of the stronger than expected post-Covid recovery of the global economy, has been the return of inflation – a scourge that the world, especially the developed world, had long forgotten. Unfortunately, Turkey has never achieved so-called “price stability” in the first place. In 2019, before the Covid-19 shock, Turkey’s consumer price inflation already averaged 15%, one of the highest among a group of major advanced and emerging market (EM) peers, ranking behind only a few extreme cases, like Venezuela, Argentina, and Iran.

[t]hings have gotten especially ugly lately, with inflation reaching almost 50%, but this was only partially driven by global factors. Much of it, as is well-recognized by now, was self-inflicted.

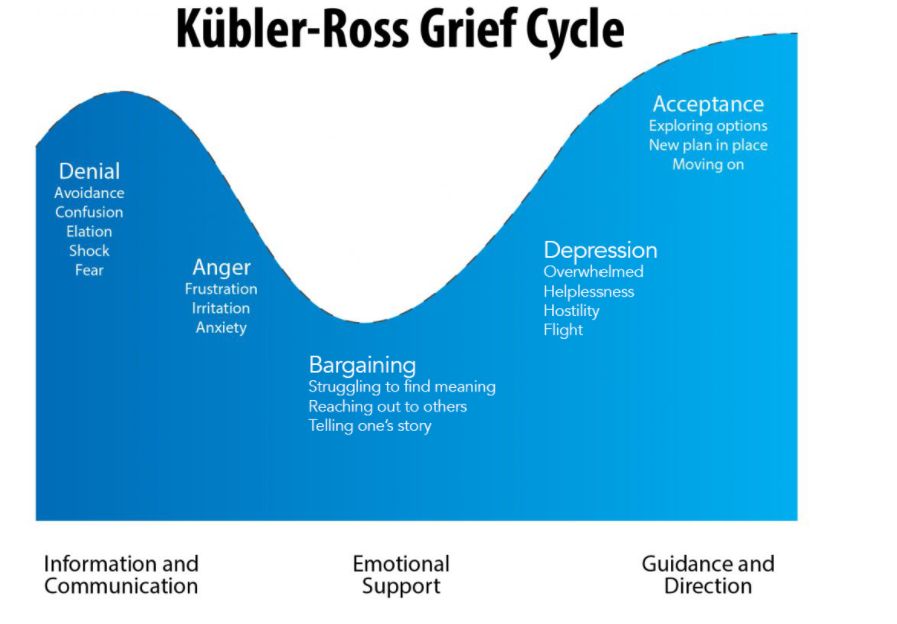

How did we get here, and where are we heading? It may sound a little strange at first, but by rearranging the so-called “Kubler-Ross Model” on the “Five Stages of Grief”, we may begin to frame our narrative and put things into perspective.

Stage I: Denial

It is perhaps best to start our story around 2010-11, when Turkey, arguably, missed a great opportunity to rein in inflation and anchor inflationary expectations once and for all. At the time, headline inflation touched a low of 4%, y/y around late 2010. Core inflation was at an even softer 2.5% around early 2011, likely reflecting a change in pricing behavior as a result of the GFC’s hugely contractionary effect on economic activity.

But this “success” proved transitory, with inflation beginning to creep up soon afterwards. In this author’s view, a key reason behind this was the Central Bank of the Republic of Turkey’s (CBRT) ill-advised policies at the time – a denial of the very basics of “what monetary policy can and cannot do”.

CBRT Governor Erdem Basci’s tenure in early 2016, was, in a nutshell, mainly about overburdening monetary policy with multiple objectives and promises in the face of volatile capital flows, while keeping interest rates low to appease political and business establishments. Put differently, at its core, this period was largely about the “intellectual” denial of a well-known dictum of international macroeconomics, the so-called “impossible trinity”, the idea that one cannot control both the interest rate and the exchange rate in an open capital account regime.

This was a missed opportunity. If, instead of denying the problem, the CBRT had fought back harder, educated the public and the business community on the limits of monetary policy, and last but certainly not least, stuck to the basics (including in the management of capital flows), things could have played out differently.

Stage II: Bargaining

This is a very long phase in Turkey’s inflation scuffle, with several – fairly dramatic – twists and turns. It starts with the appointment of Murat Cetinkaya as the CBRT Governor in April 2016, continues during Murat Uysal’s tenure during July 2019-November 2020, and ends with Naci Agbal’s tenure in March 2021.

So, what’s the “bargaining” all about? It is mainly about finding the right balance between the ire of the markets – or rather, the Turkish Lira (TL)- versus that of Erdogan. On the one hand, as is well-known by now, Erdogan holds some strange theories on the monetary policy-inflation link (read: “high interest rates beget high inflation”), and is fixated with low interest rates, which, this author would surmise, could be as low as “zero” in his mind. And of course, he always wants growth.

On the other hand, investors, which include local depositors in Turkey’s highly-dollarized economy, do not agree with these theories, simply because they want a fair return on their TL-assets.

We can consider Turkey’s boom-bust cycle of 2017-18, which ended with the “pastor crisis” of August 2018 and a 625 bps rate hike by the CBRT, and then ultimately with the dismissal of Cetinkaya. The Covid crisis was another example of this constant tension between the desire to maintain expansionary policies, and the unsustainability of these policies. Overly expansionary monetary policies of the then-Treasury and Finance Minister and President Erdogan’s son-in-law Berat Albayrak, which incidentally cost billions of dollars in CBRT reserves, ended dramatically with an overhaul of top economic management in November 2020, followed, again, by rate hikes.

Ultimately, Ankara did deliver the right response by raising interest rates when push came to shove, but could not maintain this stance because of political pressure, and because growth has always had the priority. In the meantime, perhaps unsurprisingly, inflation kept creeping up, averaging some 14% during 2017-2020, vs. around 8% in the decade prior.

Stage III: Anger

Infuriated by Agbal’s growing independence and the ongoing rate hikes at the time, by which Agbal was desperately trying to prevent inflation from heading to 20% or higher, Erdogan intervened again. After another 200 bps rate hike, delivered without the President’s consent, Agbal, who was slowly winning markets over, was dismissed in March 2021.

To the markets’ surprise, his replacement, Sahap Kavcioglu, at first exercised restraint by not cutting rates right away. However, as Erdogan apparently ran out of patience, rate cuts began earlier than expected in September, and also proceeded faster than expected, culminating in a 500 bps reduction during September-December. With the policy rate down to 14%, versus an inflation rate heading toward 20% at the time, the real rates slipped into deeply negative territory. Simultaneously, with all obstacles and pretenses pushed aside, Ankara went all in, adopting the so-called “New Economic Model” (NEM).

The NEM claims that the economy will be transformed – and simultaneously achieve a current account surplus and price stability – mainly thanks to cheap money. The economics of NEM is very problematic, to say the least, but perhaps more importantly it means that low rates have now become enshrined as Ankara’s official “development policy”. Therefore, unlike in the past, there is no going back to higher rates.

But the market did not approve any of this, nor did the global context with an inflationary surge – causing a tightening cycle in economies worldwide – help Ankara’s case. The Lira, which had already been weakening since the start of the rate cut cycle, went into a freefall in December, triggering withdrawals from the banking system and de facto bringing Turkey, on the verge of a full-blown financial crisis.

This time, instead of hiking rates, Ankara warded off currency and deposit withdrawals through the introduction of a new “currency-protected deposit scheme”, which was designed to cover losses of depositors for currency depreciations that would exceed the deposit rate (capped at 17%). The scheme, which was expanded over time to include corporate enterprises and tax advantages, was “successful” in the sense that it helped to quell the panic, but the damage was already done. Inflation, which was hovering just under 20%, y/y, in the summer months, surged to 48.7% in January, and is expected to exceed 50% in the months ahead.

As Turkey continued to feel global inflationary pressures, inflation would have likely risen further, but a back of the envelope calculation suggests that much of the jump in inflation from around 20% to 50% was self-inflicted – and therefore could have been avoided, had the monetary policy stance not changed.

Stage IV: Depression

The problem now, which even Erdogan can no longer afford to ignore because of its political implications, is that inflation has passed a crucial threshold and has become a social problem. The Turkish media, which has long lost its independence, is generally quiet on the issue, but foreign media as well as Turkish social media are blasting with news on the hardships caused by higher prices on households, particularly the huge spike in energy prices.

Stage V: …Acceptance?

Have we reached the final acceptance stage? Is Ankara finally getting the message and ready to change course?

In short, not at all. On the contrary, Ankara is busy propagating a very different narrative. It thinks the NEM, bolstered by its ingenious deposit scheme, is delivering wonders. It forecasts inflation to decelerate to single digits by 2023 before the June elections, and expects TL stability to continue throughout, thanks to current account surpluses and continued de-dollarization. In fact, Erdogan thinks the economy is about to enter the “strongest period in the history of Turkey”.

But this narrative is quite unrealistic, to say the least. It is highly doubtful that Turkey will run a current account surplus this year. Even if this were to happen, it would almost surely come at the expense of a weak – and hence, politically unsustainable – economy. As for inflation, Ankara’s forecast seems predicated on the TL remaining stable throughout, and global inflation softening on the back of a relatively quick normalization of supply chain problems in the next few months.

These assumptions are highly questionable in and of themselves, yet even if events do play out as Ankara is hoping, it is highly likely that it won’t be enough to bring inflation down to single digits. Inflationary expectations and pricing behavior have deteriorated dramatically after the turmoil of the past few months, the reversing of which won’t be an easy task, given the lack of credibility of current macroeconomic management, notably the CBRT – and, of course, the deeply negative real rates.

Instead, inflation is more likely to be stuck at a higher “plateau” of some 40%, with risks firmly placed on the upside, barring, of course, outright political interference with the data.

To reduce inflation to low single digits and achieve macroeconomic stability, Turkey will have to somehow embrace these “self-evident truths” and form a consensus around them. Otherwise, inflation cannot and will not fall.

Brief excerpt from Institut Montaigne article by the author

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng